Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary information and sample recognition to showcase 5 shares which can be slightly below the floor and deserve consideration.

Traders are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies accessible to retail merchants, the problem usually lies in sifting by means of the abundance of data to uncover new alternatives and perceive why sure shares ought to be of curiosity.

Learn Additionally: EXCLUSIVE: February’s 20 Most-Searched Tickers On Benzinga Professional – The place Do Tesla, Palantir, Alibaba, Nvidia Rank?

Here is a have a look at the Benzinga Inventory Whisper Index for the week ending March 7:

Barrick Gold GOLD: The gold firm noticed elevated curiosity from Benzinga readers in the course of the week. The most important cause for the elevated consideration was possible a UBS analyst improve on the inventory going from Impartial to Purchase with a $22 worth goal. Benzinga not too long ago shared that the corporate is getting nearer to resolving a dispute in Mali, an merchandise that has damage the corporate’s financials. Gold shares may be seeing elevated consideration from buyers as a potential hedge towards tariffs and rising macroeconomic issues.

The inventory was up 3% during the last week as proven on the Benzinga Professional chart under and shares are up 17% during the last 12 months.

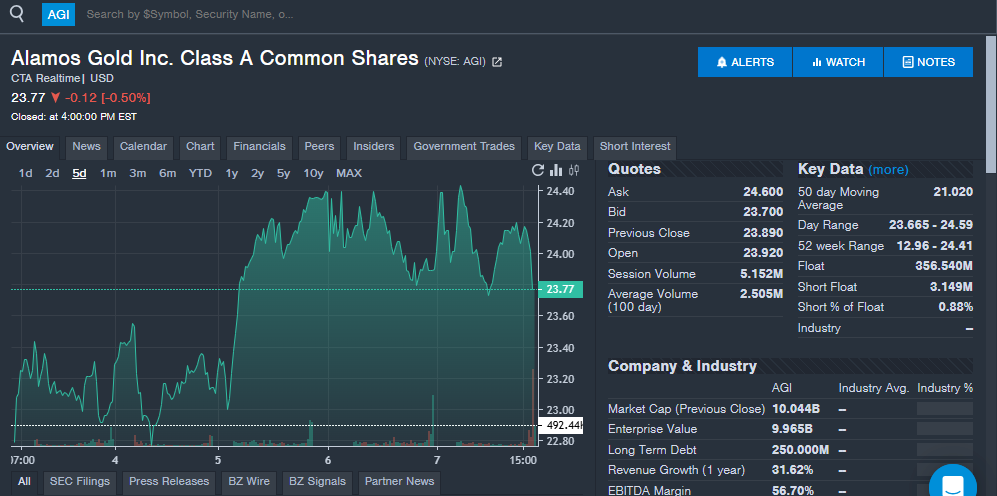

Alamos Gold Inc AGI: One other gold inventory seeing elevated consideration from Benzinga readers in the course of the week was Alamos Gold. The corporate not too long ago reported a document 2024 efficiency and predicted that manufacturing development will develop 24% yearly by means of 2027 with continued growth. The corporate’s fourth-quarter earnings per share and income every beat Avenue consensus estimates. The corporate has now overwhelmed earnings per share estimates in eight of the final 10 quarters and income estimates in seven of the final 10 quarters total.

Realty Earnings Company O: The actual property funding belief noticed robust curiosity from readers in the course of the week. The corporate not too long ago reported fourth-quarter monetary outcomes with adjusted funds from operations per share up 4% year-over-year to $1.05, falling shy of analyst estimates of $1.07. The corporate owns or holds curiosity in additional than 15,000 properties and pays a month-to-month dividend, which could possibly be a cause for the elevated curiosity. Traders could possibly be searching for funding revenue and excessive dividends to offset issues from tariffs and macroeconomic issues.

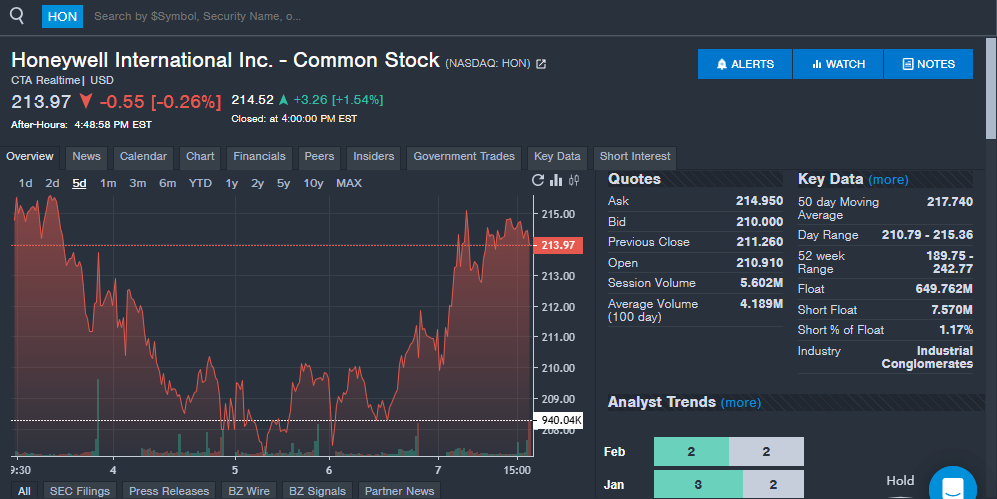

Honeywell Worldwide HON: The commercial firm noticed elevated curiosity from Benzinga readers in the course of the week, which could possibly be associated to current monetary outcomes and an acquisition. Honeywell introduced a $2.2 billion deal to accumulate Sundyne from Warburg Pincus. The acquisition will develop Honeywell’s industrial gear portfolio. Honeywell has now introduced $9 billion in acquisitions since December 2023.

The corporate not too long ago introduced it will separate into three enterprise models as a part of a portfolio transformation. The transfer will embrace tax-free spinoffs for shareholders.

Honeywell’s fourth-quarter income and earnings per share beat analyst estimates. The corporate has overwhelmed earnings per share estimates in additional than 10 straight quarters. Honeywell’s income has overwhelmed analyst estimates in 4 of the final 10 quarters total.

The inventory traded flat on the week and shares are up round 6% during the last 12 months.

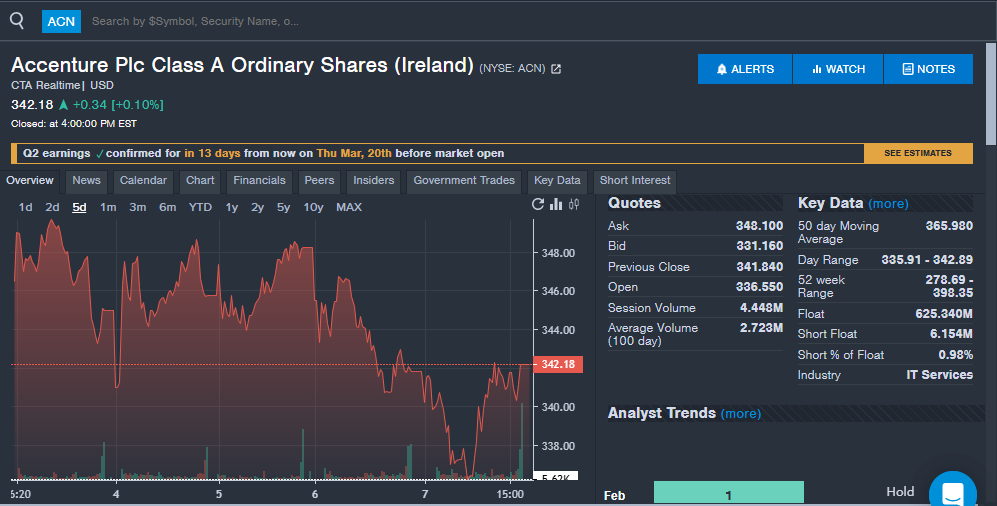

Accenture Plc ACN: The IT Providers firm noticed robust curiosity from readers in the course of the week, which comes after it introduced acquisitions and forward of quarterly monetary outcomes. The corporate introduced the acquisition of Denmark-based AI firm Halfspace. The acquisition is anticipated to spice up the corporate’s presence within the Nordic and European areas and increase the corporate’s total AI capabilities. Halfspace, which was based in 2015, develops AI options and merchandise that can be utilized by firms. Accenture can also be buying Altus Consulting, an organization that gives advisory providers. The acquisition is anticipated so as to add to Accenture’s insurance coverage division and increase its presence in the UK.

Accenture will report second-quarter monetary outcomes on March 20. Analysts count on the corporate to report income of $16.63 billion, up from $15.80 billion in final 12 months’s second quarter and earnings per share of $2.82, up from $2.77 in final 12 months’s second quarter. The corporate has overwhelmed estimates for income in two straight quarters and 7 of the final 10 quarters total. The corporate has overwhelmed earnings per share estimates in two straight quarters and 9 of the final 10 quarters total.

Keep tuned for subsequent week’s report, and comply with Benzinga Professional for all the newest headlines and high market-moving tales right here.

Learn the newest Inventory Whisper Index stories right here:

Learn Subsequent:

Momentum37.13

Development55.30

High quality23.57

Worth10.21

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.