Tesla Inc. TSLA has reportedly encountered a $1.4 billion hole between its capital expenditure and the valuation of associated property during the last six months of 2024.

What Occurred: This discrepancy, highlighted in a report by Monetary Occasions, comes as Tesla’s inventory market valuation has plummeted from $1.7 trillion to below $800 billion.

Based on the report, Tesla’s money movement assertion reveals $6.3 billion spent on property and gear purchases within the third and fourth quarters of 2024. Nevertheless, the stability sheet reveals solely a $4.9 billion enhance within the gross worth of property, plant, and gear throughout the identical interval.

Tesla didn’t instantly reply to Benzinga’s request for remark.

See Additionally: Elon Musk’s Tesla Focused With Arson Assaults In Las Vegas, Kansas Metropolis: Report

Regardless of Tesla’s substantial money reserves of $37 billion, the corporate raised $6 billion in new debt final 12 months.

This raises questions on Tesla’s monetary methods, particularly because it plans to take a position closely in AI infrastructure, robots, computing, and batteries, with no less than $11 billion earmarked for every of the approaching years.

Monetary specialists, together with Jacek Welc from SRH Berlin College, counsel that such monetary anomalies may point out weak inside controls or aggressive expense classification.

Tesla’s ongoing capital elevating, regardless of important money movement, is seen as a possible purple flag for accounting misstatements.

Why It Issues: The monetary discrepancy at Tesla comes amid a turbulent interval for Elon Musk, the corporate’s CEO. Musk has been juggling his tasks between Tesla and his function within the Division of Authorities Effectivity (DOGE) below the Trump administration.

In a latest interview, Musk admitted to going through important challenges in managing his companies, coinciding with a pointy decline in Tesla’s inventory.

Traders have expressed frustration over Musk’s divided focus, with some, like Tesla’s largest bull, voicing considerations about his consideration being diverted from the corporate. Dan Ives from Wedbush Securities has additionally highlighted the unsustainable nature of Musk’s present management scenario for Tesla’s shareholders.

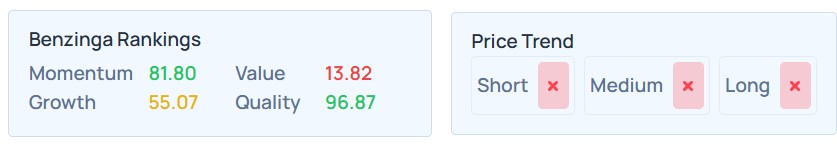

Tesla holds a momentum score of 81.80% and a development score of 55.07%, in line with Benzinga’s Proprietary Edge Rankings. The Benzinga Development metric evaluates a inventory’s historic earnings and income enlargement throughout a number of timeframes, prioritizing each long-term tendencies and up to date efficiency. For an in-depth report on extra shares and insights into development alternatives, signal up for Benzinga Edge.

Try extra of Benzinga’s Future Of Mobility protection by following this hyperlink.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Picture courtesy: Shutterstock

Momentum81.80

Development55.07

High quality96.87

Worth13.82

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.