5 analysts have expressed a wide range of opinions on Utilized Industrial Techs AIT over the previous quarter, providing a various set of opinions from bullish to bearish.

The desk under supplies a snapshot of their latest scores, showcasing how sentiments have advanced over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 1 | 4 | 0 | 0 | 0 |

| Final 30D | 0 | 2 | 0 | 0 | 0 |

| 1M In the past | 0 | 0 | 0 | 0 | 0 |

| 2M In the past | 0 | 1 | 0 | 0 | 0 |

| 3M In the past | 1 | 1 | 0 | 0 | 0 |

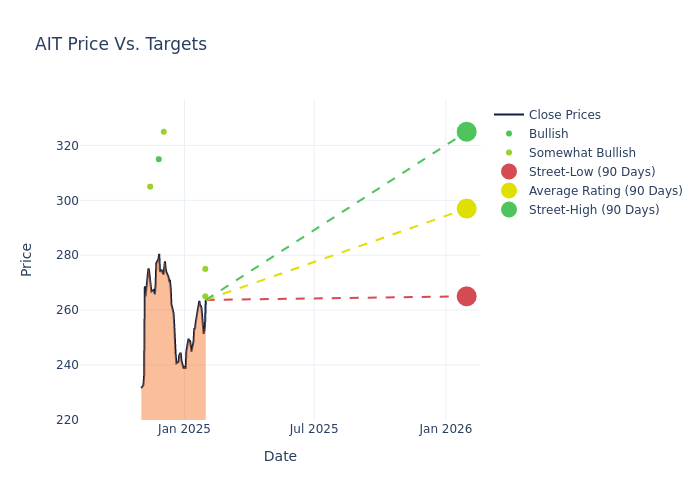

The 12-month value targets assessed by analysts reveal additional insights, that includes a mean goal of $297.0, a excessive estimate of $325.00, and a low estimate of $265.00. This present common has elevated by 12.5% from the earlier common value goal of $264.00.

Exploring Analyst Rankings: An In-Depth Overview

An in-depth evaluation of latest analyst actions unveils how monetary consultants understand Utilized Industrial Techs. The next abstract outlines key analysts, their latest evaluations, and changes to scores and value targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| David Manthey | Baird | Raises | Outperform | $275.00 | $250.00 |

| Sam Darkatsh | Raymond James | Raises | Outperform | $265.00 | $250.00 |

| Ken Newman | Keybanc | Raises | Chubby | $325.00 | $275.00 |

| Sabrina Abrams | B of A Securities | Raises | Purchase | $315.00 | $285.00 |

| Christopher Glynn | Oppenheimer | Raises | Outperform | $305.00 | $260.00 |

Key Insights:

- Motion Taken: In response to dynamic market circumstances and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Elevate’, or ‘Decrease’ their stance, it signifies their response to latest developments associated to Utilized Industrial Techs. This perception provides a snapshot of analysts’ views on the present state of the corporate.

- Ranking: Analyzing tendencies, analysts supply qualitative evaluations, starting from ‘Outperform’ to ‘Underperform’. These scores convey expectations for the relative efficiency of Utilized Industrial Techs in comparison with the broader market.

- Worth Targets: Gaining insights, analysts present estimates for the longer term worth of Utilized Industrial Techs’s inventory. This comparability reveals tendencies in analysts’ expectations over time.

Analyzing these analyst evaluations alongside related monetary metrics can present a complete view of Utilized Industrial Techs’s market place. Keep knowledgeable and make data-driven choices with the help of our Rankings Desk.

Keep updated on Utilized Industrial Techs analyst scores.

Discovering Utilized Industrial Techs: A Nearer Look

Utilized Industrial Applied sciences Inc is a distributor of commercial merchandise to the upkeep, restore, and operations market and the unique gear manufacturing business. Additional, the corporate supplies engineering and design companies for industrial and fluid energy functions. The merchandise embody bearings, energy transmission elements, fluid energy elements and methods, industrial rubber merchandise, linear movement elements, security merchandise, oilfield provides, and different industrial and upkeep provides. The corporate’s reportable segments are; Service Middle Based mostly Distribution which derives key income, and Engineered Options. Geographically, the corporate derives its key income from america and the remaining from Canada and different nations.

Unraveling the Monetary Story of Utilized Industrial Techs

Market Capitalization Evaluation: The corporate displays a decrease market capitalization profile, positioning itself under business averages. This implies a smaller scale relative to friends.

Income Development: Over the three months interval, Utilized Industrial Techs showcased constructive efficiency, reaching a income progress fee of 0.34% as of 30 September, 2024. This displays a considerable enhance within the firm’s top-line earnings. As in comparison with opponents, the corporate encountered difficulties, with a progress fee decrease than the common amongst friends within the Industrials sector.

Web Margin: Utilized Industrial Techs’s web margin is under business averages, indicating potential challenges in sustaining sturdy profitability. With a web margin of 8.38%, the corporate might face hurdles in efficient price administration.

Return on Fairness (ROE): The corporate’s ROE is under business benchmarks, signaling potential difficulties in effectively utilizing fairness capital. With an ROE of 5.35%, the corporate may have to deal with challenges in producing passable returns for shareholders.

Return on Belongings (ROA): Utilized Industrial Techs’s ROA excels past business benchmarks, reaching 3.09%. This signifies environment friendly administration of belongings and powerful monetary well being.

Debt Administration: Utilized Industrial Techs’s debt-to-equity ratio is under business norms, indicating a sound monetary construction with a ratio of 0.34.

The Core of Analyst Rankings: What Each Investor Ought to Know

Analysts work in banking and monetary methods and usually specialise in reporting for shares or outlined sectors. Analysts might attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst scores” for shares. Analysts usually fee every inventory as soon as per quarter.

Some analysts additionally supply predictions for useful metrics equivalent to earnings, income, and progress estimates to supply additional steerage as to what to do with sure tickers. You will need to understand that whereas inventory and sector analysts are specialists, they’re additionally human and may solely forecast their beliefs to merchants.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you instantaneous entry to all main analyst upgrades, downgrades, and value targets. Type by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.