Deep-pocketed traders have adopted a bearish method in the direction of Verizon Communications VZ, and it is one thing market gamers should not ignore. Our monitoring of public choices information at Benzinga unveiled this important transfer immediately. The identification of those traders stays unknown, however such a considerable transfer in VZ often suggests one thing massive is about to occur.

We gleaned this data from our observations immediately when Benzinga’s choices scanner highlighted 10 extraordinary choices actions for Verizon Communications. This degree of exercise is out of the bizarre.

The overall temper amongst these heavyweight traders is split, with 40% leaning bullish and 60% bearish. Amongst these notable choices, 2 are places, totaling $69,840, and eight are calls, amounting to $376,840.

What’s The Worth Goal?

After evaluating the buying and selling volumes and Open Curiosity, it is evident that the most important market movers are specializing in a worth band between $40.0 and $46.5 for Verizon Communications, spanning the final three months.

Insights into Quantity & Open Curiosity

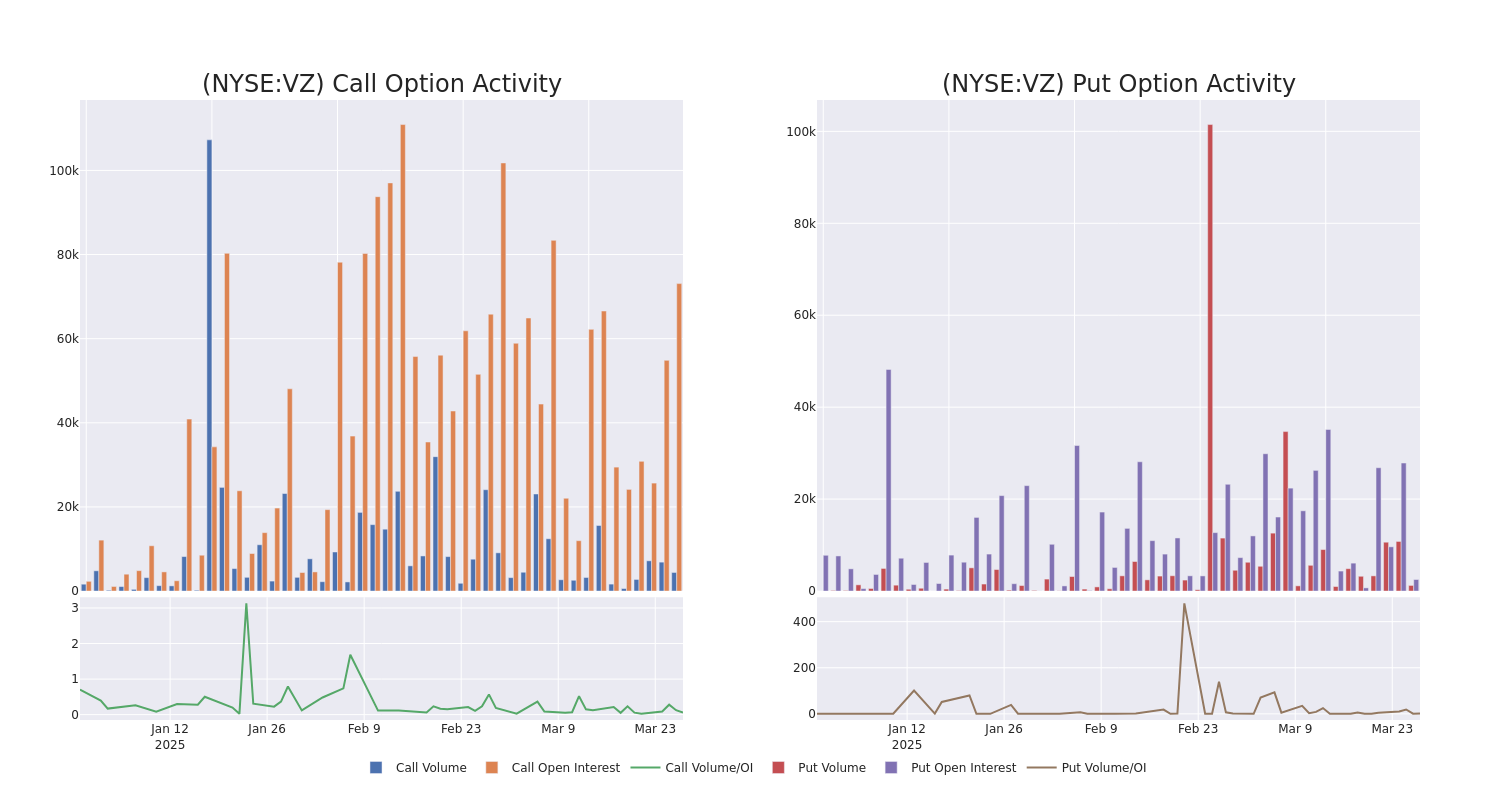

Assessing the amount and open curiosity is a strategic step in choices buying and selling. These metrics make clear the liquidity and investor curiosity in Verizon Communications’s choices at specified strike costs. The forthcoming information visualizes the fluctuation in quantity and open curiosity for each calls and places, linked to Verizon Communications’s substantial trades, inside a strike worth spectrum from $40.0 to $46.5 over the previous 30 days.

Verizon Communications Possibility Exercise Evaluation: Final 30 Days

Largest Choices Trades Noticed:

| Image | PUT/CALL | Commerce Sort | Sentiment | Exp. Date | Ask | Bid | Worth | Strike Worth | Whole Commerce Worth | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | SWEEP | BEARISH | 04/17/25 | $3.25 | $3.1 | $3.14 | $42.00 | $125.6K | 11.1K | 486 |

| VZ | CALL | SWEEP | BEARISH | 07/18/25 | $5.35 | $5.25 | $5.27 | $40.00 | $52.5K | 1.1K | 200 |

| VZ | PUT | TRADE | BEARISH | 03/20/26 | $4.25 | $4.0 | $4.2 | $45.00 | $42.0K | 1.9K | 100 |

| VZ | CALL | SWEEP | BEARISH | 04/17/25 | $4.15 | $4.05 | $4.11 | $41.00 | $40.5K | 12.9K | 116 |

| VZ | CALL | SWEEP | BULLISH | 04/04/25 | $0.34 | $0.29 | $0.34 | $45.50 | $34.0K | 515 | 1.2K |

About Verizon Communications

Wi-fi companies account for about 70% of Verizon Communications’ whole service income and almost all of its working earnings. The agency serves about 93 million postpaid and 20 million pay as you go cellphone prospects through its nationwide community, making it the most important US wi-fi service. Mounted-line telecom operations embody native networks within the Northeast, which attain about 30 million properties and companies and serve about 8 million broadband prospects. Verizon additionally gives telecom companies nationwide to enterprise prospects, usually utilizing a mix of its personal and different carriers’ networks. Verizon agreed to amass Frontier Communications in September 2024.

Following our evaluation of the choices actions related to Verizon Communications, we pivot to a better have a look at the corporate’s personal efficiency.

The place Is Verizon Communications Standing Proper Now?

- At present buying and selling with a quantity of 4,866,969, the VZ’s worth is up by 1.88%, now at $45.01.

- RSI readings recommend the inventory is at the moment could also be approaching overbought.

- Anticipated earnings launch is in 26 days.

Skilled Opinions on Verizon Communications

Over the previous month, 2 trade analysts have shared their insights on this inventory, proposing a mean goal worth of $46.5.

Uncommon Choices Exercise Detected: Good Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions massive cash is taking in your favourite shares. Click on right here for entry.

* Reflecting issues, an analyst from RBC Capital lowers its ranking to Sector Carry out with a brand new worth goal of $45.

* An analyst from Scotiabank persists with their Sector Carry out ranking on Verizon Communications, sustaining a goal worth of $48.

Choices buying and selling presents increased dangers and potential rewards. Astute merchants handle these dangers by frequently educating themselves, adapting their methods, monitoring a number of indicators, and preserving a detailed eye on market actions. Keep knowledgeable concerning the newest Verizon Communications choices trades with real-time alerts from Benzinga Professional.

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.