Within the newest quarter, 4 analysts supplied scores for Ares Comml Actual Est ACRE, showcasing a mixture of bullish and bearish views.

The next desk encapsulates their current scores, providing a glimpse into the evolving sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Rankings | 0 | 0 | 4 | 0 | 0 |

| Final 30D | 0 | 0 | 2 | 0 | 0 |

| 1M In the past | 0 | 0 | 2 | 0 | 0 |

| 2M In the past | 0 | 0 | 0 | 0 | 0 |

| 3M In the past | 0 | 0 | 0 | 0 | 0 |

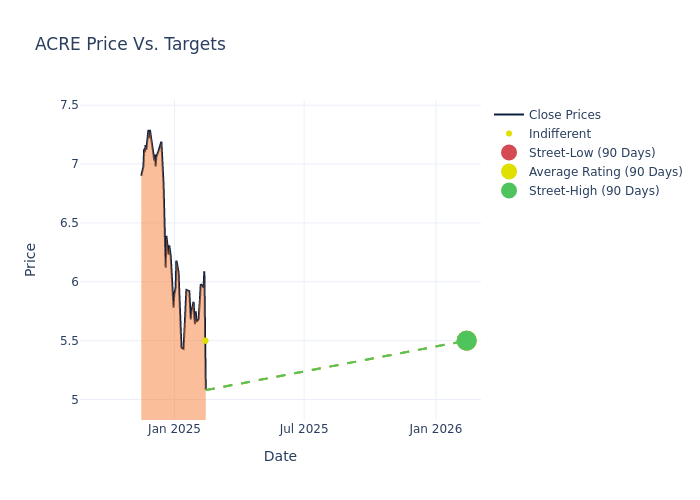

Analysts have set 12-month value targets for Ares Comml Actual Est, revealing a mean goal of $5.75, a excessive estimate of $6.00, and a low estimate of $5.50. Experiencing a 11.54% decline, the present common is now decrease than the earlier common value goal of $6.50.

Decoding Analyst Rankings: A Nearer Look

The standing of Ares Comml Actual Est amongst monetary consultants turns into clear with an intensive evaluation of current analyst actions. The abstract beneath outlines key analysts, their current evaluations, and changes to scores and value targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Richard Shane | JP Morgan | Lowers | Impartial | $5.50 | $6.00 |

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Market Carry out | $5.50 | $6.00 |

| Richard Shane | JP Morgan | Lowers | Impartial | $6.00 | $7.00 |

| Jade Rahmani | Keefe, Bruyette & Woods | Lowers | Market Carry out | $6.00 | $7.00 |

Key Insights:

- Motion Taken: Responding to altering market dynamics and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Increase’, or ‘Decrease’ their stance, it signifies their response to current developments associated to Ares Comml Actual Est. This affords perception into analysts’ views on the present state of the corporate.

- Ranking: Providing a complete view, analysts assess shares qualitatively, spanning from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Ares Comml Actual Est in comparison with the broader market.

- Value Targets: Delving into actions, analysts present estimates for the long run worth of Ares Comml Actual Est’s inventory. This evaluation reveals shifts in analysts’ expectations over time.

Understanding these analyst evaluations alongside key monetary indicators can supply helpful insights into Ares Comml Actual Est’s market standing. Keep knowledgeable and make well-considered choices with our Rankings Desk.

Keep updated on Ares Comml Actual Est analyst scores.

In case you are curious about following small-cap inventory information and efficiency you can begin by monitoring it right here.

Delving into Ares Comml Actual Est’s Background

Ares Industrial Actual Property Corp is a specialty finance firm and a Actual Property Funding Belief offering business actual property loans and associated investments. It operates in a single phase specifically originating and managing a diversified portfolio of CRE debt-related investments. The group acknowledges its revenues by the curiosity earnings it receives from loans.

Ares Comml Actual Est: Monetary Efficiency Dissected

Market Capitalization Evaluation: The corporate displays a decrease market capitalization profile, positioning itself beneath trade averages. This implies a smaller scale relative to friends.

Income Challenges: Ares Comml Actual Est’s income progress over 3 months confronted difficulties. As of 30 September, 2024, the corporate skilled a decline of roughly -42.69%. This means a lower in top-line earnings. As in comparison with rivals, the corporate encountered difficulties, with a progress fee decrease than the typical amongst friends within the Financials sector.

Web Margin: Ares Comml Actual Est’s web margin falls beneath trade averages, indicating challenges in reaching sturdy profitability. With a web margin of -54.01%, the corporate might face hurdles in efficient price administration.

Return on Fairness (ROE): The corporate’s ROE is beneath trade benchmarks, signaling potential difficulties in effectively utilizing fairness capital. With an ROE of -1.03%, the corporate may have to deal with challenges in producing passable returns for shareholders.

Return on Belongings (ROA): The corporate’s ROA is beneath trade benchmarks, signaling potential difficulties in effectively using belongings. With an ROA of -0.29%, the corporate may have to deal with challenges in producing passable returns from its belongings.

Debt Administration: Ares Comml Actual Est’s debt-to-equity ratio is beneath the trade common at 2.38, reflecting a decrease dependency on debt financing and a extra conservative monetary method.

The Fundamentals of Analyst Rankings

Analysts are specialists inside banking and monetary methods that sometimes report for particular shares or inside outlined sectors. These individuals analysis firm monetary statements, sit in convention calls and conferences, and communicate with related insiders to find out what are often known as analyst scores for shares. Usually, analysts will fee every inventory as soon as 1 / 4.

Past their normal evaluations, some analysts contribute predictions for metrics like progress estimates, earnings, and income, furnishing traders with extra steering. Customers of analyst scores must be aware that this specialised recommendation is formed by human views and could also be topic to variability.

Breaking: Wall Avenue’s Subsequent Large Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive progress. This under-the-radar firm might surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.