Buyers with some huge cash to spend have taken a bearish stance on Tesla TSLA.

And retail merchants ought to know.

We seen this at the moment when the trades confirmed up on publicly accessible choices historical past that we monitor right here at Benzinga.

Whether or not these are establishments or simply rich people, we do not know. However when one thing this large occurs with TSLA, it typically means anyone is aware of one thing is about to occur.

So how do we all know what these traders simply did?

At this time, Benzinga‘s choices scanner noticed 537 unusual choices trades for Tesla.

This is not regular.

The general sentiment of those big-money merchants is cut up between 37% bullish and 46%, bearish.

Out of the entire particular choices we uncovered, 131 are places, for a complete quantity of $7,119,197, and 406 are calls, for a complete quantity of $32,601,577.

Predicted Value Vary

Analyzing the Quantity and Open Curiosity in these contracts, evidently the massive gamers have been eyeing a worth window from $300.0 to $800.0 for Tesla through the previous quarter.

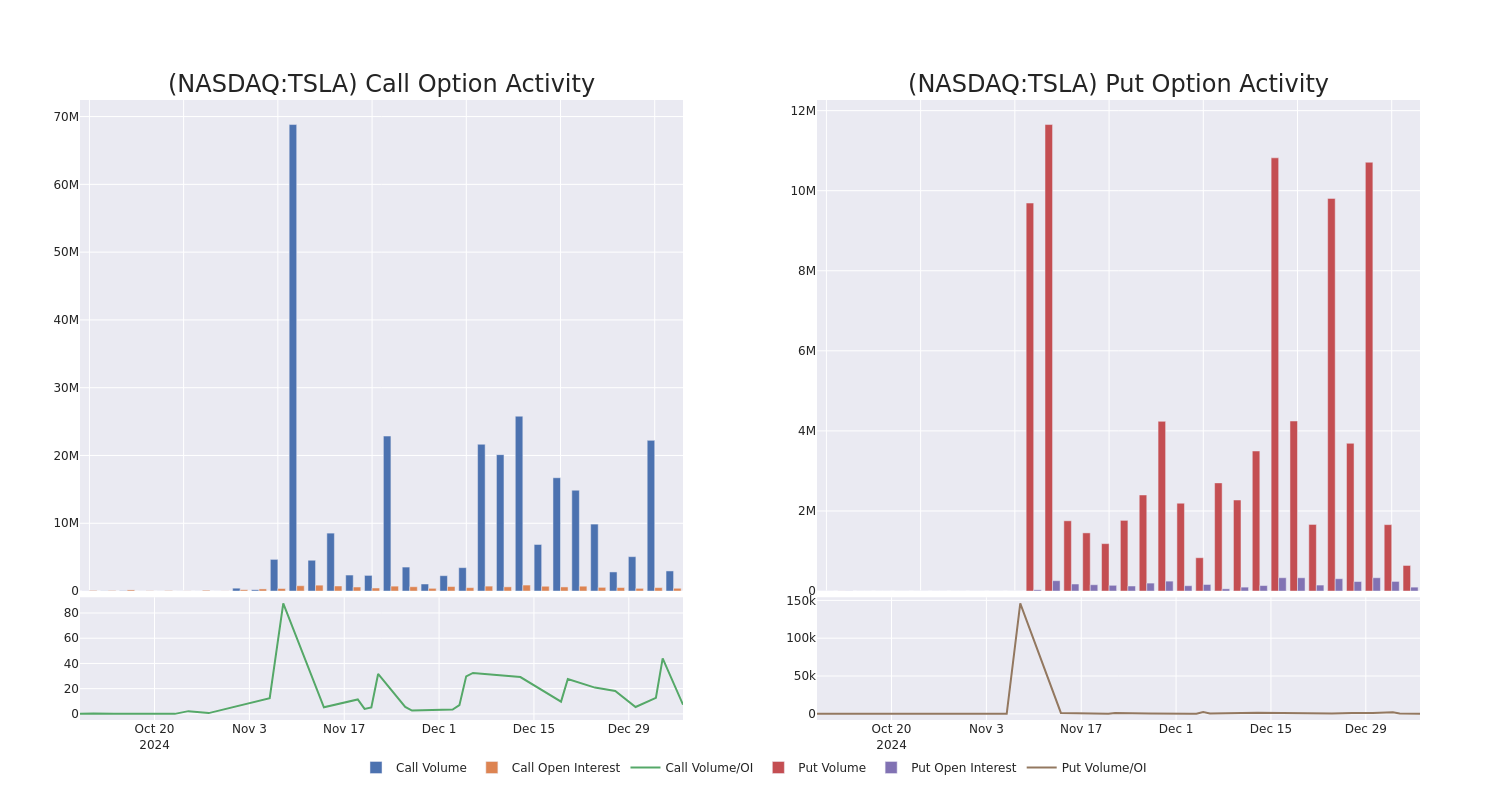

Analyzing Quantity & Open Curiosity

Trying on the quantity and open curiosity is an insightful strategy to conduct due diligence on a inventory.

This information might help you monitor the liquidity and curiosity for Tesla’s choices for a given strike worth.

Beneath, we will observe the evolution of the quantity and open curiosity of calls and places, respectively, for all of Tesla’s whale exercise inside a strike worth vary from $300.0 to $800.0 within the final 30 days.

Tesla Choice Exercise Evaluation: Final 30 Days

Largest Choices Trades Noticed:

| Image | PUT/CALL | Commerce Sort | Sentiment | Exp. Date | Ask | Bid | Value | Strike Value | Whole Commerce Value | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSLA | CALL | SWEEP | BEARISH | 01/10/25 | $8.0 | $7.9 | $7.96 | $420.00 | $246.8K | 10.6K | 32.4K |

| TSLA | CALL | SWEEP | BEARISH | 01/10/25 | $10.25 | $10.05 | $10.17 | $417.50 | $156.9K | 2.0K | 6.1K |

| TSLA | CALL | SWEEP | BEARISH | 01/17/25 | $64.05 | $63.95 | $64.0 | $350.00 | $153.6K | 25.8K | 8.5K |

| TSLA | CALL | SWEEP | BULLISH | 01/10/25 | $8.5 | $8.35 | $8.5 | $420.00 | $131.7K | 10.6K | 33.9K |

| TSLA | PUT | TRADE | BULLISH | 01/10/25 | $11.35 | $11.15 | $11.2 | $412.50 | $112.0K | 756 | 4.6K |

About Tesla

Tesla is a vertically built-in battery electrical automobile automaker and developer of autonomous driving software program. The corporate has a number of automobiles in its fleet, which embrace luxurious and midsize sedans, crossover SUVs, a light-weight truck, and a semi truck. Tesla additionally plans to start promoting extra reasonably priced automobiles, a sports activities automotive, and a robotaxi. International deliveries in 2024 had been a bit of beneath 1.8 million automobiles. The corporate sells batteries for stationary storage for residential and business properties together with utilities and photo voltaic panels and photo voltaic roofs for vitality technology. Tesla additionally owns a fast-charging community.

After a radical assessment of the choices buying and selling surrounding Tesla, we transfer to look at the corporate in additional element. This consists of an evaluation of its present market standing and efficiency.

Tesla’s Present Market Standing

- With a quantity of 21,310,146, the worth of TSLA is up 1.82% at $417.89.

- RSI indicators trace that the underlying inventory could also be approaching overbought.

- Subsequent earnings are anticipated to be launched in 23 days.

What Analysts Are Saying About Tesla

A complete of 5 skilled analysts have given their tackle this inventory within the final 30 days, setting a mean worth goal of $307.172.

Flip $1000 into $1270 in simply 20 days?

20-year professional choices dealer reveals his one-line chart approach that exhibits when to purchase and promote. Copy his trades, which have had averaged a 27% revenue each 20 days. Click on right here for entry.

* An analyst from Deutsche Financial institution persists with their Purchase ranking on Tesla, sustaining a goal worth of $370.

* An analyst from Truist Securities has determined to take care of their Maintain ranking on Tesla, which presently sits at a worth goal of $351.

* Exhibiting optimism, an analyst from Mizuho upgrades its ranking to Outperform with a revised worth goal of $515.

* Reflecting considerations, an analyst from GLJ Analysis lowers its ranking to Promote with a brand new worth goal of $24.

* An analyst from Evercore ISI Group persists with their In-Line ranking on Tesla, sustaining a goal worth of $275.

Choices buying and selling presents larger dangers and potential rewards. Astute merchants handle these dangers by frequently educating themselves, adapting their methods, monitoring a number of indicators, and conserving an in depth eye on market actions. Keep knowledgeable in regards to the newest Tesla choices trades with real-time alerts from Benzinga Professional.

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.