Whales with some huge cash to spend have taken a noticeably bearish stance on PayPal Holdings.

choices historical past for PayPal Holdings PYPL we detected 11 trades.

If we contemplate the specifics of every commerce, it’s correct to state that 27% of the buyers opened trades with bullish expectations and 45% with bearish.

From the general noticed trades, 2 are places, for a complete quantity of $80,100 and 9, calls, for a complete quantity of $720,345.

Anticipated Value Actions

Analyzing the Quantity and Open Curiosity in these contracts, it appears that evidently the large gamers have been eyeing a worth window from $50.0 to $130.0 for PayPal Holdings through the previous quarter.

Insights into Quantity & Open Curiosity

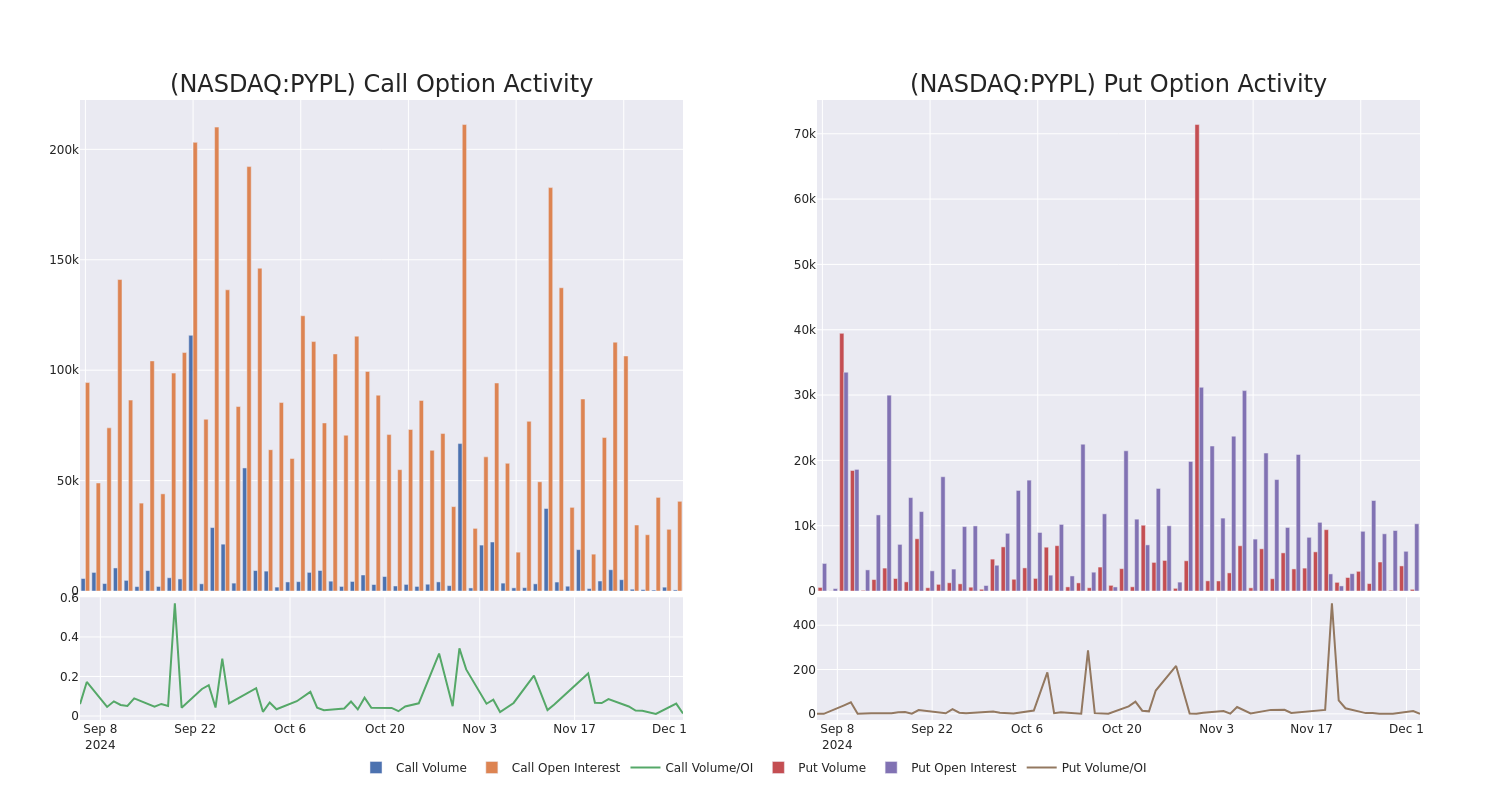

Assessing the quantity and open curiosity is a strategic step in choices buying and selling. These metrics make clear the liquidity and investor curiosity in PayPal Holdings’s choices at specified strike costs. The forthcoming knowledge visualizes the fluctuation in quantity and open curiosity for each calls and places, linked to PayPal Holdings’s substantial trades, inside a strike worth spectrum from $50.0 to $130.0 over the previous 30 days.

PayPal Holdings Name and Put Quantity: 30-Day Overview

Important Choices Trades Detected:

| Image | PUT/CALL | Commerce Sort | Sentiment | Exp. Date | Ask | Bid | Value | Strike Value | Complete Commerce Value | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BEARISH | 03/21/25 | $18.0 | $17.75 | $17.75 | $70.00 | $355.0K | 3.2K | 200 |

| PYPL | CALL | TRADE | BEARISH | 01/15/27 | $8.75 | $8.25 | $8.25 | $130.00 | $82.5K | 130 | 105 |

| PYPL | CALL | TRADE | BEARISH | 06/20/25 | $28.8 | $28.3 | $28.4 | $60.00 | $56.8K | 2.3K | 20 |

| PYPL | CALL | SWEEP | NEUTRAL | 02/21/25 | $9.3 | $9.25 | $9.25 | $80.00 | $50.8K | 1.2K | 70 |

| PYPL | CALL | TRADE | BULLISH | 01/16/26 | $24.1 | $23.95 | $24.1 | $70.00 | $48.2K | 3.0K | 25 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and supplies digital fee options to retailers and customers, with a give attention to on-line transactions. The corporate had 426 million lively accounts on the finish of 2023. The corporate additionally owns Venmo, a person-to-person fee platform.

PayPal Holdings’s Present Market Standing

- At the moment buying and selling with a quantity of three,815,285, the PYPL’s worth is down by -0.81%, now at $85.83.

- RSI readings counsel the inventory is at present could also be approaching overbought.

- Anticipated earnings launch is in 64 days.

Skilled Analyst Rankings for PayPal Holdings

1 market consultants have not too long ago issued scores for this inventory, with a consensus goal worth of $88.0.

Flip $1000 into $1270 in simply 20 days?

20-year professional choices dealer reveals his one-line chart method that exhibits when to purchase and promote. Copy his trades, which have had averaged a 27% revenue each 20 days. Click on right here for entry.

* In a cautious transfer, an analyst from Piper Sandler downgraded its score to Impartial, setting a worth goal of $88.

Choices buying and selling presents increased dangers and potential rewards. Astute merchants handle these dangers by regularly educating themselves, adapting their methods, monitoring a number of indicators, and retaining an in depth eye on market actions. Keep knowledgeable concerning the newest PayPal Holdings choices trades with real-time alerts from Benzinga Professional.

Market Information and Information delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.