Regardless of practically a 50% drop since mid-December, Tesla Inc. TSLA shares are nonetheless too costly to draw seasoned investor Ross Gerber again into the fold.

What Occurred: Ross Gerber, the president and CEO of Gerber Kawasaki Wealth & Funding Administration, in an interview with Enterprise Insider, said that he doesn’t see a transparent path for Tesla’s inventory to rebound this 12 months, even after the numerous losses.

The long-term Tesla investor maintains that Tesla’s inventory continues to be overpriced and believes that for the inventory to rebound, Tesla’s earnings want to extend. On Wednesday, Tesla’s shares had been buying and selling at a ahead price-to-earnings ratio of 65, greater than thrice the valuation a number of of the S&P 500. Gerber considers the inventory to be overpriced at its present degree, significantly as analysts have downgraded the corporate’s projected 2025 car gross sales for the second consecutive 12 months. “There’s this sport that’s occurring now the place the elemental story needs to be revalued,” said Gerber.

The investor additionally criticized Musk’s controversial political actions, which he views as a long-lasting impediment for the Tesla model. Musk’s shut affiliation with President Donald Trump has reportedly led to a shift within the model’s political alignment, with Tesla reportedly dropping liberal help whereas gaining conservative consumers.

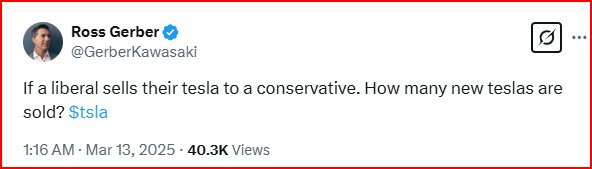

The spike in individuals promoting their EVs attributable to Musk’s political stance has brought on a pointy decline within the worth of used Tesla vehicles. In a satirical publish on X on Thursday, Ross Gerber additionally questioned, ‘If a liberal sells their tesla to a conservative. What number of new Teslas are bought?’

See Additionally: SentinelOne Inventory Slips As Analysts Reduce Worth Forecasts On Tender Steering, ARR Miss, Product Retirement

Why It Issues: The current decline in Tesla’s inventory value and its overvaluation, as identified by Gerber, are vital within the context of Tesla’s shifting buyer base and the political divide amongst its clients. Gerber had earlier predicted a 50% drop in Tesla’s inventory this 12 months attributable to CEO Elon Musk‘s shift in focus to different initiatives. This prediction has been largely correct, with Tesla’s inventory falling an extra 31% since his feedback in late February.

Gerber additionally highlighted the challenges Tesla faces within the used automotive market. He likened it to the “Apple AAPL drawback,” the place the product’s prime quality reduces the inducement for purchasers to improve often.

Moreover, a current analyst observe by JPMorgan Chase on Wednesday said that the corporate misplaced an excessive amount of model worth too rapidly. It additionally warned that the EV maker might see the lowest quarterly deliveries since 2022.

Tesla holds a momentum ranking of 89.66% and a progress ranking of 55.23%, based on Benzinga’s Proprietary Edge Rankings. The Benzinga Progress metric evaluates a inventory’s historic earnings and income growth throughout a number of timeframes, prioritizing each long-term tendencies and up to date efficiency. For an in-depth report on extra shares and insights into progress alternatives, signal up for Benzinga Edge.

Learn Extra:

Picture through Shutterstock

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Momentum89.66

Progress55.23

High quality96.81

Worth12.08

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.