TikTok has reportedly laid off a few of its U.S.-based e-commerce governance and expertise workforce, simply days after President Donald Trump prolonged the deadline for guardian firm ByteDance to divest its U.S. operations.

What Occurred: The layoffs affected members of the Governance and Expertise workforce, which handles market security, vendor compliance, and mental property safety inside TikTok Store, reported Enterprise Insider, citing 5 staff on the firm. The whole variety of job cuts is but unclear.

TikTok’s e-commerce unit has been beneath scrutiny from world management after falling wanting expectations. In February, prime govt Bob Kang criticized the workforce throughout an all-hands assembly, and several other staff acquired low efficiency evaluation scores in March, resulting in severance-based exits or efficiency enchancment plans.

This spherical of layoffs follows earlier cuts in February to TikTok’s world belief and security workforce, which oversees broader content material moderation.

TikTok didn’t instantly reply to Benzinga’s request for feedback.

Why It Issues: The transfer coincides with contemporary uncertainty about TikTok’s future within the U.S. Final week, Trump prolonged the deadline for ByteDance to divest TikTok, giving the corporate an extra 75 days. The earlier deadline had expired Saturday.

A deal had reportedly been permitted by ByteDance, the U.S. authorities, and new American buyers however collapsed after Trump imposed steep new tariffs on Chinese language items, prompting Beijing to withhold approval.

Subscribe to the Benzinga Tech Developments e-newsletter to get all the most recent tech developments delivered to your inbox.

In January, forward of TikTok’s initially proposed ban date, Wall Avenue analysts recognized three shares that would expertise important features: Meta Platforms, Inc. META, Snap Inc. SNAP and Alphabet Inc. GOOG GOOGL.

Meta is broadly seen as the highest contender to profit from a TikTok ban. Morgan Stanley analysts recommend that the corporate stands to realize essentially the most, noting that if simply 10% of TikTok customers within the U.S. shift their display time to Meta’s apps, it might increase Meta’s 2026 earnings-per-share (EPS) by roughly $0.60—elevating its estimate to round $30 per share.

Deutsche Financial institution analysts see Snap as the corporate with essentially the most to realize by way of share upside.

YouTube, Alphabet’s video platform, additionally stands to profit—particularly its short-form content material section. Morgan Stanley estimates that if YouTube manages to attract in 10% of TikTok’s display time, it might see an extra $750 million in advert income, representing a 2% carry for YouTube’s projected 2026 advert income. That might equate to a modest 0.3% enhance in Alphabet’s complete promoting earnings.

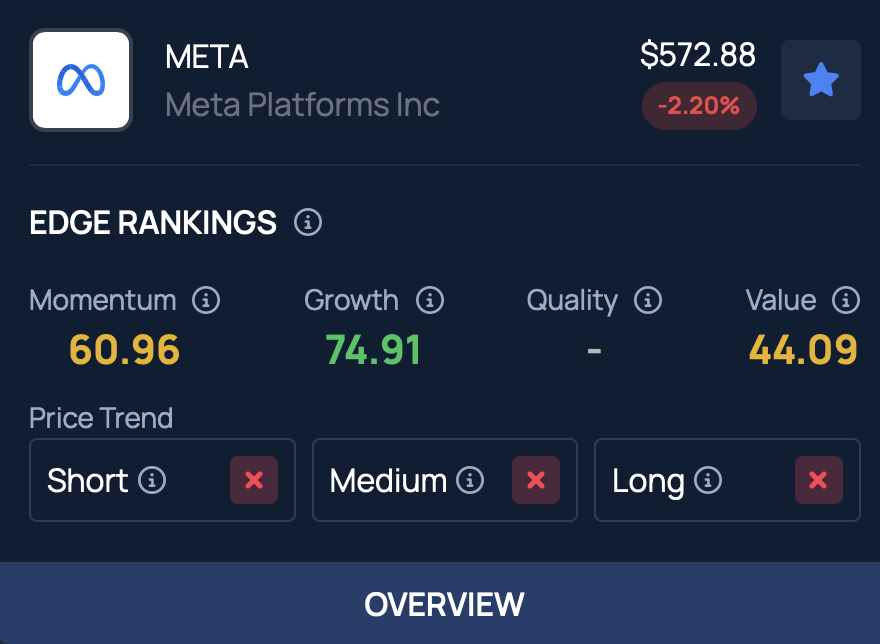

Meta holds a powerful progress rating of 74.91% primarily based on Benzinga Edge Inventory Rankings. You may see the way it compares to Snap, Alphabet, and different corporations by clicking right here.

Take a look at extra of Benzinga’s Client Tech protection by following this hyperlink.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.