Scores for Oshkosh OSK have been supplied by 14 analysts up to now three months, showcasing a mixture of bullish and bearish views.

Summarizing their current assessments, the desk beneath illustrates the evolving sentiments up to now 30 days and compares them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Scores | 2 | 4 | 7 | 1 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 1 | 0 | 0 | 0 |

| 2M In the past | 1 | 3 | 3 | 1 | 0 |

| 3M In the past | 1 | 0 | 3 | 0 | 0 |

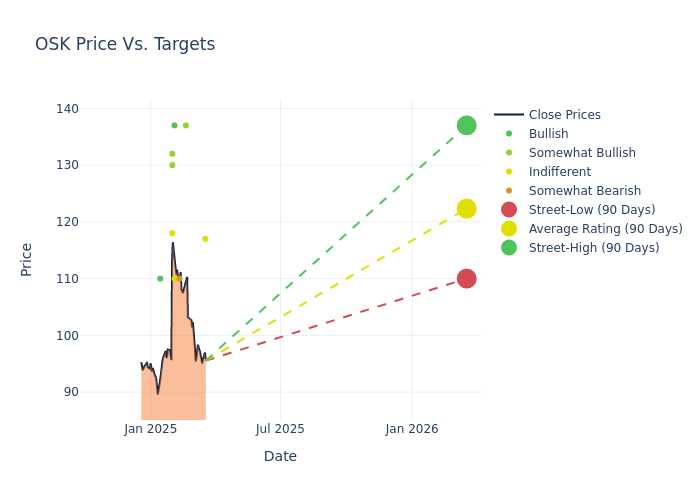

Insights from analysts’ 12-month value targets are revealed, presenting a median goal of $120.07, a excessive estimate of $137.00, and a low estimate of $109.00. Observing a 3.51% improve, the present common has risen from the earlier common value goal of $116.00.

Understanding Analyst Scores: A Complete Breakdown

In analyzing current analyst actions, we acquire insights into how monetary specialists understand Oshkosh. The next abstract outlines key analysts, their current evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Tami Zakaria | JP Morgan | Lowers | Impartial | $117.00 | $127.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $137.00 | $122.00 |

| Ross Gilardi | B of A Securities | Raises | Underperform | $110.00 | $95.00 |

| Steven Fisher | UBS | Raises | Purchase | $137.00 | $125.00 |

| Angel Castillo | Morgan Stanley | Raises | Equal-Weight | $110.00 | $98.00 |

| Tami Zakaria | JP Morgan | Raises | Impartial | $127.00 | $115.00 |

| Tim Thein | Raymond James | Raises | Outperform | $130.00 | $125.00 |

| Jamie Prepare dinner | Truist Securities | Raises | Maintain | $118.00 | $109.00 |

| Steve Barger | Keybanc | Raises | Chubby | $132.00 | $113.00 |

| Steve Barger | Keybanc | Publicizes | Chubby | $113.00 | – |

| Jamie Prepare dinner | Truist Securities | Lowers | Maintain | $109.00 | $116.00 |

| Kyle Menges | Citigroup | Lowers | Purchase | $110.00 | $125.00 |

| Tami Zakaria | JP Morgan | Lowers | Impartial | $115.00 | $125.00 |

| Jamie Prepare dinner | Truist Securities | Raises | Maintain | $116.00 | $113.00 |

Key Insights:

- Motion Taken: Responding to altering market dynamics and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Increase’, or ‘Decrease’ their stance, it signifies their response to current developments associated to Oshkosh. This gives perception into analysts’ views on the present state of the corporate.

- Score: Gaining insights, analysts present qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These rankings replicate expectations for the relative efficiency of Oshkosh in comparison with the broader market.

- Value Targets: Analysts discover the dynamics of value targets, offering estimates for the long run worth of Oshkosh’s inventory. This examination reveals shifts in analysts’ expectations over time.

Analyzing these analyst evaluations alongside related monetary metrics can present a complete view of Oshkosh’s market place. Keep knowledgeable and make data-driven choices with the help of our Scores Desk.

Keep updated on Oshkosh analyst rankings.

About Oshkosh

Oshkosh Corp is the highest producer of entry tools, specialty autos, and army vans. It serves various finish markets, the place it’s usually the market share chief in North America, or, within the case of JLG aerial work platforms. The corporate had manufactured joint gentle tactical autos for the U.S. Division of Protection. The corporate reviews in three segments: Entry, Vocational and Protection. It derives most income from Entry Section.

Oshkosh’s Monetary Efficiency

Market Capitalization: Indicating a lowered dimension in comparison with business averages, the corporate’s market capitalization poses distinctive challenges.

Income Development: Oshkosh’s exceptional efficiency in 3 months is obvious. As of 31 December, 2024, the corporate achieved a powerful income development price of 5.32%. This signifies a considerable improve within the firm’s top-line earnings. When in comparison with others within the Industrials sector, the corporate excelled with a development price increased than the typical amongst friends.

Internet Margin: Oshkosh’s monetary power is mirrored in its distinctive web margin, which exceeds business averages. With a exceptional web margin of 5.89%, the corporate showcases robust profitability and efficient price administration.

Return on Fairness (ROE): Oshkosh’s ROE is beneath business requirements, pointing in the direction of difficulties in effectively using fairness capital. With an ROE of 3.71%, the corporate might encounter challenges in delivering passable returns for shareholders.

Return on Property (ROA): Oshkosh’s ROA surpasses business requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 1.59% ROA, the corporate successfully makes use of its belongings for optimum returns.

Debt Administration: Oshkosh’s debt-to-equity ratio is beneath business norms, indicating a sound monetary construction with a ratio of 0.23.

The Fundamentals of Analyst Scores

Analysts are specialists inside banking and monetary techniques that usually report for particular shares or inside outlined sectors. These folks analysis firm monetary statements, sit in convention calls and conferences, and communicate with related insiders to find out what are referred to as analyst rankings for shares. Usually, analysts will price every inventory as soon as 1 / 4.

Some analysts publish their predictions for metrics resembling development estimates, earnings, and income to supply extra steering with their rankings. When utilizing analyst rankings, it is very important remember the fact that inventory and sector analysts are additionally human and are solely providing their opinions to traders.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you on the spot entry to all main analyst upgrades, downgrades, and value targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Momentum29.29

Development70.31

High quality–

Worth81.07

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.