How a lot does every buyer contribute to what you are promoting over time? That’s precisely what buyer lifetime worth (CLV) measures.

It may be simple to chase fast gross sales, however the true game-changer is knowing who sticks round, who retains coming again, and who quietly shapes your long-term progress.

That stated, if you shift your focus to buyer lifetime worth, you cease enjoying short-term and begin constructing one thing that lasts.

And if you wish to develop smarter, not simply sooner, studying calculate, monitor, and optimize this metric ought to be on the high of your listing.

What’s Buyer Lifetime Worth?

Buyer lifetime worth is the estimated revenue a enterprise can earn from a buyer all through their whole relationship. It’s not simply concerning the first sale, however each level that builds up over time, together with each:

- Buy

- Interplay

- Loyalty second

Consider it as a long-term snapshot of how priceless every buyer really is to what you are promoting.

Not all clients contribute equally. Some will make a single buy and by no means return, whereas others will preserve coming again, spending extra, and even referring new clients.

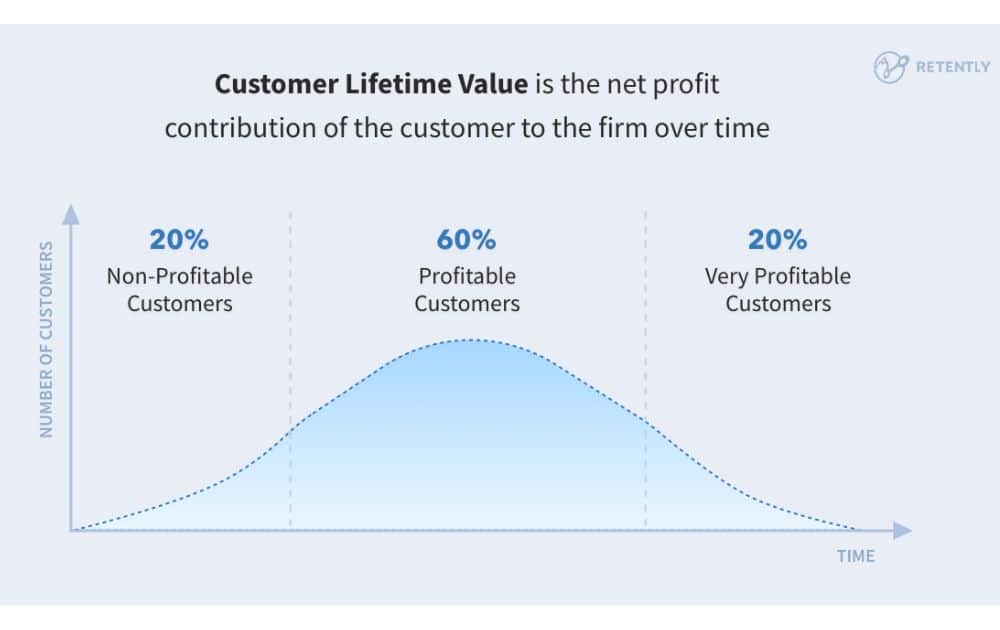

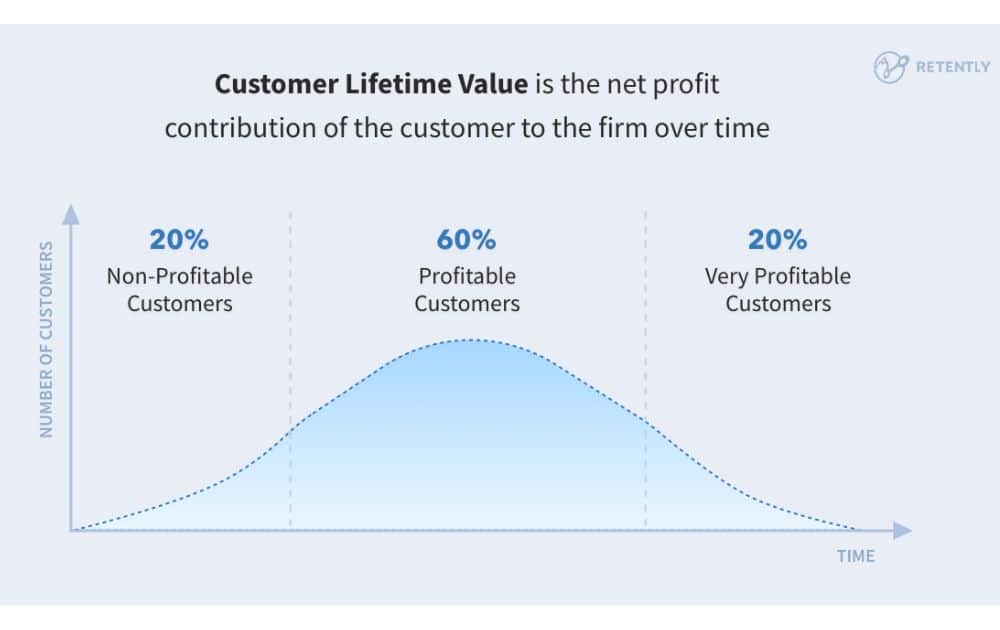

Because the picture beneath exhibits, companies sometimes have a combine of consumers:

- Round 20% of non-profitable clients

- About 60% who’re worthwhile

- A golden 20% who’re very worthwhile

That stated, figuring out which clients fall into these segments is the place buyer segmentation is available in.

Utilizing data-driven advertising and instruments like predictive CLV, companies can spot which clients are prone to stick round and which may be slipping away. This helps construct a strong gross sales funnel that doesn’t simply appeal to folks however retains them engaged.

In ecommerce KPIs, buyer lifetime worth stands out as a real progress sign. It exhibits whether or not you’re simply promoting or really constructing lasting buyer relationships. Manufacturers that prioritize CLV typically outperform those who solely give attention to one-time transactions.

Buyer Lifetime Worth Components

So, how do you calculate buyer lifetime worth? It begins with understanding the fundamental method that helps you expect how a lot income a buyer is probably going to usher in over time.

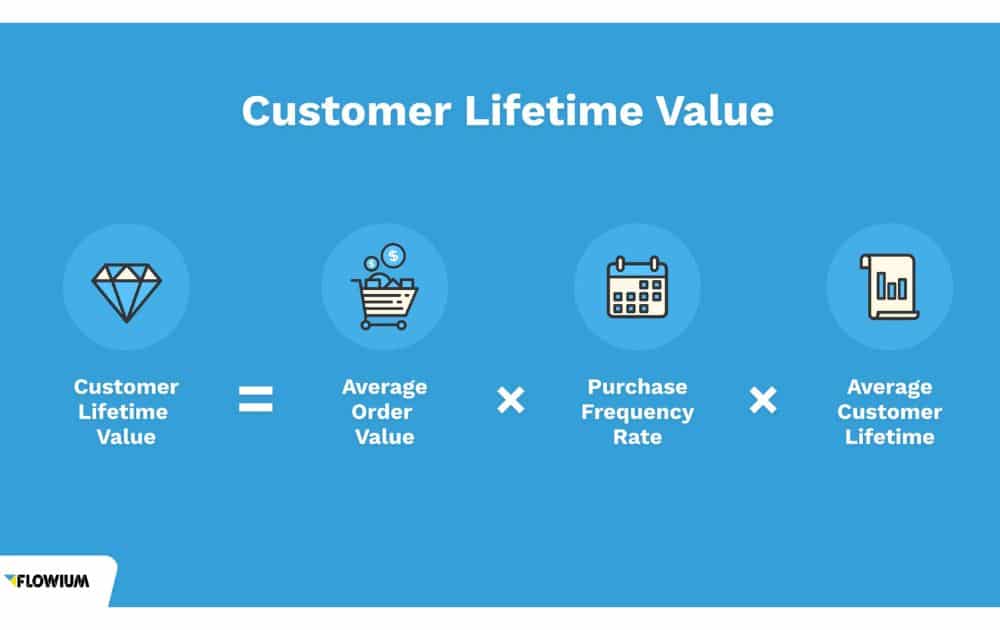

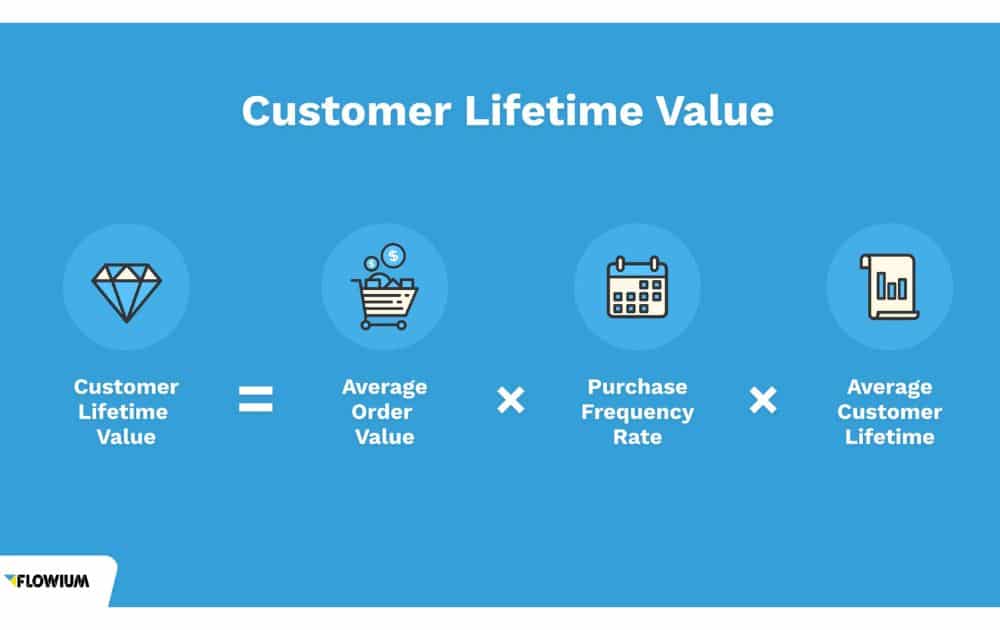

The usual buyer lifetime worth calculation appears to be like like this:

Buyer Lifetime Worth (CLV) =

Common Buy Worth × Common Buy Frequency × Common Buyer Lifespan

Let’s break down every part:

- Common Buy Worth. The everyday quantity a buyer spends every time they place an order.

- Common Buy Frequency. The frequency at which a buyer makes purchases from what you are promoting over a given timeframe.

- Common Buyer Lifespan. The same old interval a buyer stays actively buying out of your model.

For instance, if a median buyer spends $40 per order, makes three purchases every year, and sometimes stays together with your model for six years, their CLV can be:

40 × 3 × 6 = $720 CLV

This implies a single buyer is projected to usher in roughly $720 over the course of their relationship with what you are promoting.

If calculating manually feels difficult, you may simply use a buyer lifetime worth calculator to get fast outcomes. There are free calculators accessible on-line, and plenty of CRMs and ecommerce platforms now provide built-in CLV monitoring to simplify the method.

Advantages of Mastering CLV

If you prioritize your most precious clients, studying calculate buyer lifetime worth empowers you to:

- Set smarter budgets. When you know the way a lot income a buyer is prone to convey over their lifetime, you may confidently resolve how a lot you may afford to spend to accumulate them.

- Value your merchandise successfully. In case your CLV is low in comparison with your buyer acquisition price, it would imply you’re underpricing your merchandise or not upselling successfully.

- Prioritize the Proper Prospects. Understanding CLV helps you drive your conversion charges by prioritizing prospects who usually tend to make repeat purchases.

When you understand the true worth of your clients, you may construct stronger, extra worthwhile relationships that transcend simply chasing one-off gross sales.

CLV vs CAC vs COA

Understanding CLV might be much more priceless if you evaluate it to buyer acquisition price (CAC) and price of acquisition (CoA). In spite of everything, these three metrics work collectively to inform you whether or not your progress technique is definitely sustainable.

- Buyer Lifetime Worth represents the overall revenue a buyer is prone to generate for what you are promoting over the course of your whole relationship.

- Buyer Acquisition Price refers back to the complete quantity you make investments to achieve a brand new buyer, masking all advertising, gross sales, and promotional efforts.

- Price of Acquisition covers broader prices, together with overhead or oblique spending tied to bringing in clients.

Why do you have to evaluate CLV in opposition to CAC and CoA? The purpose is straightforward: your CLV ought to all the time be larger than your CAC.

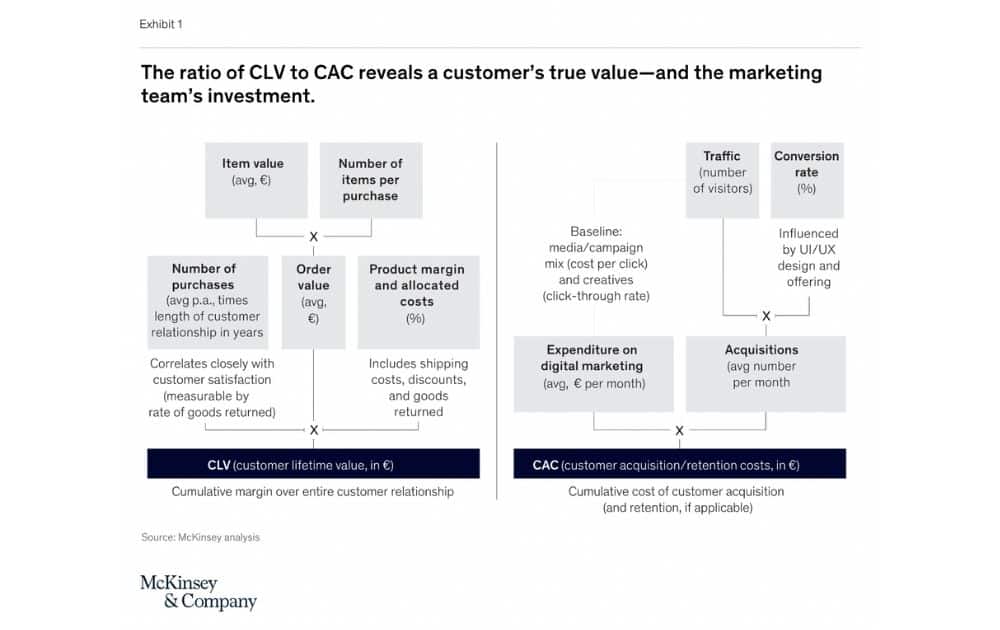

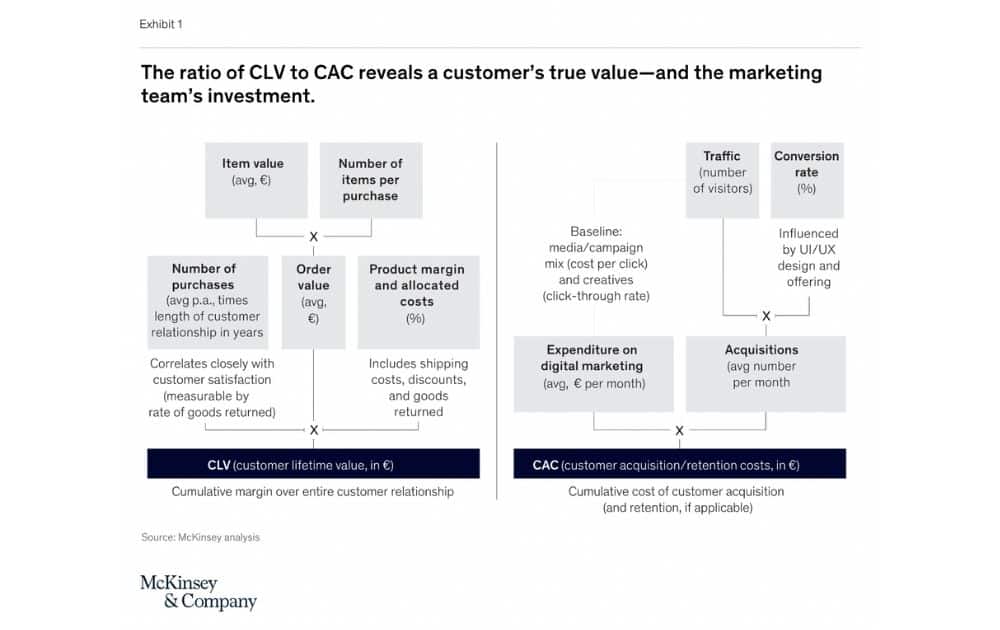

As an illustration, the picture beneath illustrates how the CLV to CAC ratio helps companies perceive a buyer’s true worth in comparison with the price of buying them.

It visually breaks down what contributes to CLV on the left and buyer acquisition price (CAC) on the correct, exhibiting how each side work together to measure profitability.

Associated content material: Price Per Acquisition Components

What is taken into account a superb CLV?

A wholesome CLV-to-CAC ratio is commonly round 3:1. This implies for each greenback you spend on buying a buyer, you must purpose to earn three {dollars} again over that buyer’s lifetime.

If you monitor these metrics collectively:

- You may spend smarter on advertising.

- You may determine in the event you’re overpaying to get low-value clients.

- You may refine your gross sales funnel to draw higher-value patrons.

Overlooking this stability might result in fast good points, however it may possibly make long-term profitability troublesome to attain.

Specializing in each buyer lifetime worth and buyer acquisition price ensures your progress isn’t simply quick—it’s worthwhile and sustainable.

The best way to Enhance Buyer Lifetime Worth

Boosting buyer lifetime worth includes utilizing sensible, confirmed methods that flip one-time patrons into loyal, high-value clients.

Personalize the Buyer Expertise

Personalization means buyer conduct and preferences and tailoring components like:

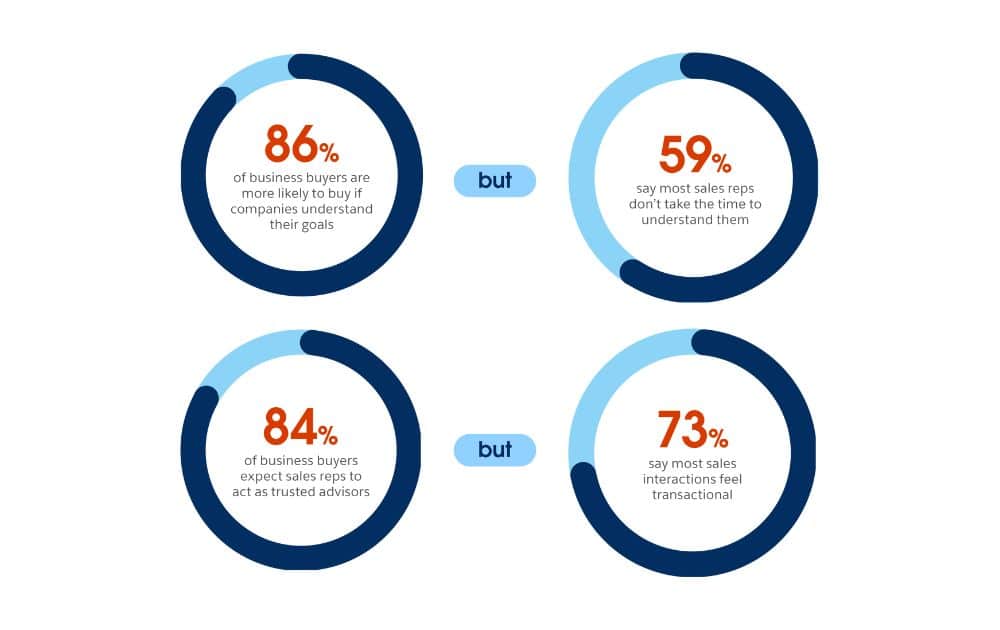

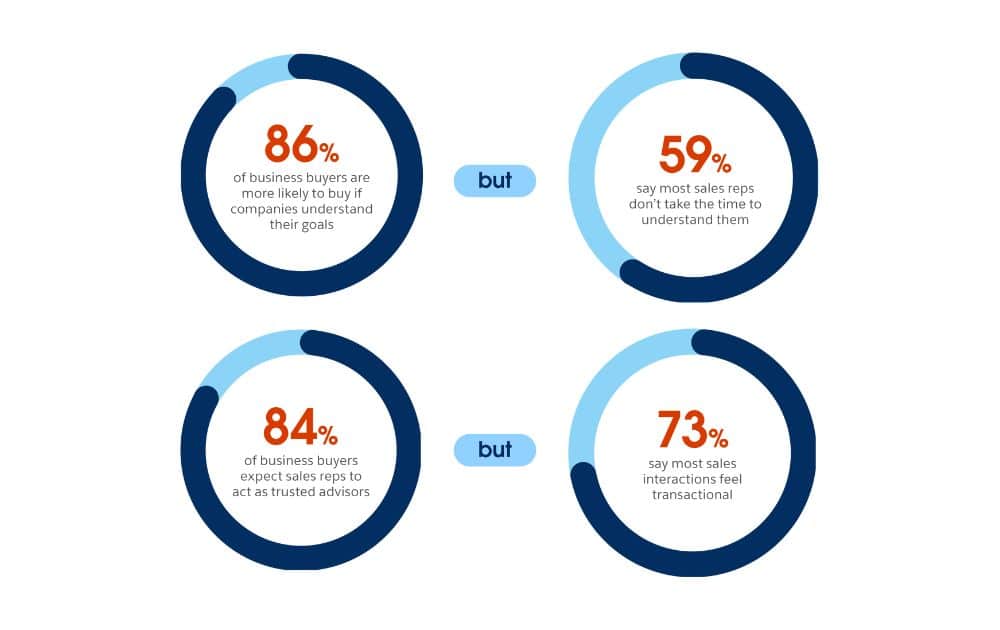

Why does it matter? Knowledge from Salesforce reveals that 86% of consumers usually tend to assist a model that understands their targets. On the identical time, 84% anticipate the model’s representatives to present them trusted recommendation.

As an illustration, Amazon makes use of customized recommendations like “Advisable for You” primarily based on shopping historical past, growing buy frequency. That’s personalization at work.

- Actionable Tip. Begin by segmenting your buyer lists and sending focused provides primarily based on buy conduct. Even a easy, customized thank-you e mail can enhance engagement.

Launch a Loyalty Program

Loyalty applications encourage clients to purchase once more by offering rewards for his or her continued assist. These perks can embody:

- Reductions

- Factors

- Unique perks

As an illustration, Accenture stories that clients who take part in high-performing loyalty applications enhance their spending greater than non-members.

And the way about Starbucks Rewards? Because it provides free drinks, birthday treats, and app-only provides, this system encourages clients to be persistently engaged with the model.

- Actionable Tip. Create a points-based system that’s simple to affix and monitor. Make certain rewards are simple to achieve to maintain clients persistently engaged.

Conduct Common Competitors Evaluation

Competitors evaluation includes rigorously researching your opponents to grasp their enterprise, together with:

- Pricing methods

- Product choices

- Advertising and marketing techniques

- Buyer critiques

- Total buyer expertise

It’s about figuring out how they function, what clients love about them, and the place they fall quick.

By persistently learning your competitors, you may determine developments, spot market gaps, and uncover alternatives to enhance your individual provides. This proactive method helps you keep related in your business as an alternative of reacting to what opponents do after the actual fact.

- Actionable Tip. Arrange alerts to watch competitor pricing, promotions, and buyer suggestions. Leverage this info to refine your provides or improve the general buyer expertise.

Upsell and Cross-Promote Well

Some sellers confuse the phrases upselling and cross-selling, however there are distinct variations between the 2:

- Upselling includes persuading clients to decide on a higher-end or extra feature-rich model of a product. This could possibly be a bigger dimension, a higher-tier subscription, or a product bundle that provides extra worth.

- Cross-selling recommends additional gadgets that improve the client’s present buy. These are associated merchandise that naturally go along with what the client is shopping for and provide further advantages.

As an illustration, say you’re buying a laptop computer. The upsell may current a higher-end model with extra storage and a sooner processing velocity. The cross-sell might counsel a laptop computer sleeve, wi-fi mouse, or antivirus software program at checkout.

These suggestions make sense as a result of they align with what the client at present needs or wants.

- Actionable Tip. By no means suggest random add-ons simply to extend the sale. Use buyer conduct knowledge to supply complementary or upgraded merchandise that genuinely make sense.

For a extra superior technique, think about working with specialists like AMZ Advisers to craft product bundles or upsell flows that maximize each buyer satisfaction and profitability.

The Backside Line

Buyer lifetime worth is a mindset. It shifts your focus from chasing short-term wins to constructing lasting buyer relationships that may gasoline sustainable progress.

If you prioritize CLV, you cease considering transaction by transaction and begin creating experiences that make folks come again, spend extra, and advocate to your model.

By calculating CLV correctly, balancing it in opposition to your acquisition prices, and making use of methods like personalization, loyalty applications, competitors evaluation, and sensible upselling, you may unlock actual progress with out overspending.

Bear in mind, it’s not about getting essentially the most clients—it’s about getting the correct clients and retaining them for the lengthy haul.

Creator

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of revolutionary options, reminiscent of ecommerce and digital advertising.

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of revolutionary options, reminiscent of ecommerce and digital advertising.