Intel Corp. INTC inventory has had a tough journey in 2024 to this point, falling by over 56% year-to-date.

The explanation? The world’s main chipmaker has fallen behind the curve, ceding floor to rivals like Superior Micro Gadgets Inc. AMD, Nvidia Corp. NVDA and failing to even catch as much as Qualcomm Inc. QCOM on the smartphone facet of issues.

The world’s main chipmaker misplaced the plot throughout each establishing in addition to rising applied sciences – it’s now not as dominant because it was within the x86 area, and corporations like Nvidia have totally dominated the AI chips area.

See Additionally: Nvidia’s AI Dominance Leaves Intel, AMD Scrambling For Second Place

Intel’s failure to innovate is mirrored in its inventory efficiency as properly – at $20.92, its inventory is roughly again to the identical degree it was at practically 27 years in the past.

To make issues worse for Group Blue, that’s Intel (its rival AMD is Group Purple,) the corporate’s market capitalization has shrunk sufficient that there are rumors doing the rounds that rivals like Qualcomm might be desirous about scooping it up. Qualcomm’s curiosity in buying Intel subsequently waned, reportedly because of the “complexities” concerned within the transaction.

See Additionally: Palantir Co-Founder Joe Lonsdale Cheers Trump’s New SEC Decide, Calls Out Gary Gensler For ‘Purposely’ Not Defining Crypto Guidelines

For context, Intel’s market capitalization stands at $90.22 billion, whereas Qualcomm’s is at $177.26 billion.

Intel’s closest rival, AMD, is valued greater than two occasions at $224.91 billion.

Nvidia, however, has a comparatively stratospheric market capitalization of $3.488 trillion – value over 38 occasions Intel’s market capitalization.

Issues have gotten so unhealthy for Intel, that the chipmaker let go of Pat Gelsinger, an trade and Intel veteran, in a considerably less-than-ideal vogue.

Lack Of Innovation, Manufacturing Difficulties, And Growing Competitors

Whereas Intel’s woes have been ongoing for a number of years now, points with its newest desktop chips have been probably the straw that broke the proverbial camel’s again.

After a number of experiences revealed points with Intel’s thirteenth and 14th technology chips, the corporate took discover however finally gave up on fixing them with software program updates.

The outcome? Gelsinger needed to depart earlier than realizing his mission to finish the 18A fabrication course of – whereas the corporate says it has been set in movement, chips made utilizing the method haven’t been rolled out but.

See Additionally: MicroStrategy’s Michael Saylor Dangers Breaking Down The ‘Magic Cash Creation Machine’ With His Rising Bitcoin Guess, Says Knowledgeable

Gelsinger and Intel would have hoped for the success of 18A, particularly to maintain its struggling foundry enterprise alive.

Nonetheless, with Gelsinger now out and no suitor in sight, Intel’s future appears to be hanging within the stability.

Worth Motion: Intel’s inventory closed at $20.92 on Friday, up 0.6% for the day. 12 months-to-date, it has fallen 56.2%.

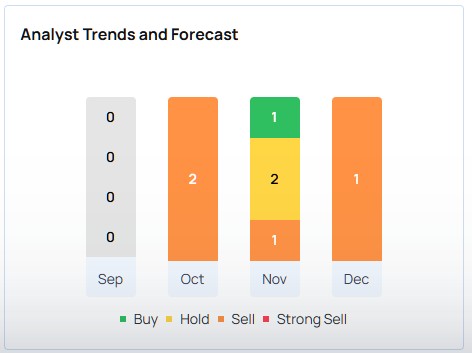

Knowledge from Benzinga Professional exhibits that analysts have a consensus ranking of “Impartial” for the Intel inventory. BofA Securities, Northland Capital Markets, and Mizuho are among the many three most up-to-date analyst scores, and their common worth goal stands at $24, implying a 14.7% upside.

Will Intel have the ability to flip round its fortunes, although? Solely time will inform.

Take a look at extra of Benzinga’s Shopper Tech protection by following this hyperlink.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Photograph courtesy: Unsplash

Market Information and Knowledge delivered to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.