Cummins CMI has been analyzed by 10 analysts within the final three months, revealing a various vary of views from bullish to bearish.

The next desk summarizes their current rankings, shedding mild on the altering sentiments throughout the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Scores | 4 | 1 | 5 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 1 | 0 | 2 | 0 | 0 |

| 2M In the past | 1 | 0 | 2 | 0 | 0 |

| 3M In the past | 2 | 1 | 0 | 0 | 0 |

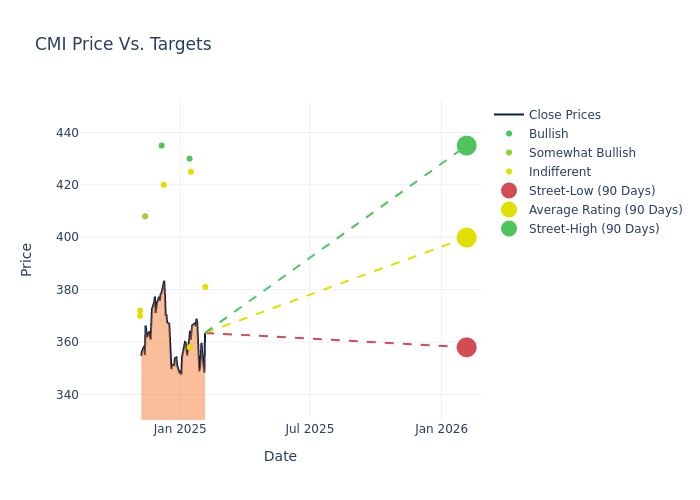

Analysts present deeper insights by way of their assessments of 12-month value targets, revealing a mean goal of $413.1, a excessive estimate of $435.00, and a low estimate of $358.00. This present common has elevated by 10.43% from the earlier common value goal of $374.10.

Understanding Analyst Scores: A Complete Breakdown

The notion of Cummins by monetary specialists is analyzed by way of current analyst actions. The next abstract presents key analysts, their current evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Adam Seiden | Barclays | Raises | Equal-Weight | $381.00 | $310.00 |

| Jamie Prepare dinner | Truist Securities | Raises | Maintain | $425.00 | $424.00 |

| Kyle Menges | Citigroup | Lowers | Purchase | $430.00 | $435.00 |

| Michael Feniger | B of A Securities | Raises | Impartial | $358.00 | $354.00 |

| Jamie Prepare dinner | Truist Securities | Raises | Maintain | $424.00 | $369.00 |

| Kyle Menges | Citigroup | Raises | Purchase | $435.00 | $415.00 |

| Tami Zakaria | JP Morgan | Raises | Impartial | $420.00 | $355.00 |

| Stephen Volkmann | Jefferies | Raises | Purchase | $435.00 | $410.00 |

| Kyle Menges | Citigroup | Raises | Purchase | $415.00 | $375.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $408.00 | $294.00 |

Key Insights:

- Motion Taken: Analysts often replace their suggestions based mostly on evolving market circumstances and firm efficiency. Whether or not they ‘Preserve’, ‘Elevate’ or ‘Decrease’ their stance, it displays their response to current developments associated to Cummins. This data supplies a snapshot of how analysts understand the present state of the corporate.

- Score: Offering a complete evaluation, analysts supply qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These rankings replicate expectations for the relative efficiency of Cummins in comparison with the broader market.

- Worth Targets: Analysts navigate by way of changes in value targets, offering estimates for Cummins’s future worth. Evaluating present and prior targets affords insights into analysts’ evolving expectations.

Analyzing these analyst evaluations alongside related monetary metrics can present a complete view of Cummins’s market place. Keep knowledgeable and make data-driven selections with the help of our Scores Desk.

Keep updated on Cummins analyst rankings.

Delving into Cummins’s Background

Cummins is the highest producer of diesel engines utilized in industrial vans, off-highway equipment, and railroad locomotives, along with standby and prime energy mills. The corporate additionally sells powertrain elements, which embody transmissions, turbochargers, aftertreatment techniques, and gas techniques. Cummins is within the distinctive place of competing with its main clients, heavy-duty truck producers, who make and aggressively market their very own engines. Regardless of strong competitors throughout all its segments and rising authorities regulation of carbon emissions, Cummins has maintained its management place within the business.

Monetary Milestones: Cummins’s Journey

Market Capitalization Evaluation: Above business benchmarks, the corporate’s market capitalization emphasizes a noteworthy measurement, indicative of a robust market presence.

Income Development: Cummins displayed constructive leads to 3 months. As of 30 September, 2024, the corporate achieved a strong income progress fee of roughly 0.3%. This means a notable improve within the firm’s top-line earnings. As in comparison with its friends, the income progress lags behind its business friends. The corporate achieved a progress fee decrease than the common amongst friends in Industrials sector.

Web Margin: Cummins’s monetary energy is mirrored in its distinctive internet margin, which exceeds business averages. With a exceptional internet margin of 9.57%, the corporate showcases sturdy profitability and efficient price administration.

Return on Fairness (ROE): The corporate’s ROE is a standout performer, exceeding business averages. With a formidable ROE of 8.14%, the corporate showcases efficient utilization of fairness capital.

Return on Property (ROA): Cummins’s ROA stands out, surpassing business averages. With a formidable ROA of 2.55%, the corporate demonstrates efficient utilization of belongings and robust monetary efficiency.

Debt Administration: Cummins’s debt-to-equity ratio is under the business common at 0.79, reflecting a decrease dependency on debt financing and a extra conservative monetary strategy.

Understanding the Relevance of Analyst Scores

Analysts work in banking and monetary techniques and usually focus on reporting for shares or outlined sectors. Analysts might attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst rankings” for shares. Analysts usually fee every inventory as soon as per quarter.

Analysts might complement their rankings with predictions for metrics like progress estimates, earnings, and income, providing buyers a extra complete outlook. Nevertheless, buyers must be aware that analysts, like several human, can have subjective views influencing their forecasts.

Breaking: Wall Road’s Subsequent Huge Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive progress. This under-the-radar firm might surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.