Nike Inc. NKE reported its worst footwear income in over a decade as the corporate transitions beneath its new CEO. The athletic footwear and attire firm beat its third-quarter earnings and income expectations whereas issuing a disappointing outlook for the fourth quarter.

What Occurred: Nike posted a complete footwear income of $7.208 billion within the third quarter as in comparison with $8.162 billion in the identical quarter of the earlier fiscal. This represents a 12% year-on-year decline in its footwear income, which was worse in over a decade in line with FinChat.

CFO Matthew Good friend spoke about clearing extra stock selecting up from the earlier quarter, in the course of the firm’s earnings name. He stated, “Stock declined 2% versus the prior yr. However as I stated final quarter, stock stays elevated throughout all geographies.”

He emphasised that the corporate has been offering its wholesale companions with larger “reductions to liquidate aged stock.”

Elliott Hill, the president and CEO participated in his second earnings name after rejoining Nike in October 2024. He stated that “rightsizing” the stock will assist the corporate get again to working a “full and balanced portfolio.”

Good friend added, “We’re going to proceed to be liquidating stock. And we anticipate that it’s going to take us a number of quarters to work by way of. However the motive why we’re assured is as a result of we all know we’ll be liquidating it by way of the channels the place we’re used to liquidating that stock.”

See Additionally: SoundHound AI Brief Curiosity Jumps To 32.9%: ‘Carry It On,’ Says CEO, Shorts ‘Solely Make The Prize Of Profitable Larger’

Why It Issues: Nike surpassed Wall Road expectations in its third quarter, reporting income of $11.27 billion and earnings of 54 cents per share, exceeding analyst estimates of $11.01 billion and 28 cents per share, respectively.

“Win Now” is a set of strategic priorities that Nike is engaged on to enhance its enterprise. Speaking in regards to the firm’s fourth-quarter outlook, the CFO stated “Trying forward, we imagine that the fourth quarter will replicate the biggest influence from our Win Now actions, and on the headwinds to income and gross margin will start to reasonable from there.”

Whereas he expects income to be down within the mid-teens vary, the agency expects gross margins to be down roughly 400 to 500 foundation factors within the subsequent quarter. “We now have included the estimated influence from newly applied tariffs on imports from China and Mexico,” he added.

Value Motion: Shares of Nike fell 1.55% on Thursday and declined 5.23% in afterhours. The exchange-traded fund monitoring the S&P 500 index, SPDR S&P 500 ETF Belief SPY, fell 0.29% throughout the identical session. Nike was down 2.46% on a year-to-date foundation, whereas it was 28.72% decrease over a yr.

Invoice Ackman‘s Pershing Sq. Capital Administration elevated its stake in Nike by 15% within the fourth quarter after a 436% enhance within the third quarter. As per its 13F submitting, Nike now represents 11% of Pershing Sq.’s holdings with a complete of 18.768 million shares valued at $1.420 billion.

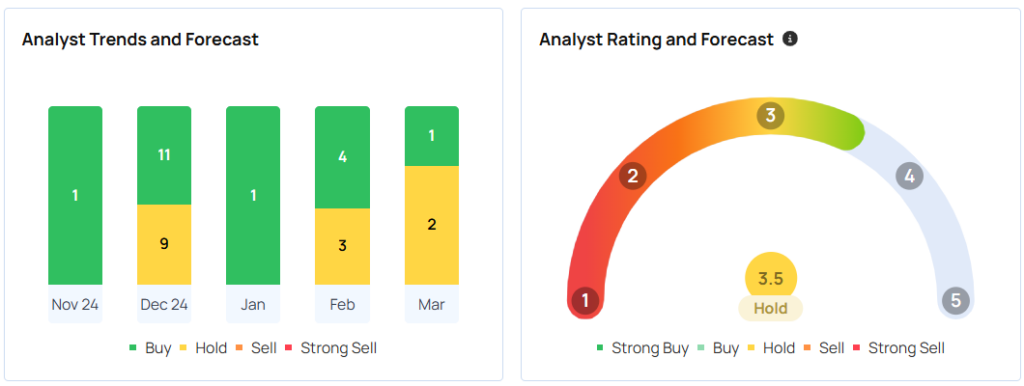

Its consensus worth goal was $91.41, with a ‘maintain’ score, primarily based on the 32 analysts tracked by Benzinga. The value targets ranged from a low of $70 to a excessive of $120. The three newest rankings from Needham, TAG, and Morgan Stanley averaged $77.44, implying a 13.56% upside.

Learn Subsequent:

Picture courtesy: Shutterstock

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.