Robinhood Markets Inc. HOOD has launched Robinhood Cortex on Wednesday, with early entry granted to Gold members, an AI-powered funding device designed to supply real-time evaluation, commerce solutions, and market insights.

What Occurred: Introduced on the firm’s second annual Gold keynote occasion, Cortex is a part of a broader push to reinforce its premium providers, alongside the launch of Robinhood Methods and Robinhood Banking.

Robinhood Cortex goals to democratize entry to high-quality market intelligence, traditionally reserved for institutional buyers. The device will analyze real-time market actions, generate inventory summaries, and supply trade-building insights primarily based on consumer preferences and danger tolerance.

Whereas it is not going to execute trades, Cortex is positioned as a strong AI-driven assistant that may assist buyers navigate risky markets with data-driven suggestions.

“Excessive-quality, premium funding and market evaluation has traditionally been reserved for institutional buyers and the wealthy,” mentioned Abhishek Fatehpuria, Robinhood’s VP of Brokerage Product. “Over time, Robinhood Cortex will fully remodel the Robinhood expertise as we attempt to bridge that hole and put a premium analysis assistant proper in your pocket.”

See Additionally: Jim Cramer On Lululemon Optimism: ‘Don’t Know How They Might Be Happy’ As Inventory Drops Over 10% In After-Hours Buying and selling

Why It Issues: The rollout of Cortex follows Robinhood’s introduction of Robinhood Methods, a robo-advisory service providing actively managed portfolios with a capped annual charge for Gold members, and Robinhood Banking, a personal banking platform that features high-yield financial savings, wealth administration, and luxurious monetary providers.

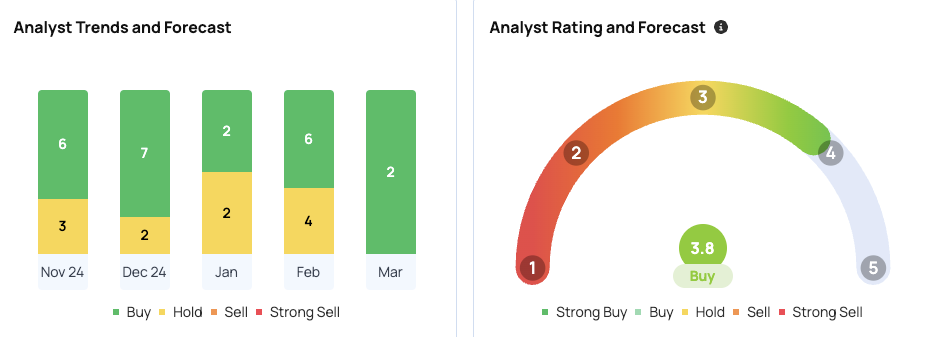

Robinhood’s consensus worth goal is $59.53 from 19 analysts, starting from $90 to $11. The newest scores from Compass Level, Deutsche Financial institution, and Keefe, Bruyette & Woods common $60.67, implying a 38.13% upside.

By leveraging AI, the corporate goals to strengthen buyer engagement and drive development in its subscription-based Robinhood Gold service.

Worth Motion: Robinhood closed at $43.99 on Thursday, down 1.65%, and fell 0.16% after hours to $43.92. The inventory is up 11.54% year-to-date and 118.53% over the previous 12 months.

In keeping with the Benzinga Edge rating, Robinhood has a medium- and long-term worth pattern however lacks a valuation metric. Register for Benzinga Edge to achieve extra in-depth data.

Learn Subsequent:

Picture through Shutterstock

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Momentum97.97

Development93.04

High quality–

Worth29.17

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.