Mizuho Securities upgraded Chewy Inc. CHWY to Outperform from Impartial and raised its worth goal to $42, representing a 13.29% improve from present worth ranges, citing bettering pet class fundamentals and a number of progress catalysts for 2025.

What Occurred: The e-commerce pet provides retailer is poised to profit from recovering business developments and inner initiatives that might drive EBITDA margin growth towards excessive single to double digits, in response to Mizuho analyst David Bellinger.

“The pet class is starting to get better into 2025, yielding a return to web lively buyer progress for Chewy and a subsequent top-line re-acceleration,” Bellinger wrote in a Jan. 6 analysis be aware, including, “Chewy notches to our high choose general and inside our shopper web vertical. Bull case suggests +50% upside.”

Key progress drivers embody Chewy’s underpenetrated cell app, which at the moment accounts for about 20% of revenues however may exceed 40-50% penetration over the following 12-24 months. The corporate’s automation initiatives have already lowered order-to-delivery instances by 10% whereas chopping success prices by 30% throughout 40% of volumes.

Mizuho tasks Chewy’s income progress of 4.5% in fiscal 2025, accelerating to 7.9% within the monetary yr 2026 and eight.1% within the monetary yr 2027. The agency forecasts adjusted EBITDA margins reaching 5.5% within the monetary yr 2025, increasing to six.5% within the monetary yr 2026 and seven.2% within the monetary yr 2027 – barely forward of consensus estimates.

Chewy gained important consideration final yr when influential dealer Keith Gill, generally known as Roaring Kitty, collected and later bought a stake within the firm.

See Additionally: Amid Nvidia’s CES 2025 Buzz, Traders Neglected Apple Provider Foxconn’s Sturdy This autumn, Says Jim Cramer

Why It Issues: The improve follows Chewy’s sturdy third-quarter efficiency, the place it added roughly 160,000 web lively clients. JPMorgan tasks this progress may speed up to 650,000 new clients in 2025.

Bellinger famous that issues about increased promoting spend are “short-sighted,” as the corporate maintains a robust return on funding metrics whereas investing in buyer acquisition. The analyst highlighted Chewy’s excessive income visibility by means of its Autoship subscription program, which accounts for over 80% of gross sales.

The brand new worth goal represents a a number of of 20x the monetary yr 2026 estimated EBITDA of $868 million, reflecting a premium to e-commerce friends given Chewy’s publicity to the resilient pet class and a transparent path to margin growth. The corporate additionally has over $400 million remaining in its share buyback program.

Value Motion: Chewy’s inventory closed at $37.07 on Monday, reflecting a 3.09% improve. In after-hours buying and selling, the inventory fell by 1.97%. Over the previous yr, Chewy has skilled a notable progress of 79.17%, in response to knowledge from Benzinga Professional.

The inventory’s 52-week vary is between $14.69 and $39.10. With a market capitalization of $14.80 billion, Chewy holds a price-to-earnings ratio of 40.29 and a relative energy index of 53.

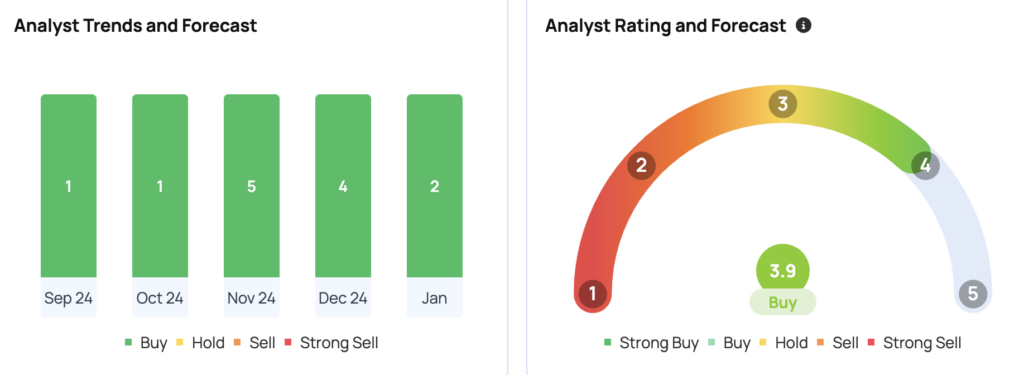

Chewy has a consensus worth goal of $35.19. The excessive goal is $42, and the low is $25. Current scores recommend a $39 goal, implying a 7.32% upside.

Learn Subsequent:

Picture By way of Shutterstock

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and printed by Benzinga editors.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.