Federal Reserve Chair Jerome Powell adopted a hawkish stance throughout his Wednesday press convention after the December Fed assembly, sparking a market massacre because the New York session headed to the shut.

Though the Federal Reserve lowered rates of interest by 0.25% to a spread of 4.25%-4.5%, as broadly anticipated, the up to date financial projections recommend simply two potential charge cuts in 2025 — down from 4 projected in September and fewer than the three anticipated by markets earlier than the assembly.

Powell described the shift as “a brand new section” for financial coverage, emphasizing that after 100 foundation factors of charge cuts in 2024, charges at the moment are considerably nearer to a impartial stance.

Shares tumbled throughout the board, the U.S. greenback soared to two-year highs and Bitcoin BTC/USD cratered over 5%, as traders digested the truth of a shift within the financial coverage stance by the Federal Reserve.

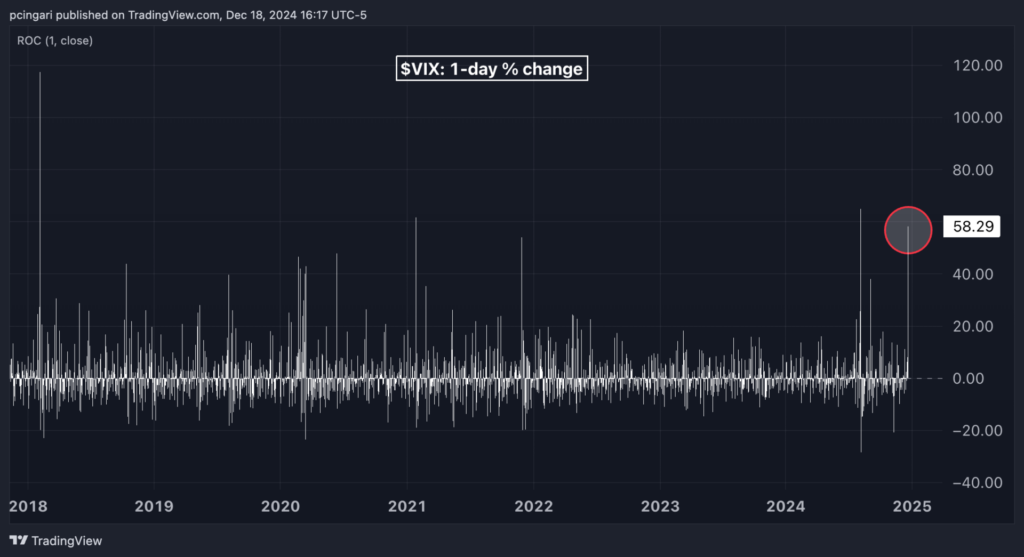

The CBOE Volatility Index, referred to as the VIX and Wall Road’s worry gauge, skyrocketed 58% to 25, reflecting a spike in investor uncertainty and heightened nervousness over the way forward for rates of interest.

Wall Road Wipeout: Main Indices Slammed

The Dow Jones Industrial Common, as tracked by the SPDR Dow Jones Industrial Common ETF DIA, dropped 1,123 factors, falling 2.6% to shut at 42,326, marking its worst one-day drop since September 2022. Amazon.com Inc. AMZN recorded the worst efficiency amongst blue-chip shares, down 4.6%.

The S&P 500 index — tracked by the SPDR S&P 500 ETF Belief SPY — fell 178 factors, down 2.9% to five,872, additionally marking its worst day since September 2022. Paycom Software program Inc. PAYC was the key laggard inside the S&P 500, down 10%.

The tech-heavy Nasdaq 100, tracked by the Invesco QQQ Belief, Collection 1 QQQ, skilled an excellent sharper drop of three.6%, closing at 21,209 as curiosity rate-sensitive know-how shares took a beating. Tesla Inc. TSLA tumbled 8.1%, marking the worst efficiency inside the Nasdaq 100.

Each Magnificent Seven firm ended the day within the pink, collectively erasing greater than $600 billion in market worth on Wednesday.

Small caps within the Russell 2000 posted the steepest losses, plummeting 4.7% to 2,225. With Wednesday’s transfer, the iShares Russell 2000 ETF IWM has totally erased the post-election rally.

All main U.S. fairness sectors completed within the pink.

Shopper Discretionary shares suffered essentially the most, plunging 4.5%, adopted by Actual Property, which dropped 4% as rising charges weigh closely on growth-oriented and interest-rate-sensitive industries.

Know-how, the most important sector by market capitalization, fell 3.2%, with chipmakers and software program firms bearing the brunt of the selloff.

Communications and Supplies each declined 2.9%, whereas Financials dropped 3%, reflecting strain throughout cyclical areas of the market.

Even historically defensive sectors failed to flee the selloff. Utilities and Shopper Staples fell 2.4% and 1.5%, respectively.

Greenback Surges To 2-Yr Highs, Hammers Gold And Bitcoin

The U.S. greenback emerged because the day’s clear winner, with the greenback index (DXY), adopted by the Invesco DB USD Index Bullish Fund ETF UUP, climbing 1.2% to succeed in its highest stage since November 2022.

Because the dollar rallied, gold failed to supply a protected haven, falling 2.1% to $2,580 per ounce, whereas silver dropped 3.5%.

Threat-off sentiment prolonged into different property. Bitcoin plunged 5.5%, buying and selling simply above $101,500.

In the course of the press convention, Powell was requested whether or not the U.S. authorities ought to think about constructing a strategic reserve of Bitcoin. Powell shortly dismissed the concept, making it clear that such a transfer shouldn’t be on the Fed’s radar.

“We’re not allowed to personal Bitcoin,” Powell mentioned, emphasizing the authorized and structural limitations of the Federal Reserve. “The Federal Reserve Act dictates what we are able to personal, and we’re not searching for any adjustments to that regulation.”

Learn Subsequent:

Illustration generated with AI through Dall-E.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.