Deep-pocketed traders have adopted a bullish method in direction of Barrick Gold GOLD, and it is one thing market gamers should not ignore. Our monitoring of public choices information at Benzinga unveiled this important transfer immediately. The identification of those traders stays unknown, however such a considerable transfer in GOLD often suggests one thing large is about to occur.

We gleaned this info from our observations immediately when Benzinga’s choices scanner highlighted 30 extraordinary choices actions for Barrick Gold. This stage of exercise is out of the strange.

The final temper amongst these heavyweight traders is split, with 46% leaning bullish and 43% bearish. Amongst these notable choices, 8 are places, totaling $398,820, and 22 are calls, amounting to $1,569,465.

Anticipated Value Actions

After evaluating the buying and selling volumes and Open Curiosity, it is evident that the most important market movers are specializing in a worth band between $13.0 and $22.0 for Barrick Gold, spanning the final three months.

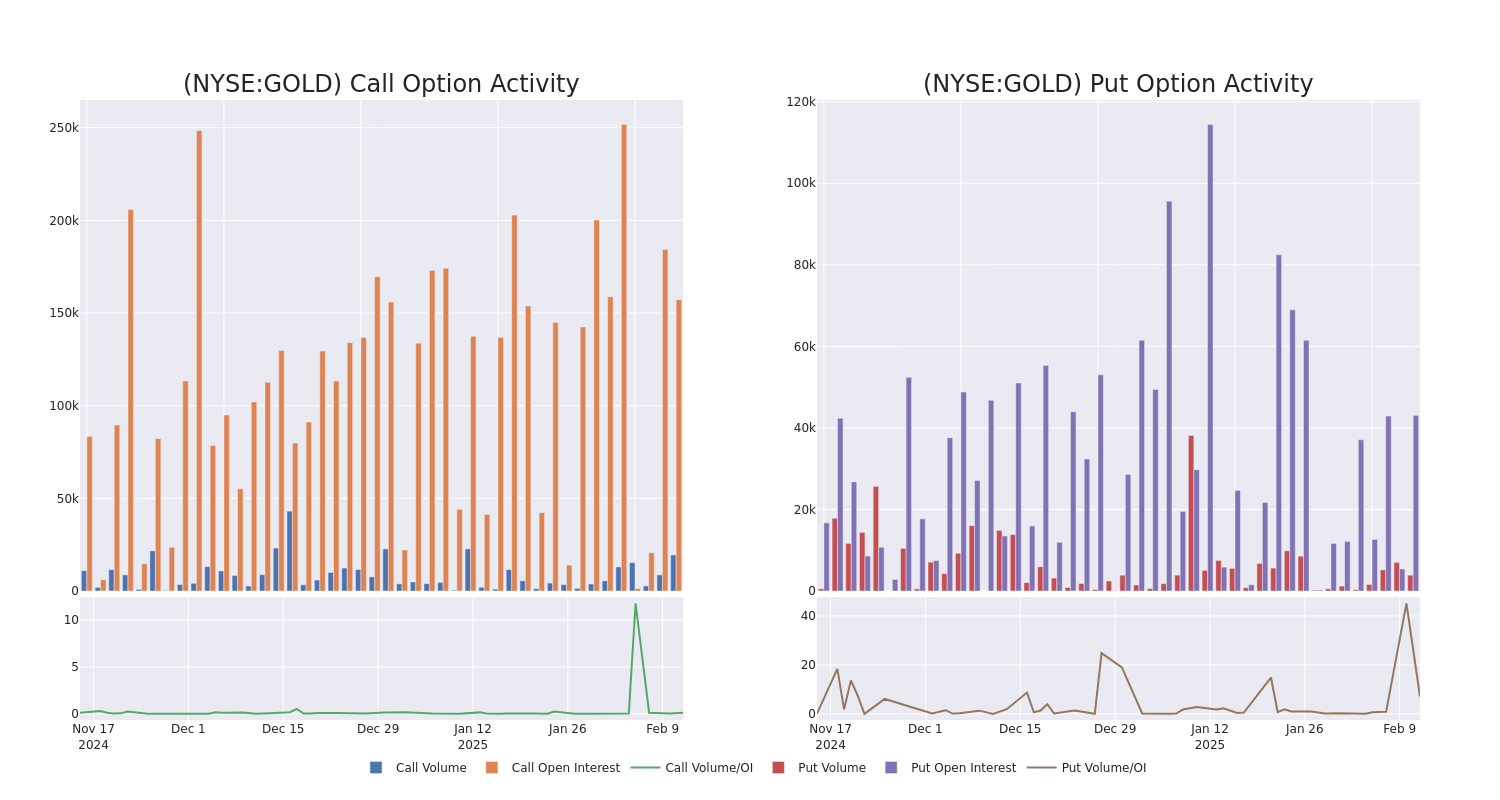

Quantity & Open Curiosity Improvement

By way of liquidity and curiosity, the imply open curiosity for Barrick Gold choices trades immediately is 9536.76 with a complete quantity of twenty-two,863.00.

Within the following chart, we’re in a position to comply with the event of quantity and open curiosity of name and put choices for Barrick Gold’s large cash trades inside a strike worth vary of $13.0 to $22.0 over the past 30 days.

Barrick Gold Possibility Exercise Evaluation: Final 30 Days

Largest Choices Trades Noticed:

| Image | PUT/CALL | Commerce Kind | Sentiment | Exp. Date | Ask | Bid | Value | Strike Value | Complete Commerce Value | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BULLISH | 04/17/25 | $2.43 | $2.38 | $2.42 | $16.00 | $241.2K | 2.4K | 1.0K |

| GOLD | CALL | SWEEP | NEUTRAL | 01/16/26 | $4.3 | $4.2 | $4.25 | $15.00 | $210.8K | 56.7K | 917 |

| GOLD | CALL | TRADE | BEARISH | 09/19/25 | $4.0 | $3.95 | $3.95 | $15.00 | $118.5K | 1.5K | 517 |

| GOLD | CALL | SWEEP | NEUTRAL | 03/21/25 | $2.26 | $2.13 | $2.2 | $16.00 | $110.0K | 4.9K | 686 |

| GOLD | CALL | SWEEP | BULLISH | 01/15/27 | $3.8 | $3.7 | $3.8 | $18.00 | $85.1K | 881 | 338 |

About Barrick Gold

Primarily based in Toronto, Barrick Gold is likely one of the world’s largest gold miners. In 2023, the agency produced almost 4.1 million attributable ounces of gold and about 420 million kilos of copper. At year-end 2023, Barrick had about 20 years of gold reserves together with important copper reserves. After shopping for Randgold in 2019 and mixing its Nevada mines in a three way partnership with competitor Newmont later that 12 months, it operates mines in 19 nations within the Americas, Africa, the Center East, and Asia. The corporate additionally has rising copper publicity. Its potential Reko Diq mission in Pakistan, if developed, might double copper manufacturing by the top of the last decade.

Following our evaluation of the choices actions related to Barrick Gold, we pivot to a more in-depth take a look at the corporate’s personal efficiency.

Current Market Standing of Barrick Gold

- Buying and selling quantity stands at 31,893,320, with GOLD’s worth up by 6.41%, positioned at $18.16.

- RSI indicators present the inventory to be could also be overbought.

- Earnings announcement anticipated in 0 days.

Professional Opinions on Barrick Gold

Over the previous month, 2 business analysts have shared their insights on this inventory, proposing a mean goal worth of $18.5.

Uncommon Choices Exercise Detected: Sensible Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions large cash is taking in your favourite shares. Click on right here for entry.

* An analyst from Scotiabank has revised its score downward to Sector Carry out, adjusting the value goal to $19.

* An analyst from B of A Securities has revised its score downward to Impartial, adjusting the value goal to $18.

Choices are a riskier asset in comparison with simply buying and selling the inventory, however they’ve greater revenue potential. Critical choices merchants handle this threat by educating themselves every day, scaling out and in of trades, following multiple indicator, and following the markets carefully.

If you wish to keep up to date on the newest choices trades for Barrick Gold, Benzinga Professional provides you real-time choices trades alerts.

Overview Score:

Speculative

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.