As of Dec. 6, 2024, three shares within the client staples sector may very well be flashing an actual warning to traders who worth momentum as a key standards of their buying and selling selections.

The RSI is a momentum indicator, which compares a inventory’s energy on days when costs go as much as its energy on days when costs go down. When in comparison with a inventory’s worth motion, it may give merchants a greater sense of how a inventory could carry out within the quick time period. An asset is often thought-about overbought when the RSI is above 70, in response to Benzinga Professional.

This is the most recent listing of main overbought gamers on this sector.

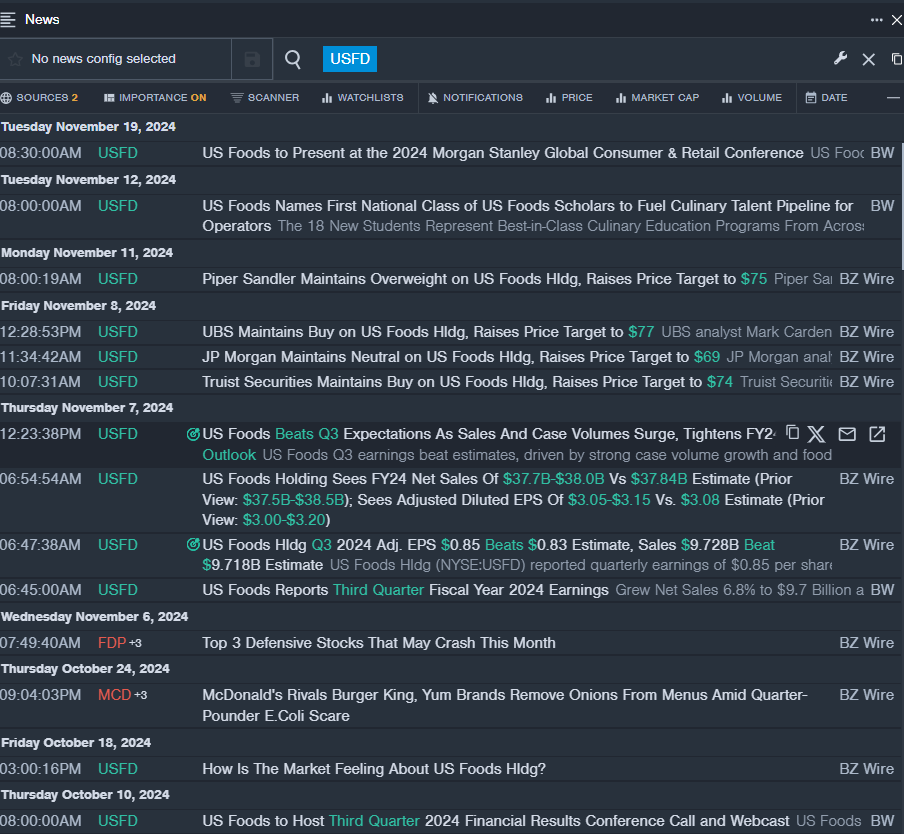

US Meals Holding Corp USFD

- On Nov. 7, US Meals Holding reported third-quarter adjusted earnings per share of 85 cents, beating the road view of 83 cents. Quarterly gross sales of $9.728 billion (+6.8%) outpaced the analyst consensus estimate of $9.718 billion, pushed by whole case quantity progress and meals price inflation of three.2%. “We delivered sturdy leads to the third quarter regardless of the softer macro setting and weather-related challenges which pressured trade case volumes,” stated Dave Flitman, CEO.. The corporate’s inventory gained round 10% over the previous month and has a 52-week excessive of $72.84.

- RSI Worth: 80.83

- USFD Value Motion: Shares of US Meals gained 0.5% to shut at $72.33 on Thursday.

- Benzinga Professional’s real-time newsfeed alerted to newest USFD information.

Hormel Meals Corp HRL

- On Dec. 4, the corporate reported that fourth-quarter adjusted earnings per share had been 42 cents, which is according to the road view. Quarterly gross sales of $3.138 billion missed the analyst consensus estimate of $3.144 billion. “The mixture of underlying enterprise energy and the seize of $75 million in working earnings profit from our Rework and Modernize (T&M) initiative helped to offset a dynamic client setting, the steep decline in complete chicken turkey commodity markets, and the manufacturing disruption at our Suffolk, Virginia, facility,” stated Jim Snee, chairman of the board, president and chief government officer. The corporate’s inventory gained round 7% over the previous month and has a 52-week excessive of $36.86.

- RSI Worth: 73.95

- HRL Value Motion: Shares of Hormel Meals gained 2.7% to shut at $32.86 on Thursday.

- Benzinga Professional’s charting instrument helped determine the development in HRL inventory.

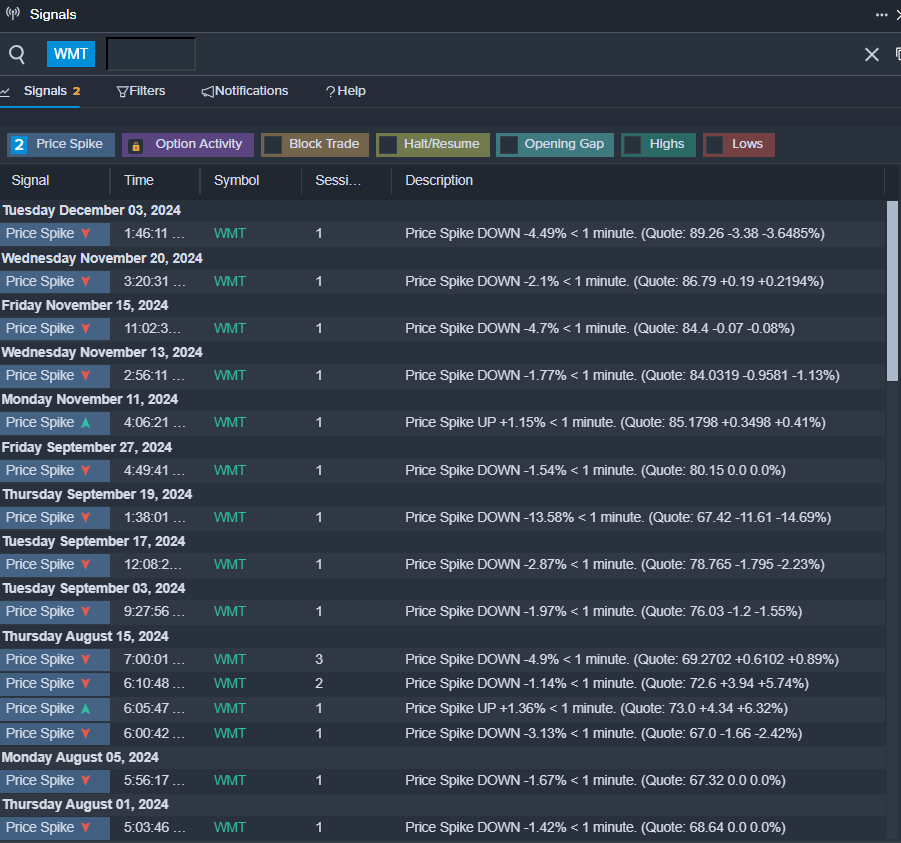

Walmart Inc WMT

- On Nov. 19, Walmart introduced third-quarter outcomes and raised its fiscal-2025 steering. The retailer reported adjusted EPS of 58 cents, beating the consensus of 53 cents. The corporate’s inventory gained round 14% over the previous month and has a 52-week excessive of $95.60.

- RSI Worth: 84.40

- WMT Value Motion: Shares of Walmart gained 0.9% to shut at $95.30 on Thursday.

- Benzinga Professional’s indicators characteristic notified of a possible breakout in WMT shares.

Learn This Subsequent:

Market Information and Knowledge dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.