BSP Enterprise Expectations Survey Q1 2025

MANILA, Philippines — Native enterprise sentiment has weakened within the first three months of the 12 months, with the general confidence index considerably declining amid a string of financial uncertainties.

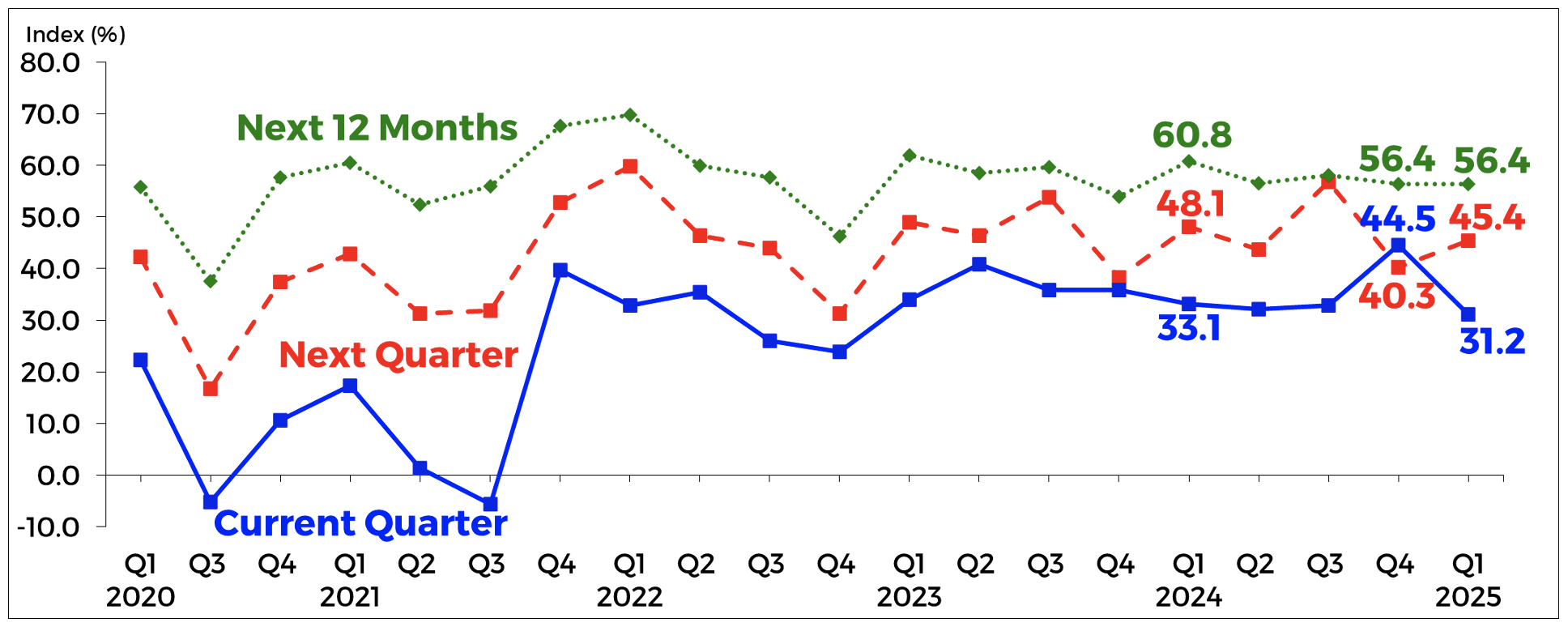

Outcomes of the Bangko Sentral ng Pilipinas’ Enterprise Expectation Survey launched on Friday confirmed that the general confidence index (CI) this primary quarter had dropped to 31.2 % from 44.5 % within the final quarter of 2024.

The extra cautious outlook was primarily pushed by issues over the “post-holiday decline in demand for items and companies, a slowdown in enterprise actions and a possible resurgence of inflationary pressures,” the BSP mentioned in a press release.

Higher outlook for Q2

Globally, the tariffs imposed by US President Donald Trump on metal and aluminum imports, and up to date plans to slap tariffs on automobiles, are broadly anticipated to extend the price of doing enterprise. That is particularly as international locations like China and Canada needed to readjust their commerce insurance policies, leading to a commerce struggle.

Nonetheless, the native central financial institution mentioned that optimism rebounded by way of the outlook for the second quarter, with the general CI rising to 45.4 % from 40.3 % within the earlier survey.

The newest survey coated 1,527 companies through the Jan. 8 to March 1 interval.

The CI is computed as the share of corporations that answered within the affirmative much less the share of corporations that answered within the damaging with regard to their views on the general enterprise outlook.

For the subsequent 12 months, enterprise confidence remained steady, with the general CI holding at 56.4 %, unchanged from the earlier quarter.

The report confirmed that enterprise sentiment weakened throughout all sectors, aside from the development sector, whose optimism remained regular.

READ: Filipino shoppers, companies extra upbeat about This fall

Decrease utilization

Confidence amongst buying and selling corporations declined, with exporters, dual-activity corporations (engaged in each importing and exporting) and domestic-oriented corporations indicating decrease confidence from the earlier survey.

Alternatively, importers’ confidence remained largely unchanged.

The common capability utilization price of each the trade and development sectors additionally declined to 71.4 % from 73.9 % within the fourth quarter of 2024.

Utilization price is an indicator of manufacturing exercise because it reveals how a lot capability is being deployed to fulfill buyer demand.

The report confirmed that corporations anticipated tighter monetary situations and restricted entry to credit score through the first quarter.

“The monetary situation index grew to become extra damaging, reflecting expectations of tighter money or liquidity positions,” mentioned the report.

Companies additionally anticipated a extra constrained funding surroundings, because the credit score entry index reverted to damaging territory, the central financial institution mentioned.