4 analysts have shared their evaluations of Hancock Whitney HWC throughout the current three months, expressing a mixture of bullish and bearish views.

Within the desk under, you will discover a abstract of their current scores, revealing the shifting sentiments over the previous 30 days and evaluating them to the earlier months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 1 | 3 | 0 | 0 | 0 |

| Final 30D | 1 | 1 | 0 | 0 | 0 |

| 1M In the past | 0 | 1 | 0 | 0 | 0 |

| 2M In the past | 0 | 1 | 0 | 0 | 0 |

| 3M In the past | 0 | 0 | 0 | 0 | 0 |

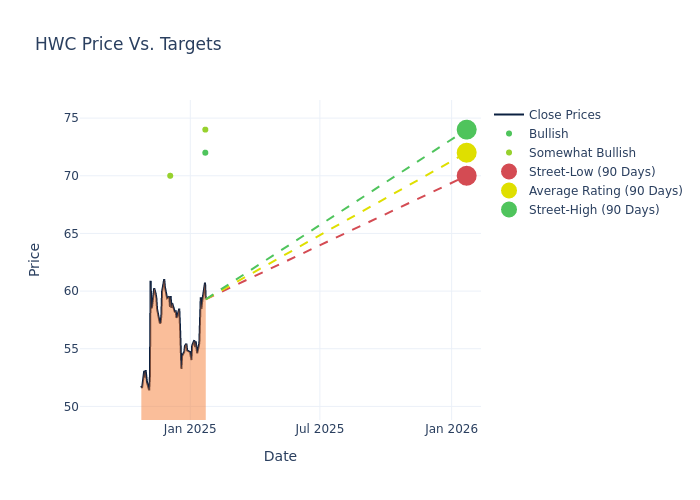

Insights from analysts’ 12-month value targets are revealed, presenting a median goal of $71.0, a excessive estimate of $74.00, and a low estimate of $68.00. This upward development is clear, with the present common reflecting a 9.23% enhance from the earlier common value goal of $65.00.

Investigating Analyst Rankings: An Elaborate Examine

In analyzing current analyst actions, we achieve insights into how monetary consultants understand Hancock Whitney. The next abstract outlines key analysts, their current evaluations, and changes to scores and value targets.

| Analyst | Analyst Agency | Motion Taken | Ranking | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Michael Rose | Raymond James | Raises | Robust Purchase | $72.00 | $64.00 |

| Matt Olney | Stephens & Co. | Raises | Obese | $74.00 | $68.00 |

| Matt Olney | Stephens & Co. | Maintains | Obese | $68.00 | $68.00 |

| Catherine Mealor | Keefe, Bruyette & Woods | Raises | Outperform | $70.00 | $60.00 |

Key Insights:

- Motion Taken: In response to dynamic market circumstances and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Elevate’, or ‘Decrease’ their stance, it signifies their response to current developments associated to Hancock Whitney. This perception provides a snapshot of analysts’ views on the present state of the corporate.

- Ranking: Analysts assign qualitative assessments to shares, starting from ‘Outperform’ to ‘Underperform’. These scores convey the analysts’ expectations for the relative efficiency of Hancock Whitney in comparison with the broader market.

- Worth Targets: Gaining insights, analysts present estimates for the longer term worth of Hancock Whitney’s inventory. This comparability reveals developments in analysts’ expectations over time.

For worthwhile insights into Hancock Whitney’s market efficiency, think about these analyst evaluations alongside essential monetary indicators. Keep well-informed and make prudent choices utilizing our Rankings Desk.

Keep updated on Hancock Whitney analyst scores.

Delving into Hancock Whitney’s Background

Hancock Whitney Corp operates financial institution places of work and monetary facilities. The corporate provides a spread of conventional and on-line banking providers to industrial, small enterprise and retail prospects, offering quite a lot of transaction and financial savings deposit merchandise, treasury administration providers, secured and unsecured mortgage merchandise (together with revolving credit score services), letters of credit score and comparable monetary ensures. The Financial institution offers belief and funding administration providers to retirement plans, companies and people and offers its prospects entry to funding advisory and brokerage merchandise.

Hancock Whitney: A Monetary Overview

Market Capitalization: Positioned above business common, the corporate’s market capitalization underscores its superiority in measurement, indicative of a powerful market presence.

Income Development: Hancock Whitney displayed constructive ends in 3 months. As of 30 September, 2024, the corporate achieved a strong income development price of roughly 3.05%. This means a notable enhance within the firm’s top-line earnings. When in comparison with others within the Financials sector, the corporate excelled with a development price greater than the common amongst friends.

Internet Margin: Hancock Whitney’s internet margin is spectacular, surpassing business averages. With a internet margin of 31.48%, the corporate demonstrates robust profitability and efficient price administration.

Return on Fairness (ROE): The corporate’s ROE is a standout performer, exceeding business averages. With a powerful ROE of 2.84%, the corporate showcases efficient utilization of fairness capital.

Return on Belongings (ROA): Hancock Whitney’s monetary energy is mirrored in its distinctive ROA, which exceeds business averages. With a exceptional ROA of 0.33%, the corporate showcases environment friendly use of belongings and powerful monetary well being.

Debt Administration: Hancock Whitney’s debt-to-equity ratio is under the business common. With a ratio of 0.2, the corporate depends much less on debt financing, sustaining a more healthy stability between debt and fairness, which might be considered positively by traders.

What Are Analyst Rankings?

Analyst scores function important indicators of inventory efficiency, supplied by consultants in banking and monetary programs. These specialists diligently analyze firm monetary statements, take part in convention calls, and interact with insiders to generate quarterly scores for particular person shares.

Some analysts publish their predictions for metrics equivalent to development estimates, earnings, and income to offer further steerage with their scores. When utilizing analyst scores, it is very important remember that inventory and sector analysts are additionally human and are solely providing their opinions to traders.

Which Shares Are Analysts Recommending Now?

Benzinga Edge provides you prompt entry to all main analyst upgrades, downgrades, and value targets. Kind by accuracy, upside potential, and extra. Click on right here to remain forward of the market.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.