Whales with some huge cash to spend have taken a noticeably bullish stance on Costco Wholesale.

Taking a look at choices historical past for Costco Wholesale COST we detected 13 trades.

If we think about the specifics of every commerce, it’s correct to state that 46% of the traders opened trades with bullish expectations and 46% with bearish.

From the general noticed trades, 4 are places, for a complete quantity of $537,393 and 9, calls, for a complete quantity of $420,462.

Predicted Worth Vary

After evaluating the buying and selling volumes and Open Curiosity, it is evident that the main market movers are specializing in a value band between $285.0 and $1360.0 for Costco Wholesale, spanning the final three months.

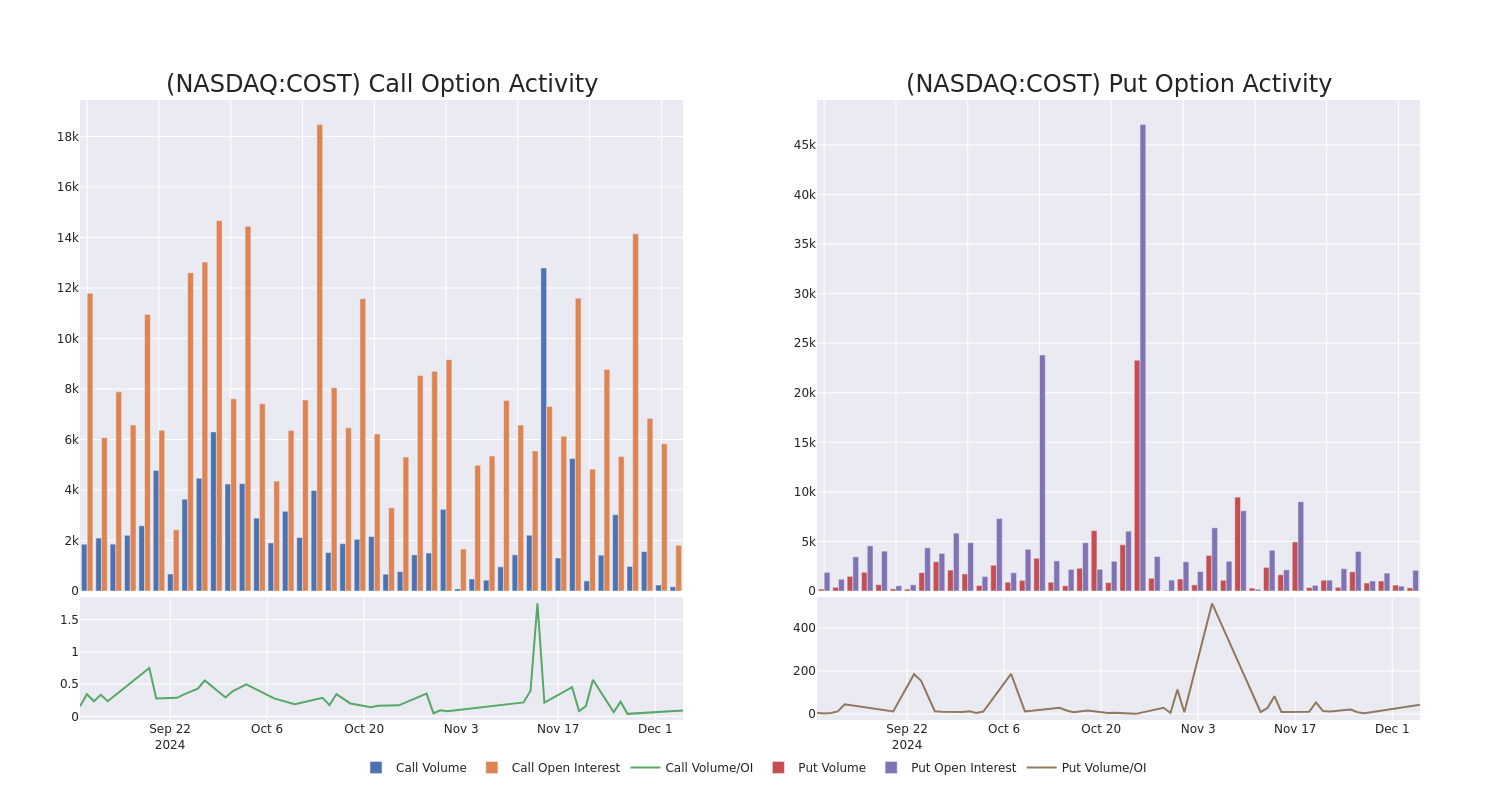

Quantity & Open Curiosity Traits

In right now’s buying and selling context, the typical open curiosity for choices of Costco Wholesale stands at 355.18, with a complete quantity reaching 493.00. The accompanying chart delineates the development of each name and put choice quantity and open curiosity for high-value trades in Costco Wholesale, located inside the strike value hall from $285.0 to $1360.0, all through the final 30 days.

Costco Wholesale 30-Day Possibility Quantity & Curiosity Snapshot

Largest Choices Trades Noticed:

| Image | PUT/CALL | Commerce Kind | Sentiment | Exp. Date | Ask | Bid | Worth | Strike Worth | Complete Commerce Worth | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|---|---|---|

| COST | PUT | SWEEP | BULLISH | 07/18/25 | $43.55 | $43.35 | $43.35 | $940.00 | $173.8K | 1 | 42 |

| COST | PUT | TRADE | BULLISH | 12/13/24 | $27.25 | $25.95 | $26.25 | $995.00 | $147.0K | 1.2K | 60 |

| COST | PUT | SWEEP | BULLISH | 01/17/25 | $25.15 | $25.1 | $25.15 | $975.00 | $135.7K | 140 | 62 |

| COST | PUT | TRADE | BEARISH | 03/21/25 | $5.15 | $4.85 | $5.05 | $820.00 | $80.8K | 708 | 161 |

| COST | CALL | SWEEP | NEUTRAL | 12/18/26 | $49.4 | $47.95 | $49.4 | $1360.00 | $78.7K | 22 | 18 |

About Costco Wholesale

Costco operates a membership-based, no-frills retail mannequin, predicated on providing a choose product assortment in bulk portions at cut price costs. The agency avoids sustaining expensive product shows by preserving stock on pallets and limits distribution bills by storing its stock at level of sale within the warehouse. Given Costco’s frugal price construction, the agency is ready to value its merchandise under competing retailers, driving excessive gross sales quantity per warehouse and permitting the retailer to generate robust income on skinny margins. Costco operates over 600 warehouses in the USA and boasts over 60% market share within the home warehouse membership business. Internationally, Costco operates one other 270 warehouses, primarily in markets akin to Canada, Mexico, Japan, and the UK.

Having examined the choices buying and selling patterns of Costco Wholesale, our consideration now turns on to the corporate. This shift permits us to delve into its current market place and efficiency

The place Is Costco Wholesale Standing Proper Now?

- With a quantity of 506,910, the value of COST is down -0.89% at $982.06.

- RSI indicators trace that the underlying inventory could also be approaching overbought.

- Subsequent earnings are anticipated to be launched in 7 days.

What The Specialists Say On Costco Wholesale

Within the final month, 5 specialists launched rankings on this inventory with a median goal value of $1030.0.

Uncommon Choices Exercise Detected: Good Cash on the Transfer

Benzinga Edge’s Uncommon Choices board spots potential market movers earlier than they occur. See what positions large cash is taking in your favourite shares. Click on right here for entry.

* An analyst from Telsey Advisory Group persists with their Outperform score on Costco Wholesale, sustaining a goal value of $1050.

* An analyst from Telsey Advisory Group has determined to take care of their Outperform score on Costco Wholesale, which presently sits at a value goal of $1000.

* Constant of their analysis, an analyst from Baird retains a Outperform score on Costco Wholesale with a goal value of $1075.

* Sustaining their stance, an analyst from BMO Capital continues to carry a Outperform score for Costco Wholesale, focusing on a value of $1075.

* An analyst from Wells Fargo has determined to take care of their Equal-Weight score on Costco Wholesale, which presently sits at a value goal of $950.

Choices are a riskier asset in comparison with simply buying and selling the inventory, however they’ve larger revenue potential. Severe choices merchants handle this danger by educating themselves every day, scaling out and in of trades, following a couple of indicator, and following the markets intently.

If you wish to keep up to date on the most recent choices trades for Costco Wholesale, Benzinga Professional provides you real-time choices trades alerts.

Market Information and Information dropped at you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.