Enterprise-software stalwart Oracle Corp ORCL suffered vital volatility throughout Monday’s after-hours session following the discharge of disappointing monetary outcomes.

For its fiscal second quarter, the corporate posted adjusted earnings per share of $1.47, lacking Wall Avenue’s consensus view of $1.48. Additional, on the highest line, gross sales of $14.06 billion fell in need of the anticipated $14.11 billion.

What made the matter worse was that simply forward of the disclosure, ORCL inventory printed what seemed to be a robust bullish wave. Particularly, Oracle shares have been above their 5, 20- and 50-day exponential transferring averages.

To be truthful, circumstances do not seem auspicious. Nonetheless, it is also essential to appreciate simply how uncommon deeply detrimental classes are for Oracle inventory. Within the trailing 5 years, there have been 1,238 buying and selling classes. Of this huge quantity, solely 15 classes noticed a day-to-day lack of higher than 5%.

In fact, nobody desires to incur deep crimson ink. However, except compelling proof exists to recommend {that a} secular downturn is on the horizon, a bullish posture stays the extra affordable strategy.

Additionally Learn: Trump’s Tariff Storm: 3 Survival Methods US Firms Are Utilizing To Battle Again

Holding Agency to Empirical Knowledge

Whereas a robust temptation exists to learn between the strains of Oracle’s tough Q2 earnings report, it might be higher to belief the empirical information. Certainly, it is this information that implies ORCL inventory instructions an upward bias.

As a number of specialists have demonstrated, the market itself displays an upward bias over prolonged durations. This framework very a lot applies to established entities like Oracle. Subsequently, as a common strategy, it is prudent to not battle the tape, particularly for blue-chip tech juggernauts.

Curiously, over the previous 5 years, the weekly efficiency of ORCL inventory (as decided by the distinction between Monday’s opening value and Friday’s shut) signifies that on any given week, Oracle has a few 55% probability of delivering a optimistic return. Over the long term, the chances modestly favor speculators to win their wagers, assuming strict cash administration.

Nonetheless, the aforementioned success ratio additionally interprets to a failure price of roughly 45%. That is fairly steep, which means {that a} section of misfortune may result in damage. Nonetheless, one of many underappreciated points of multi-leg choices trades is that speculators can artificially modulate the parameters of success.

Deploying the Highly effective Bull Name Unfold

Reasonably than merely shopping for an Oracle name choice — which will be expensive for a lot of retail buyers due to the inventory’s three-digit price ticket — a dealer can concurrently promote a name choice at the next strike value. The thought is that the credit score acquired from the quick name sale helps to offset the debit paid for the lengthy name.

Granted, this strategy interprets to the utmost reward being restricted by the brink represented by the quick name strike. On the optimistic aspect, a transparent advantage of the bull name unfold is that the breakeven level will be lowered, generally to beneath the present market value.

In different phrases, the choice dealer’s definition of success now not must abide by widespread understanding; that’s, a safety that returns a determine higher than 0%. As a substitute, for example, success will be outlined as a weekly return higher than a half-a-percent loss.

Below this framework, the likelihood that ORCL inventory might be at the very least considerably profitable jumps to over 60%. That is clearly a superior hand than a 55%-win ratio, nevertheless it will get even higher.

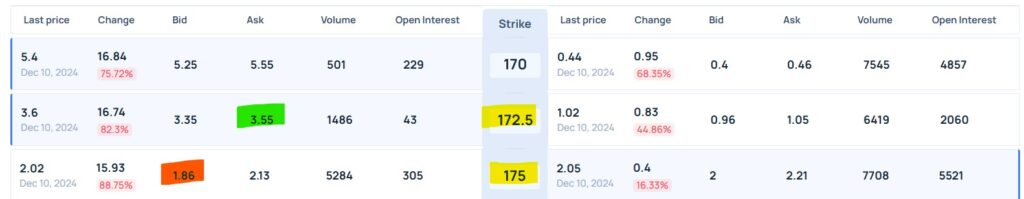

At this second, the 172.50/175.00 bull name unfold (that’s, shopping for the $172.50 name and promoting the $175 name) gives a most reward of $81 for each $169 in danger or a payout of 47.93%. Furthermore, the breakeven value for this commerce sits at $174.19, which is about 0.97% beneath the present market value.

If the brink of success is outlined as a weekly return of higher than a 0.97% loss, the likelihood of revenue clocks it at round 65.5%. Simply as effectively, ORCL inventory doesn’t must materially rise from right here. It simply wants to remain at or above $175 to gather the total reward.

Learn Subsequent:

Picture: Shutterstock

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.