10 analysts have shared their evaluations of Corpay CPAY in the course of the latest three months, expressing a mixture of bullish and bearish views.

The desk under offers a snapshot of their latest scores, showcasing how sentiments have advanced over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Scores | 1 | 5 | 4 | 0 | 0 |

| Final 30D | 0 | 0 | 1 | 0 | 0 |

| 1M In the past | 0 | 1 | 0 | 0 | 0 |

| 2M In the past | 0 | 2 | 0 | 0 | 0 |

| 3M In the past | 1 | 2 | 3 | 0 | 0 |

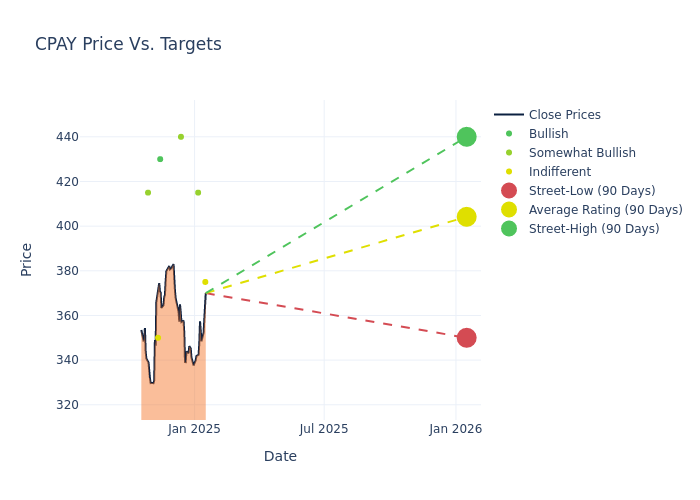

Analysts have set 12-month worth targets for Corpay, revealing a median goal of $389.5, a excessive estimate of $440.00, and a low estimate of $320.00. This present common has elevated by 7.6% from the earlier common worth goal of $362.00.

Exploring Analyst Scores: An In-Depth Overview

In inspecting latest analyst actions, we acquire insights into how monetary specialists understand Corpay. The next abstract outlines key analysts, their latest evaluations, and changes to scores and worth targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| Andrew Bauch | Wells Fargo | Raises | Equal-Weight | $375.00 | $340.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Lowers | Outperform | $415.00 | $425.00 |

| Rufus Hone | BMO Capital | Raises | Outperform | $440.00 | $400.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Outperform | $425.00 | $400.00 |

| Peter Christiansen | Citigroup | Raises | Purchase | $430.00 | $405.00 |

| James Faucette | Morgan Stanley | Raises | Equal-Weight | $350.00 | $325.00 |

| Sanjay Sakhrani | Keefe, Bruyette & Woods | Raises | Outperform | $400.00 | $380.00 |

| James Faucette | Morgan Stanley | Raises | Equal-Weight | $325.00 | $275.00 |

| Ramsey El-Assal | Barclays | Raises | Obese | $415.00 | $385.00 |

| Andrew Bauch | Wells Fargo | Raises | Equal-Weight | $320.00 | $285.00 |

Key Insights:

- Motion Taken: Analysts adapt their suggestions to altering market situations and firm efficiency. Whether or not they ‘Preserve’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to latest developments associated to Corpay. This data offers a snapshot of how analysts understand the present state of the corporate.

- Score: Analysts unravel qualitative evaluations for shares, starting from ‘Outperform’ to ‘Underperform’. These scores supply insights into expectations for the relative efficiency of Corpay in comparison with the broader market.

- Worth Targets: Analysts discover the dynamics of worth targets, offering estimates for the longer term worth of Corpay’s inventory. This examination reveals shifts in analysts’ expectations over time.

For beneficial insights into Corpay’s market efficiency, think about these analyst evaluations alongside essential monetary indicators. Keep well-informed and make prudent choices utilizing our Scores Desk.

Keep updated on Corpay analyst scores.

About Corpay

Corpay Inc is a world S&P500 company funds firm that helps companies and shoppers pay bills in a easy, managed method. Its suite of recent cost options helps its prospects higher handle vehicle-related bills (comparable to fueling and parking), journey bills (e.g. lodge bookings), and payables (e.g. paying distributors). This ends in its prospects saving time and in the end spending much less.

A Deep Dive into Corpay’s Financials

Market Capitalization: With restricted market capitalization, the corporate is positioned under business averages. This displays a smaller scale relative to friends.

Optimistic Income Pattern: Inspecting Corpay’s financials over 3 months reveals a optimistic narrative. The corporate achieved a noteworthy income progress charge of 6.01% as of 30 September, 2024, showcasing a considerable enhance in top-line earnings. When in comparison with others within the Financials sector, the corporate faces challenges, reaching a progress charge decrease than the common amongst friends.

Internet Margin: The corporate’s internet margin is a standout performer, exceeding business averages. With a formidable internet margin of 26.86%, the corporate showcases sturdy profitability and efficient value management.

Return on Fairness (ROE): Corpay’s ROE excels past business benchmarks, reaching 9.47%. This signifies sturdy monetary administration and environment friendly use of shareholder fairness capital.

Return on Property (ROA): Corpay’s ROA lags behind business averages, suggesting challenges in maximizing returns from its property. With an ROA of 1.63%, the corporate might face hurdles in reaching optimum monetary efficiency.

Debt Administration: Corpay’s debt-to-equity ratio stands notably increased than the business common, reaching 2.51. This means a heavier reliance on borrowed funds, elevating considerations about monetary leverage.

Analyst Scores: Simplified

Consultants in banking and monetary techniques, analysts specialise in reporting for particular shares or outlined sectors. Their complete analysis entails attending firm convention calls and conferences, analyzing monetary statements, and interesting with insiders to generate what are often known as analyst scores for shares. Sometimes, analysts assess and charge every inventory as soon as per quarter.

Along with their assessments, some analysts lengthen their insights by providing predictions for key metrics comparable to earnings, income, and progress estimates. This supplementary data offers additional steerage for merchants. It’s essential to acknowledge that, regardless of their specialization, analysts are human and might solely present forecasts primarily based on their beliefs.

Breaking: Wall Road’s Subsequent Huge Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive progress. This under-the-radar firm may surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Overview Score:

Speculative

Market Information and Knowledge delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.