Apple Inc.’s AAPL manufacturing prices for its newest iPhone lineup present promising tendencies for margins, in keeping with a brand new Financial institution of America evaluation.

The teardown research reveals important value reductions in Professional fashions whereas highlighting the corporate’s strategic pricing method throughout its product vary.

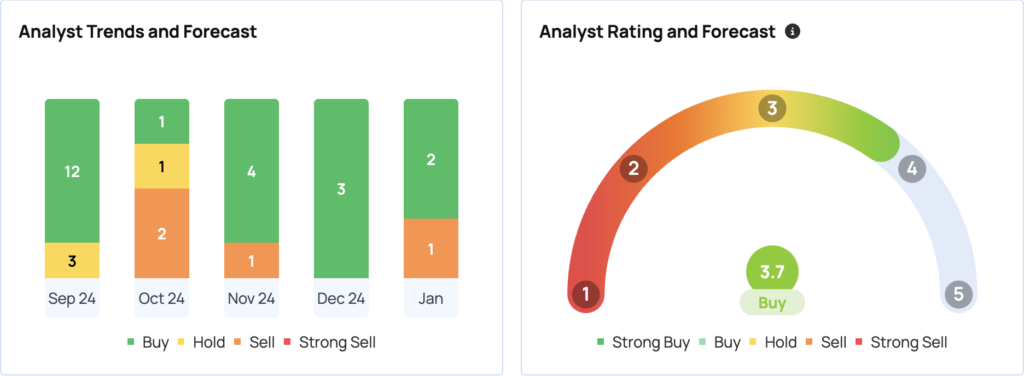

The Apple Analyst: Financial institution of America analyst Wamsi Mohan maintains a “Purchase” ranking on Apple with a worth goal of $256, implying an upside of practically 8% from Wednesday’s closing worth.

The Apple Thesis: BofA’s teardown evaluation reveals important manufacturing value enhancements for iPhone 16 Professional fashions, whereas base fashions see elevated prices.

The analyst highlights that the iPhone 16 Professional Max’s manufacturing prices are 5% decrease than its predecessor, contributing roughly 320 foundation factors to gross margins. When adjusting for reminiscence prices, the year-over-year financial savings improve to eight%.

“At Apple’s scale, these add as much as significant financial savings of $3.7bn for 250mn iPhones that may be a tailwind of >100 bps of product GMs when totally ramped,” famous the evaluation.

See Additionally: Elon Musk Shopping for TikTok May Damage Tesla Inventory, Warns Gary Black — However Wedbush’s Dan Ives Thinks It Makes Sense

Key Findings:

- Major digital assemblies make up 50% of iPhone 16 Professional Max manufacturing prices, up from 47% within the iPhone 15 Professional Max.

- Base iPhone 16 exhibits a ten% improve in manufacturing prices in comparison with iPhone 15, primarily on account of AI processing and digital camera enhancements. When adjusted for reminiscence prices, this improve narrows to six%.

- Potential financial savings of not less than $10 per iPhone from insourcing the baseband modem from Qualcomm Inc. QCOM.

- Vertical integration efforts might drive additional margin enhancements. The corporate spends roughly $250 on built-in circuits per iPhone 16 Professional Max, creating alternatives for value financial savings via element insourcing.

Why It Issues: The findings help BofA’s broader thesis on Apple’s margin resilience. The financial institution expects robust iPhone improve cycles in fiscal 2025 and 2026, pushed by {hardware} necessities for generative AI options.

Apple’s gross margins have been trending larger within the final a number of years, supported by each providers combine and iPhone margin stability regardless of elevated performance.

Buying and selling at $237.87, Apple shares have gained practically 30% over the previous yr. Apple is ready to announce its first-quarter 2025 earnings on Jan. 30. In October final yr, the corporate reported fiscal fourth-quarter income of $94.9 billion, surpassing analysts’ expectations of $94.56 billion.

Worth Motion: Apple’s inventory gained 1.97% on Wednesday, closing at $237.87. In after-hours buying and selling, it edged up one other 0.31%, reaching $238.60, in keeping with Benzinga Professional information.

Apple’s consensus worth goal stands at $245.17, based mostly on evaluations from 30 analysts, with Wedbush setting the best goal of $325 on Dec. 26. The most recent scores from MoffettNathanson, Bernstein, and BofA Securities level to a median goal of $234.67, implying a possible draw back of 1.65%.

Learn Subsequent:

Disclaimer: This content material was partially produced with the assistance of Benzinga Neuro and was reviewed and printed by Benzinga editors.

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.