Deep-pocketed buyers have adopted a bearish strategy in direction of Cheniere Vitality LNG, and it is one thing market gamers should not ignore. Our monitoring of public choices data at Benzinga unveiled this vital transfer at present. The identification of those buyers stays unknown, however such a considerable transfer in LNG often suggests one thing large is about to occur.

We gleaned this data from our observations at present when Benzinga’s choices scanner highlighted 20 extraordinary choices actions for Cheniere Vitality. This degree of exercise is out of the odd.

The final temper amongst these heavyweight buyers is split, with 35% leaning bullish and 45% bearish. Amongst these notable choices, 14 are places, totaling $3,086,380, and 6 are calls, amounting to $229,568.

Anticipated Value Actions

Primarily based on the buying and selling exercise, it seems that the numerous buyers are aiming for a worth territory stretching from $160.0 to $230.0 for Cheniere Vitality over the latest three months.

Insights into Quantity & Open Curiosity

By way of liquidity and curiosity, the imply open curiosity for Cheniere Vitality choices trades at present is 798.33 with a complete quantity of 21,653.00.

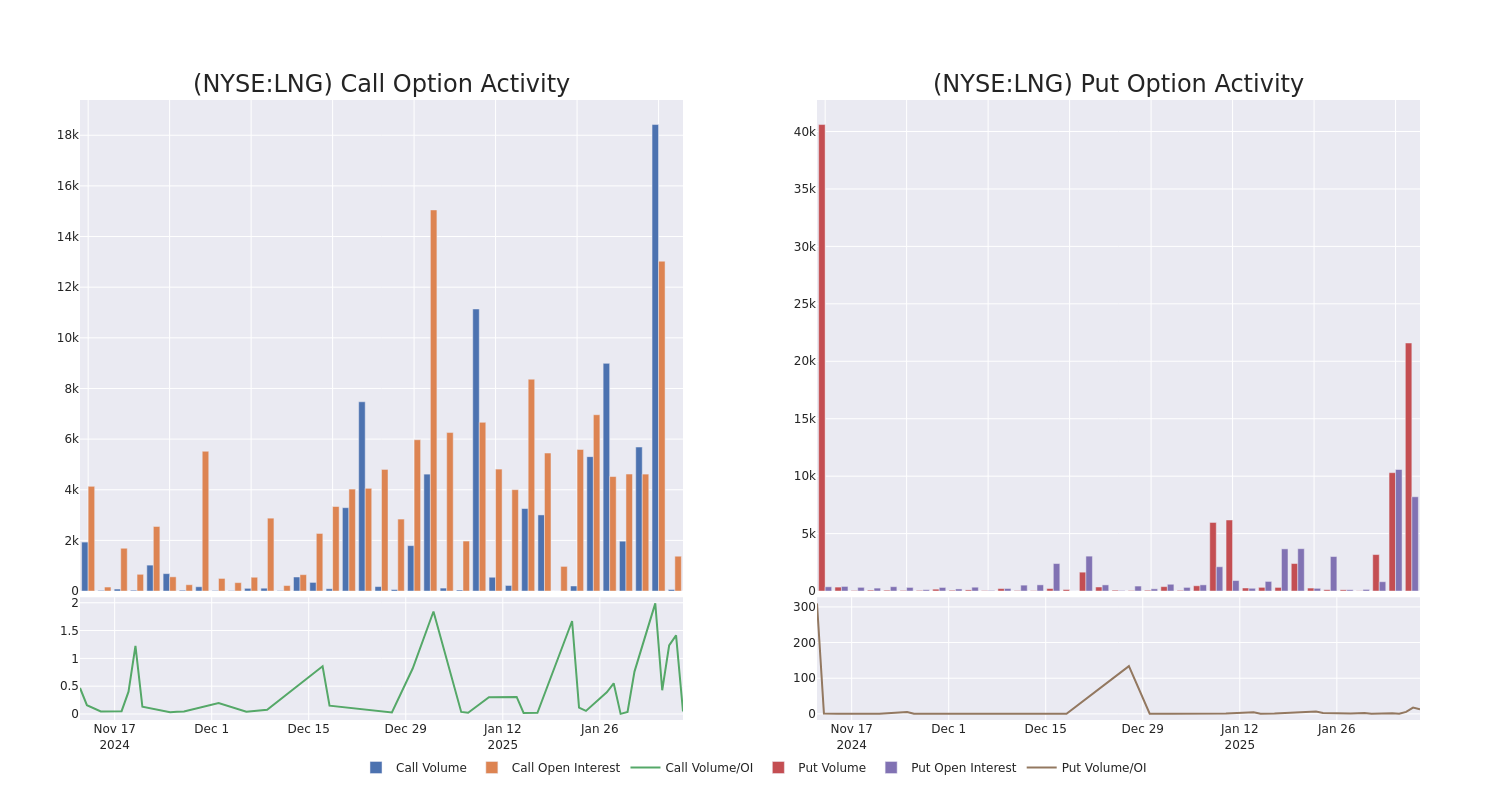

Within the following chart, we’re capable of observe the event of quantity and open curiosity of name and put choices for Cheniere Vitality’s large cash trades inside a strike worth vary of $160.0 to $230.0 over the past 30 days.

Cheniere Vitality Choice Exercise Evaluation: Final 30 Days

Noteworthy Choices Exercise:

| Image | PUT/CALL | Commerce Sort | Sentiment | Exp. Date | Ask | Bid | Value | Strike Value | Whole Commerce Value | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LNG | PUT | TRADE | BEARISH | 03/21/25 | $3.1 | $2.7 | $2.95 | $200.00 | $1.4M | 3.1K | 5.0K |

| LNG | PUT | TRADE | NEUTRAL | 03/21/25 | $3.2 | $3.0 | $3.1 | $200.00 | $930.0K | 3.1K | 5.2K |

| LNG | PUT | SWEEP | BEARISH | 06/20/25 | $7.4 | $7.2 | $7.3 | $200.00 | $94.1K | 414 | 72 |

| LNG | PUT | TRADE | BULLISH | 06/20/25 | $15.5 | $15.3 | $15.3 | $220.00 | $87.2K | 270 | 115 |

| LNG | PUT | SWEEP | BULLISH | 03/21/25 | $3.2 | $3.0 | $3.0 | $200.00 | $83.7K | 3.1K | 8.2K |

About Cheniere Vitality

Cheniere Vitality owns and operates the Sabine Go liquefied pure gasoline terminal by way of its stake in Cheniere Companions. It additionally owns the Corpus Christi LNG terminals in addition to Cheniere Advertising, which markets LNG utilizing Cheniere’s gasoline volumes.

In mild of the latest choices historical past for Cheniere Vitality, it is now acceptable to give attention to the corporate itself. We purpose to discover its present efficiency.

The place Is Cheniere Vitality Standing Proper Now?

- With a quantity of 715,023, the value of LNG is down -0.96% at $216.03.

- RSI indicators trace that the underlying inventory is at the moment impartial between overbought and oversold.

- Subsequent earnings are anticipated to be launched in 13 days.

Skilled Analyst Scores for Cheniere Vitality

A complete of 4 skilled analysts have given their tackle this inventory within the final 30 days, setting a mean worth goal of $249.25.

Uncommon Choices Exercise Detected: Good Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions large cash is taking in your favourite shares. Click on right here for entry.

* Sustaining their stance, an analyst from Barclays continues to carry a Chubby score for Cheniere Vitality, concentrating on a worth of $253.

* Reflecting issues, an analyst from Scotiabank lowers its score to Sector Outperform with a brand new worth goal of $242.

* Constant of their analysis, an analyst from Scotiabank retains a Sector Outperform score on Cheniere Vitality with a goal worth of $247.

* Constant of their analysis, an analyst from Morgan Stanley retains a Chubby score on Cheniere Vitality with a goal worth of $255.

Buying and selling choices entails better dangers but in addition provides the potential for larger income. Savvy merchants mitigate these dangers via ongoing schooling, strategic commerce changes, using numerous indicators, and staying attuned to market dynamics. Sustain with the newest choices trades for Cheniere Vitality with Benzinga Professional for real-time alerts.

Market Information and Knowledge dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.