All through the final three months, 13 analysts have evaluated Lam Analysis LRCX, providing a various set of opinions from bullish to bearish.

The next desk summarizes their current rankings, shedding gentle on the altering sentiments throughout the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 5 | 1 | 7 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 3 | 0 | 5 | 0 | 0 |

| 3M In the past | 2 | 1 | 1 | 0 | 0 |

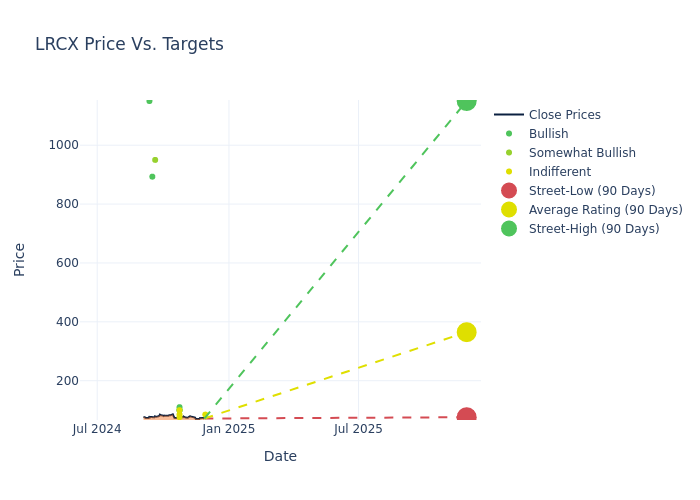

Within the evaluation of 12-month value targets, analysts unveil insights for Lam Analysis, presenting a median goal of $484.85, a excessive estimate of $1150.00, and a low estimate of $76.00. A unfavourable shift in sentiment is clear as analysts have decreased the common value goal by 11.09%.

Decoding Analyst Rankings: A Detailed Look

The standing of Lam Analysis amongst monetary consultants is revealed by means of an in-depth exploration of current analyst actions. The abstract under outlines key analysts, their current evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Stacy Rasgon | Bernstein | Lowers | Market Carry out | $85.00 | $95.00 |

| C J Muse | Cantor Fitzgerald | Maintains | Impartial | $100.00 | $100.00 |

| Joseph Moore | Morgan Stanley | Lowers | Equal-Weight | $76.00 | $77.00 |

| Brian Chin | Stifel | Lowers | Purchase | $100.00 | $105.00 |

| Joseph Quatrochi | Wells Fargo | Lowers | Equal-Weight | $85.00 | $88.00 |

| Craig Ellis | B. Riley Securities | Raises | Purchase | $110.00 | $105.00 |

| Charles Shi | Needham | Maintains | Purchase | $100.00 | $100.00 |

| Joseph Quatrochi | Wells Fargo | Lowers | Equal-Weight | $880.00 | $1000.00 |

| C J Muse | Cantor Fitzgerald | Lowers | Impartial | $1000.00 | $1200.00 |

| Vijay Rakesh | Mizuho | Lowers | Outperform | $950.00 | $1050.00 |

| Joseph Moore | Morgan Stanley | Lowers | Equal-Weight | $774.00 | $929.00 |

| Atif Malik | Citigroup | Lowers | Purchase | $893.00 | $990.00 |

| Timothy Arcuri | UBS | Lowers | Purchase | $1150.00 | $1250.00 |

Key Insights:

- Motion Taken: Responding to altering market dynamics and firm efficiency, analysts replace their suggestions. Whether or not they ‘Preserve’, ‘Elevate’, or ‘Decrease’ their stance, it signifies their response to current developments associated to Lam Analysis. This gives perception into analysts’ views on the present state of the corporate.

- Score: Providing insights into predictions, analysts assign qualitative values, from ‘Outperform’ to ‘Underperform’. These rankings convey expectations for the relative efficiency of Lam Analysis in comparison with the broader market.

- Value Targets: Gaining insights, analysts present estimates for the longer term worth of Lam Analysis’s inventory. This comparability reveals tendencies in analysts’ expectations over time.

Navigating by means of these analyst evaluations alongside different monetary indicators can contribute to a holistic understanding of Lam Analysis’s market standing. Keep knowledgeable and make data-driven choices with our Rankings Desk.

Keep updated on Lam Analysis analyst rankings.

Discovering Lam Analysis: A Nearer Look

Lam Analysis is without doubt one of the largest semiconductor wafer fabrication gear producers on the earth. It makes a speciality of deposition and etch, which entail the buildup of layers on a semiconductor and the next selective removing of patterns from every layer. Lam holds the highest market share in etch and holds the clear second share in deposition. It’s extra uncovered to reminiscence chipmakers for DRAM and NAND chips. It counts as high clients the biggest chipmakers on the earth, together with TSMC, Samsung, Intel, and Micron.

Monetary Insights: Lam Analysis

Market Capitalization: Boasting an elevated market capitalization, the corporate surpasses business averages. This indicators substantial measurement and robust market recognition.

Constructive Income Development: Analyzing Lam Analysis’s financials over 3 months reveals a optimistic narrative. The corporate achieved a noteworthy income development price of 19.7% as of 30 September, 2024, showcasing a considerable improve in top-line earnings. Compared to its business friends, the corporate stands out with a development price larger than the common amongst friends within the Info Expertise sector.

Internet Margin: The corporate’s internet margin is a standout performer, exceeding business averages. With a formidable internet margin of 26.79%, the corporate showcases sturdy profitability and efficient price management.

Return on Fairness (ROE): Lam Analysis’s ROE stands out, surpassing business averages. With a formidable ROE of 13.13%, the corporate demonstrates efficient use of fairness capital and robust monetary efficiency.

Return on Belongings (ROA): Lam Analysis’s ROA excels past business benchmarks, reaching 5.83%. This signifies environment friendly administration of belongings and robust monetary well being.

Debt Administration: With a excessive debt-to-equity ratio of 0.59, Lam Analysis faces challenges in successfully managing its debt ranges, indicating potential monetary pressure.

Understanding the Relevance of Analyst Rankings

Specialists in banking and monetary techniques, analysts concentrate on reporting for particular shares or outlined sectors. Their complete analysis entails attending firm convention calls and conferences, analyzing monetary statements, and fascinating with insiders to generate what are generally known as analyst rankings for shares. Sometimes, analysts assess and price every inventory as soon as per quarter.

Along with their assessments, some analysts prolong their insights by providing predictions for key metrics equivalent to earnings, income, and development estimates. This supplementary info gives additional steering for merchants. It’s essential to acknowledge that, regardless of their specialization, analysts are human and may solely present forecasts primarily based on their beliefs.

Breaking: Wall Road’s Subsequent Massive Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive development. This under-the-radar firm may surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Knowledge delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.