Scores for Flooring & Decor Hldgs FND have been offered by 9 analysts previously three months, showcasing a mixture of bullish and bearish views.

The desk beneath gives a concise overview of latest scores by analysts, providing insights into the altering sentiments over the previous 30 days and drawing comparisons with the previous months for a holistic perspective.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Scores | 1 | 2 | 5 | 0 | 1 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 1 | 0 | 0 | 0 | 0 |

| 2M In the past | 0 | 2 | 3 | 0 | 1 |

| 3M In the past | 0 | 0 | 1 | 0 | 0 |

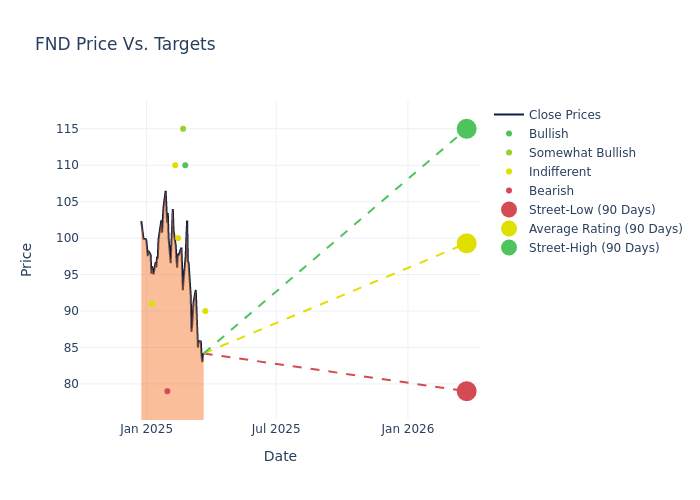

Offering deeper insights, analysts have established 12-month value targets, indicating a median goal of $101.44, together with a excessive estimate of $115.00 and a low estimate of $79.00. Surpassing the earlier common value goal of $99.78, the present common has elevated by 1.66%.

Understanding Analyst Scores: A Complete Breakdown

The notion of Flooring & Decor Hldgs by monetary consultants is analyzed by way of latest analyst actions. The next abstract presents key analysts, their latest evaluations, and changes to scores and value targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Peter Keith | Piper Sandler | Lowers | Impartial | $90.00 | $103.00 |

| W. Andrew Carter | Stifel | Raises | Purchase | $110.00 | $100.00 |

| Joseph Feldman | Telsey Advisory Group | Maintains | Outperform | $115.00 | $115.00 |

| Peter Keith | Piper Sandler | Lowers | Impartial | $103.00 | $118.00 |

| Seth Basham | Wedbush | Lowers | Impartial | $100.00 | $110.00 |

| Joseph Feldman | Telsey Advisory Group | Raises | Outperform | $115.00 | $95.00 |

| Christopher Horvers | JP Morgan | Raises | Impartial | $110.00 | $103.00 |

| Kate McShane | Goldman Sachs | Maintains | Promote | $79.00 | $79.00 |

| Seth Sigman | Barclays | Raises | Equal-Weight | $91.00 | $75.00 |

Key Insights:

- Motion Taken: In response to dynamic market circumstances and firm efficiency, analysts replace their suggestions. Whether or not they ‘Preserve’, ‘Increase’, or ‘Decrease’ their stance, it signifies their response to latest developments associated to Flooring & Decor Hldgs. This perception offers a snapshot of analysts’ views on the present state of the corporate.

- Ranking: Unveiling insights, analysts ship qualitative insights into inventory efficiency, from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Flooring & Decor Hldgs in comparison with the broader market.

- Value Targets: Analysts predict actions in value targets, providing estimates for Flooring & Decor Hldgs’s future worth. Analyzing the present and prior targets provides insights into analysts’ evolving expectations.

Contemplating these analyst evaluations along with different monetary indicators can supply a complete understanding of Flooring & Decor Hldgs’s market place. Keep knowledgeable and make well-informed choices with our Scores Desk.

Keep updated on Flooring & Decor Hldgs analyst scores.

All You Have to Know About Flooring & Decor Hldgs

Flooring & Decor Holdings Inc operates as a specialty retailer within the onerous floor flooring market. Its shops supply a variety of tile, wooden, laminate, and pure stone flooring merchandise, in addition to ornamental and set up equipment at on a regular basis low costs. It appeals to a wide range of prospects together with skilled installers, industrial companies, Do It Your self (DIY) prospects, and prospects who purchase the merchandise for skilled set up. Geographically, the group has a presence in america area and in addition provides its product by way of an e-commerce website.

Understanding the Numbers: Flooring & Decor Hldgs’s Funds

Market Capitalization Evaluation: The corporate’s market capitalization is beneath the business common, suggesting that it’s comparatively smaller in comparison with friends. This might be resulting from numerous components, together with perceived development potential or operational scale.

Income Development: Flooring & Decor Hldgs’s outstanding efficiency in 3 months is obvious. As of 31 December, 2024, the corporate achieved a powerful income development charge of 5.66%. This signifies a considerable improve within the firm’s top-line earnings. As in comparison with rivals, the corporate surpassed expectations with a development charge larger than the typical amongst friends within the Shopper Discretionary sector.

Internet Margin: Flooring & Decor Hldgs’s monetary energy is mirrored in its distinctive web margin, which exceeds business averages. With a outstanding web margin of 4.29%, the corporate showcases sturdy profitability and efficient value administration.

Return on Fairness (ROE): Flooring & Decor Hldgs’s ROE is beneath business averages, indicating potential challenges in effectively using fairness capital. With an ROE of 2.22%, the corporate could face hurdles in attaining optimum monetary returns.

Return on Property (ROA): Flooring & Decor Hldgs’s monetary energy is mirrored in its distinctive ROA, which exceeds business averages. With a outstanding ROA of 0.95%, the corporate showcases environment friendly use of belongings and robust monetary well being.

Debt Administration: Flooring & Decor Hldgs’s debt-to-equity ratio is beneath the business common. With a ratio of 0.78, the corporate depends much less on debt financing, sustaining a more healthy stability between debt and fairness, which may be seen positively by traders.

How Are Analyst Scores Decided?

Benzinga tracks 150 analyst corporations and studies on their inventory expectations. Analysts usually arrive at their conclusions by predicting how a lot cash an organization will make sooner or later, often the upcoming 5 years, and the way dangerous or predictable that firm’s income streams are.

Analysts attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish their scores on shares. Analysts usually charge every inventory as soon as per quarter or each time the corporate has a significant replace.

Some analysts publish their predictions for metrics comparable to development estimates, earnings, and income to supply extra steerage with their scores. When utilizing analyst scores, it is very important understand that inventory and sector analysts are additionally human and are solely providing their opinions to traders.

If you wish to hold monitor of which analysts are outperforming others, you’ll be able to view up to date analyst scores alongside withanalyst success scores in Benzinga Professional.

Which Shares Are Analysts Recommending Now?

Benzinga Edge offers you prompt entry to all main analyst upgrades, downgrades, and value targets. Type by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.