ON Semiconductor Corp. ON missed road expectations within the fourth quarter, predicting a sluggish first quarter for its automotive phase as its shares tumbled over 8% after the earnings report on Monday.

What Occurred: Decrease international automotive demand mixed with slower-than-expected adoption of electrical autos impacted the fourth-quarter outcomes of the semiconductor firm that provides customized units for automotive gamers.

Based on its president and CEO, “Getting into the primary quarter, we anticipate persisting volatility because of the geopolitical uncertainty throughout all geographies as our buyer assess their manufacturing footprints and the impression of tariffs,” mentioned Hassane El-Khoury throughout its earnings name.

The administration mentioned that the corporate might be monitoring the demand indicators of EV adoption, given the uncertainty round “EV tax credit and slowing infrastructure deployment.”

Whereas the 8% sequential progress within the fourth quarter was pushed by China, the corporate expects it to say no by 25% or extra within the first quarter owing to the early Chinese language New Yr within the month of January.

The corporate is engaged on its ‘Fab Proper’ technique and lowering its working expenditures through potential website closures, headcount reductions, and portfolio rationalization.

“The structural modifications we plan on making will place us to react shortly and favorably to altering market situations,” mentioned firm CFO Thad Trent.

The administration expects a “significant impression” of opex discount within the second quarter, and gross margin enhancements by late in 2025.

See Additionally: Tariffs Are ‘The Solely Means’ To Fund Tax Cuts With out ‘Deficit Enlargement’, Argues Professional As It Takes Middle Stage In Donald Trump’s Financial Plan

Why It Issues: Its income declined by 15% year-on-year to $1.72 billion, lacking the analyst consensus estimate of $1.76 billion, and its reported adjusted earnings of $0.95 per share lacking the analyst consensus estimate of $0.97.

For the complete 12 months 2024, the income got here in at $7.1 billion with a non-GAAP gross margin of 45.5% and a free money movement of $1.2 billion.

Within the first quarter, ON expects income within the vary of $1.35-$1.45 billion and non-GAAP gross margin inside 39-41%, with non-GAAP EPS at $0.45-$0.55.

“We consider electrification, AI knowledge heart and renewable power are nonetheless the main progress drivers for our business over the subsequent decade, and we stay assured our expertise and improvements in these markets will enable us to capitalize on these traits,” added CFO Trent.

Worth Motion: The shares fell by 8.21% to $47.04 apiece on Monday and slid by 0.09% in after-hours, whereas the exchange-traded enjoyable monitoring Nasdaq Composite index, Constancy NASDAQ Composite Index ETF ONEQ rose 0.92%.

ON shares have plunged 23.77% on a year-to-date foundation, whereas it was down by 41.87% over the past one 12 months.

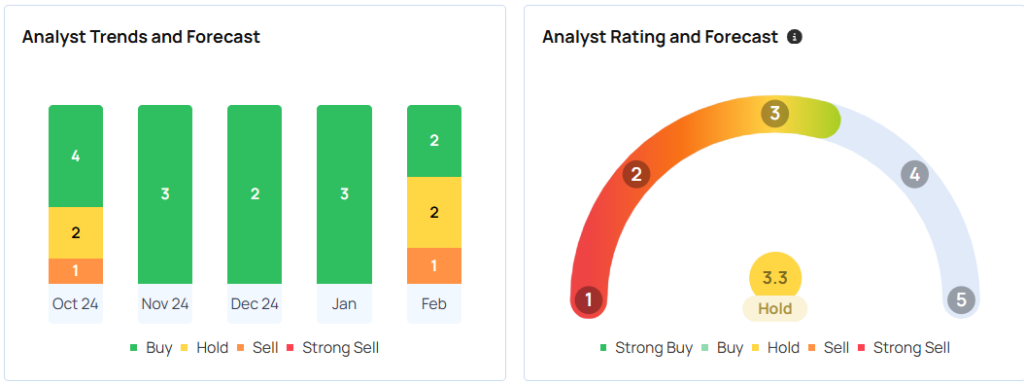

The common value goal amongst 30 analysts tracked by Benzinga is $81.43 with a ‘maintain’ score. The estimates vary from $52 to $110 apiece. Current scores from Needham, Jefferies, and Rosenblatt counsel a $72.33 goal, implying a possible upside of 53.90%.

Photograph Courtesy: Ju Jae-young On Shutterstock.com

Learn Subsequent:

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.