Extra than simply an choice, stock financing has develop into a lifeline for a lot of enterprise sellers, together with Amazon sellers, who’re struggling to maintain their cabinets stocked.

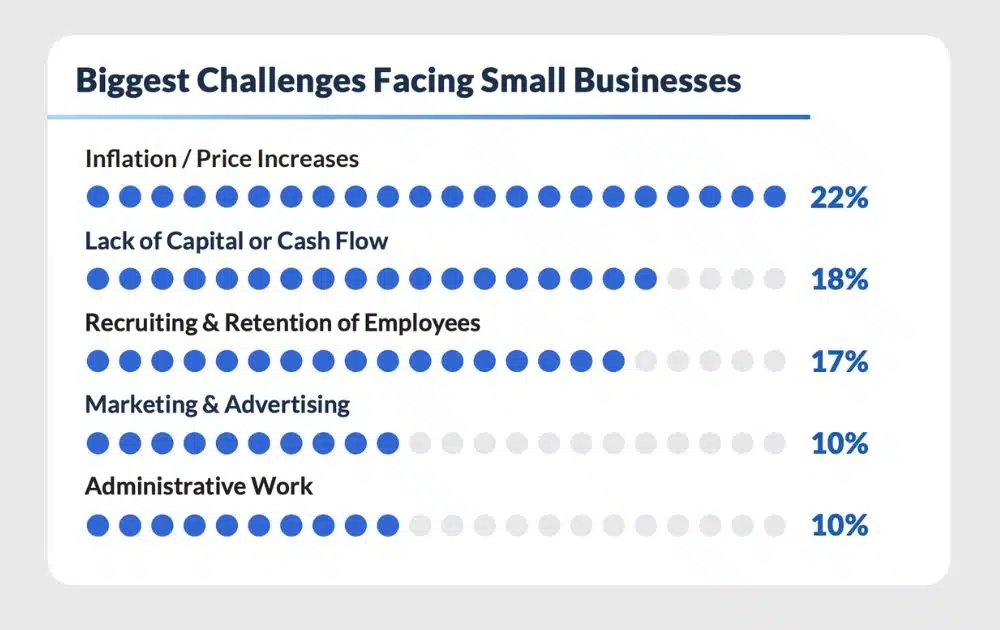

Information reveals that inflation and better costs are squeezing income, making it the highest problem (22%) confronted by small companies, adopted by lack of capital or money stream (18%).

For ecommerce sellers and Amazon entrepreneurs, these challenges hit quick and arduous. Enter stock financing, which supplies sellers the pliability to maintain merchandise transferring with out ready for money to catch up.

What’s Stock Financing?

Stock financing is a kind of short-term mortgage or line of credit score that helps companies buy stock with out draining their working capital. As a substitute of requiring hefty collateral like property or tools, this financing choice makes use of the stock itself as safety.

It’s a versatile answer that, even when money is tight, permits sellers to purchase extra inventory, meet buyer demand, and maintain merchandise transferring.

For ecommerce sellers, stock financing is usually a game-changer. In any case, when retailers can’t afford to purchase the merchandise they want, gross sales come to a halt. Ecommerce stock financing solves this by offering upfront capital so companies can develop their enterprise, together with:

- Bulk order stock

- Put together for gross sales surges

- Launch new product traces

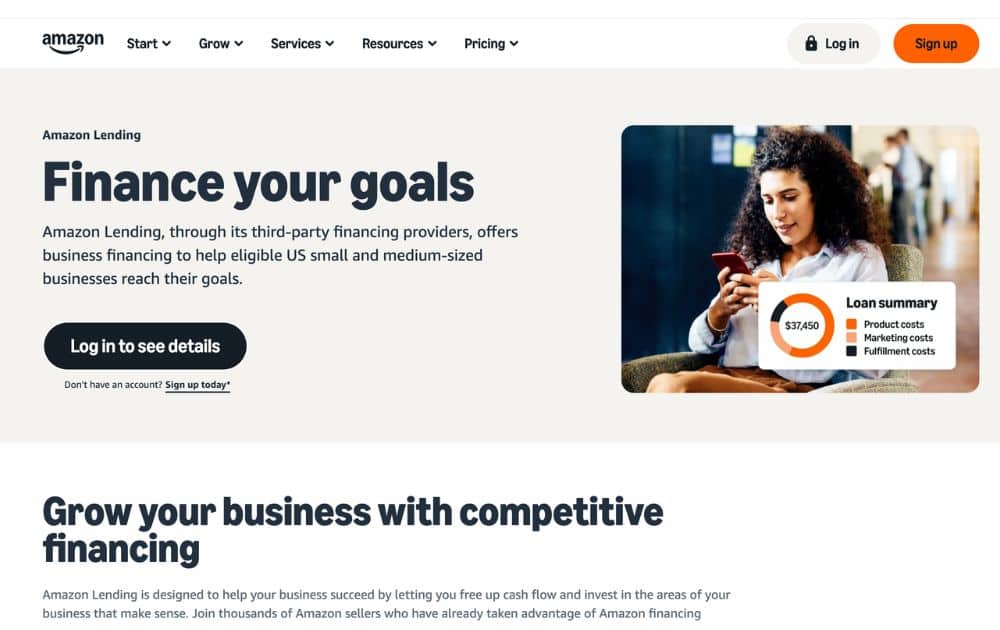

Amazon itself gives stock financing via Amazon Lending, which gives eligible sellers with loans based mostly on their gross sales efficiency and retailer well being. That is significantly helpful for manufacturers who must replenish forward of high-traffic occasions like This fall holidays, however don’t have instant entry to money.

Why Financing Stock Issues for eCommerce Sellers

Not like conventional enterprise loans, which can take weeks to course of, stock financing is usually sooner, with some choices providing approvals in as little as a couple of days. However stock financing goes past getting further money in a short while interval.

Listed here are a few of the advantages of stock financing for cash-strapped sellers.

Solves money stream gaps

Even when your merchandise are promoting, your cash can get caught in unpaid orders or transport delays. Stock financing helps you restock with out ready for money to clear.

Prevents stockouts

Working out of inventory can push your product off the radar. In actual fact, knowledge tells us that 37% of shoppers would flip to a different model when confronted by a stockout. With financing choices like Amazon Lending, you possibly can rapidly purchase extra stock to remain aggressive.

Helps you put together for gross sales peaks

Being a sensible vendor means making probably the most out of accessible alternatives. Take Prime Day, as an illustration. In 2024, Amazon Prime Day racked up $14.2 billion in international gross sales over simply 48 hours. And if we take a look at year-by-year gross sales, the numbers solely get larger yearly.

Whether or not you’re preparing for Amazon Prime Day, Black Friday, or seasonal rushes, stock financing ensures you will have sufficient inventory to satisfy the surge in demand.

Presents aggressive charges

Stock financing loans normally have an annual share price of 8% to twenty%. For Amazon manufacturers, the Lending program could provide higher phrases based mostly in your gross sales historical past.

Funding Choices to Take into account

Totally different companies have completely different funding wants. Fortuitously, a number of stock financing corporations and strategies may also help you retain your cabinets stocked and your gross sales flowing.

Amazon Lending

Amazon Lending is a financing program supplied by Amazon to assist manufacturers develop their companies. As a substitute of going via conventional banks, Amazon gives pre-approved loans on to eligible sellers based mostly on their gross sales efficiency, account well being, and retailer historical past.

Lending is an invite-only program, and you may’t apply by yourself. Amazon invitations sellers who meet their inner standards, which normally embody good gross sales quantity, stable buyer rankings, and a dependable achievement file.

- Finest for. Amazon sellers with robust gross sales efficiency and good account well being.

- Key profit. Quick entry to capital with pre-approved mortgage gives proper inside your Amazon Vendor Central account.

Conventional Stock Financing Loans

Conventional stock financing loans are short-term enterprise loans offered by banks or established monetary establishments. These loans are particularly designed to assist companies buy stock, utilizing the stock itself as collateral.

One downside of this financing choice is the applying course of, which might take a number of weeks. It additionally requires detailed paperwork, monetary statements, and generally private ensures.

- Finest for. Retailers and ecommerce companies searching for bigger mortgage quantities.

- Key profit. Can be utilized to finance giant buy orders or put together for seasonal peaks.

Stock Strains of Credit score

A listing line of credit score is a versatile financing choice that offers you entry to a set amount of cash you possibly can draw from as wanted, particularly for buying stock.

Not like a standard mortgage, the place you get a lump sum upfront, a line of credit score works extra like a bank card―you borrow what you want if you want it, and also you solely pay curiosity on the quantity you employ.

It’s essential to notice that rates of interest underneath this selection could also be larger than a standard mortgage in case your credit score rating is decrease. Additionally, should you constantly max out the credit score line, it might result in overleveraging and tight compensation home windows.

- Finest for. Companies with fluctuating stock wants.

- Key profit. You solely pay curiosity on the quantity you really use, not the total credit score restrict.

Stock Financing & Crowdfunding Podcast

Sean De Clercq got here up with the unique thought behind Kickfurther. Sean realized he wasn’t the one vendor with a financing downside, so he created a group of distributors to assist one another out.

Kickfurther helps you develop and prevents you from making rookie errors.

On this interview with Sean, we focus on how stock financing works and crowdfunding for rising corporations, not only for startups.

Finest Practices to Safe Funding and Keep away from Debt

Listed here are the very best practices to safe funding correctly and maintain your funds wholesome:

Keep a Wholesome Stock Turnover Charge

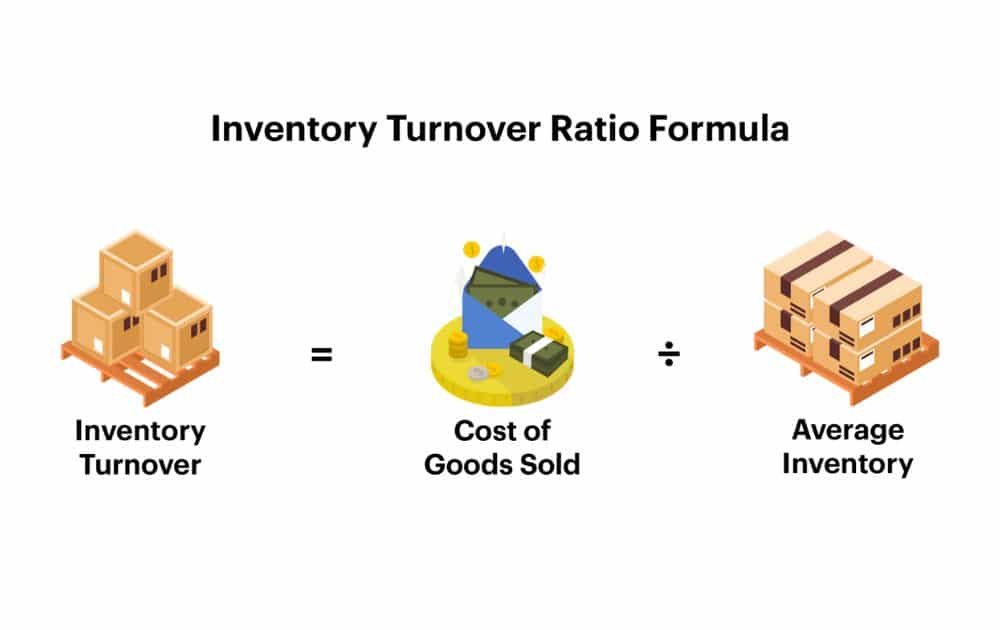

Your stock turnover price measures how rapidly you promote and substitute your inventory. The stock turnover formulation is the price of items bought divided by the typical stock.

A excessive turnover tells lenders you possibly can transfer merchandise effectively, lowering their danger. Why does it matter? Lenders want companies that promote stock quick as a result of it means they’re extra prone to repay on time.

A gradual turnover can flag money stream points and result in larger rates of interest or mortgage rejection.

- Actionable Tip. Monitor your turnover frequently and give attention to fast-selling merchandise. Keep away from holding on to stock that doesn’t promote rapidly, as this may make your financing phrases much less favorable to lenders.

Know Your Stock’s Market Worth

Not all stock holds the identical worth within the eyes of lenders. Merchandise which are in demand or have a steady market are simpler to finance.

That stated, in case your stock is seasonal, extremely specialised, or liable to dropping worth rapidly, lenders would possibly see it as dangerous. As well as, gadgets with robust resale worth (like shopper electronics or standard home items) are safer collateral.

For instance, retail stock financing for smartphones is commonly simpler to safe than financing for area of interest vacation decorations that rapidly lose worth after the season ends.

- Actionable Tip. When making use of for financing, give attention to high-demand, easy-to-resell merchandise and current their market knowledge to strengthen your mortgage software.

Evaluate Stock Financing Corporations Fastidiously

Every lender has its personal rates of interest, charges, and mortgage buildings. That stated, buying round is essential to discovering the appropriate match.

In any case, selecting the improper lender might lock you into excessive stock financing charges or unfavorable compensation schedules that pressure your money stream.

For example, an Amazon vendor could get a greater price from Amazon Lending than from a third-party lender. However one other vendor would possibly discover decrease charges from specialised stock financing corporations that cater to ecommerce companies.

- Actionable Tip. Request gives from a number of lenders and evaluate charges, charges, and compensation flexibility earlier than signing any settlement.

Borrow Solely What You Can Realistically Promote

It’s tempting to take the total mortgage quantity you’re supplied, however borrowing greater than you want will increase monetary danger. It goes with out saying that over-financing can result in extra stock, unsold merchandise, and compensation struggles, particularly if demand drops unexpectedly.

For example, should you borrow $50,000 to arrange for a vacation rush however solely promote $30,000 price of inventory, you’ll be left with further debt and slow-moving stock.

- Actionable Tip. Work with Amazon consultants like AMZ Advisers to fine-tune your gross sales forecasting and stock planning. Our Amazon consultants may also help you analyze your retailer’s efficiency knowledge and supply the assist that you must make smarter, data-driven enterprise choices.

The Lowdown

Stock financing can spell the distinction between seizing alternatives and lacking out. For Amazon sellers, it’s not nearly having sufficient inventory however about protecting your gross sales flowing and your retailer aggressive.

To make stock financing give you the results you want, it’s important to know your numbers, perceive your stock’s worth, and borrow responsibly. In the long run, sensible stock financing isn’t about borrowing extra however about borrowing higher.

Creator

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of progressive options, akin to ecommerce, digital advertising, and knowledge analytics.

Carla Bauto Deña is a journalist and content material author producing tales for conventional and digital media. She believes in empowering small companies with the assistance of progressive options, akin to ecommerce, digital advertising, and knowledge analytics.