As know-how evolves, so do buyer expectations, making a dynamic interaction that drives innovation within the monetary sector.

Fashionable clients demand quicker, extra versatile banking choices. Digital banking platforms are main this transformation, enabling banks to supply a variety of providers with higher comfort.

High digital banking statistics for 2025

- The worldwide digital banking market is projected to achieve a quantity of $53.5 billion by 2030.

- Digital banking customers in the USA are anticipated to develop year-over-year, reaching almost 216.8 million by 2025.

- The digital banking market dimension is estimated to register a CAGR of over 3% between 2024 and 2032.

- The AI-driven banking market is projected to develop at an annual price of 28.58% until 2026.

- 59% of individuals need digital banking to supply easy instruments and assets for studying methods to handle cash.

However how are individuals responding to those developments? The next statistics present a deeper look into digital banking’s development, adoption, and position in shaping the way forward for finance.

Conventional banking vs. digital banking

The best way we financial institution has modified considerably lately. Conventional banking depends on bodily branches and face-to-face interactions, whereas digital banking presents handy on-line providers. This part compares the 2, highlighting their options, advantages, and challenges to present a transparent image of how they differ.

Let’s take a look at competing statistics to unpack conventional and digital banking details.

| Conventional banking | Digital banking |

| 77% of customers depend on conventional banks as their main or secondary suppliers. | Out of 43% of client funds, 35% of client funds stored in non-traditional accounts stay in digital-only banks and stand-alone digital accounts. |

| Among the many 65% of customers utilizing conventional banks as their main supplier, solely 66% specific satisfaction. | Person satisfaction will increase to 79% and 81% for customers of digital-only banks (21%) and stand-alone digital accounts (7%). |

Digital banking utilization statistics

Digital banking has turn out to be an integral a part of how individuals handle their funds. This part offers key statistics on its utilization, shedding gentle on adoption charges, person demographics, and the rising impression of digital banking within the monetary trade.

73%

p.c of the world’s interactions with banks now happen by means of digital channels

Supply: McKinsey & Firm

- The USA, Canada, Japan, China, and Europe will drive an estimated 13% CAGR within the world funding banking sector.

- Financial institution of America leads with over 30 million lively cellular app customers and over 40 million on-line banking clients.

- China, the world’s second-largest economic system, is projected to achieve a market dimension of $4.6 billion by 2026, with a compound annual development price (CAGR) of 19.9% in the course of the evaluation interval.

- China is anticipated to stay among the many fastest-growing on this cluster of regional digital banking markets. The Asia-Pacific market, together with India, Australia, and South Korea, is forecasted to achieve $615.6 million by 2026.

- Japan and Canada are among the many different noteworthy geographic markets; every is forecasted to develop at 11% and 13.1%, respectively, from 2021 to 2026.

- Germany is projected to develop at roughly 14.5% CAGR in Europe. On the identical time, the remainder of the European market will attain $5.2 billion by 2026.

- Roughly 295.5 million digital banking customers are in India, surpassing the U.S. by over 70 million.

- The online curiosity revenue from digital banks is anticipated to develop at a median annual price of 6.86% from 2024 to 2029, reaching a complete of $2.09 trillion by 2029.

- By 2029, the whole worth of buyer deposits at digital banks is estimated to exceed 5.4 trillion U.S. {dollars}

- It’s estimated that digital banking channels will account for over 90% of banking interactions globally by 2025.

- The typical digital spending per $1 billion in belongings has risen dramatically, from about $200,000 in 2022 to just about $780,000 in 2024, a 310% improve over two years.

The desk beneath discusses customers’ preferences for digital-only banks in response to age.

| Age group | Proportion of customers preferring digital-only banks |

| All age teams | 21% |

| 18-24 years | 24% |

| 25-35 years | 26% |

| 35-44 years | 29% |

| 45-54 years | 18% |

| 55-64 years | 8% |

Conventional banking utilization statistics

Regardless of the rise of digital banking, conventional banking continues to play a big position in monetary providers. This part explores key statistics on its utilization, providing insights into buyer preferences, demographics, and the continued relevance of in-person banking

- In 2024, world internet curiosity revenue for conventional banks reached a powerful $7.03 trillion.

- As of 2024, round 4.5% of individuals within the U.S. do not need financial institution accounts.

- 65% of customers use conventional banks for his or her main financial institution accounts.

- 46% of consumers with out on-line financial institution accounts choose in-person department entry.

- 82% of individuals within the U.S. think about having a close-by financial institution department essential.

- 24% of customers anticipate to go to financial institution branches much less often in 2025.

- In a shift towards on-line banking, HSBC Financial institution within the UK closed over 10% of its branches in 2022, decreasing its community by 69 out of 510 areas.

- 61% of customers point out their chance of switching to a digital-only financial institution.

- $2.05 trillion is the anticipated world market dimension of digital-only banks by the 12 months 2030.

- 74% of millennials and 68% of Gen Z are probably to choose digital banking

On-line banking statistics

On-line banking has grown quickly as extra individuals flip to digital options for managing their funds. This part highlights key statistics on on-line banking utilization, together with adoption tendencies, person demographics, and its position in shaping fashionable monetary habits.

- 77% of Canadians, 71% of US inhabitants, and 69% of Spanish clients use their on-line banking providers at the least month-to-month.

- 79% of web customers who didn’t belief synthetic intelligence (AI) know-how have been much less prone to financial institution on-line, in comparison with 88% of those that trusted AI.

- On-line chat know-how, which connects clients to a human customer support consultant, has a satisfaction price of 66%.

- 54% of monetary service suppliers view chatbots as a method to remodel the buyer expertise.

- In 2023, over 66 p.c of the inhabitants within the US used on-line banking.

- The proportion of older adults utilizing on-line banking elevated from 62% in 2018 to 70% in 2022

Cell banking statistics

Cell banking has turn out to be a key participant in the best way individuals entry and handle their funds on the go. This part presents essential statistics on cellular banking utilization, together with development tendencies, person habits, and the impression of cellular banking on the monetary trade.

- Within the first quarter of 2023, 63% of checking account holders processed banking issues on their smartphone or pill.

- 63% of checking account holders processed banking-related duties on their smartphone or pill in 1Q 2024

- Specialists foresee cellular funds will develop at a CAGR of 29% from 2020 to 2027, reaching an estimated $8.94 trillion.

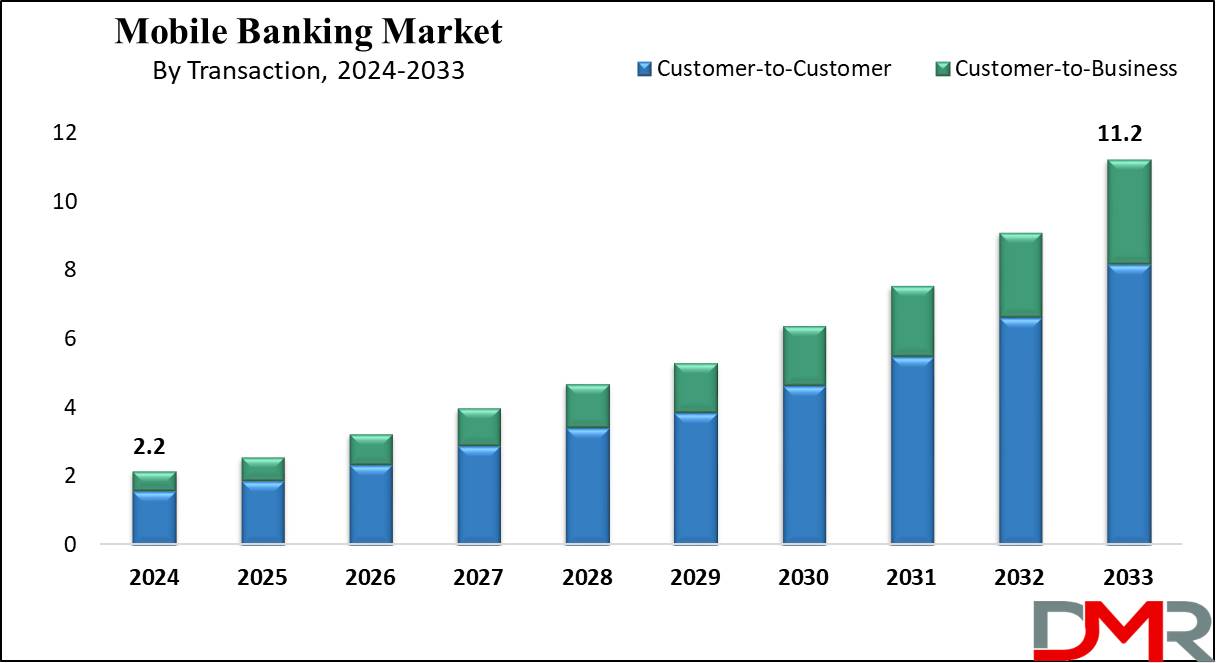

- The worldwide cellular banking market is anticipated to develop to USD 11.2 billion by 2033, at a CAGR of 20.0%.

Supply: Dimension Market Analysis

- 71% of customers choose to handle their financial institution accounts by means of a cellular app or laptop.

- As of 2024, nearly 59% of individuals used their cell phones to handle their financial institution accounts.

- 53% of consumers are annoyed once they cannot reply to cellular messages, making a key alternative for monetary establishments to enhance buyer expertise with two-way digital conversations.

- Android as a platform is anticipated to get the most important income share in 2024 within the cellular banking market.

- North America is anticipated to contribute about 56.7% to the worldwide cellular banking market in 2024, sustaining its main place within the coming years.

- The worldwide quantity of cellular cost transactions is anticipated to surpass USD 13 trillion by 2025.

AI in banking statistics

Synthetic intelligence is quickly remodeling the banking trade, bringing advantages in a number of key areas. AI is making banking quicker, extra environment friendly, and safer for banks and their clients. As AI know-how develops, we anticipate to see much more progressive purposes emerge within the banking sector.

61%

improve is projected within the adoption price of AI throughout monetary establishments by 2025

Supply: Agile Infoways

- AI has the potential to enhance banking trade productiveness by round 5% and cut back world spending by as much as $300 billion.

- 79% of consumers say digital improvements are making banking providers extra accessible.

- AI adoption in banking is anticipated to develop by 52% by 2025.

- AI can automate 20% of banking and monetary actions.

- Banks utilizing AI have witnessed a 34% improve of their revenues.

- AI has the potential to generate $140 billion in income for the banking sector by 2025.

- By 2030, AI might assist banks cut back operational prices by 22%.

- AI-based fraud detection in banking is anticipated to achieve $68.6 million by 2026.

- 17% of decision-makers are specializing in utilizing AI for personalizing investments, 15% on credit score scoring, and 13% on portfolio optimization.

- 85% of buyer interactions in banking shall be powered by AI by 2025.

- 83% of banking executives consider AI and digital banking make banks extra susceptible to cyber threats.

Digital banking safety statistics

Digital banking is susceptible to cyber threats. In 2023, the Reserve Financial institution of India (RBI) reported financial institution frauds amounting to over 302.5 billion Indian Rupees.

With huge digital transactions, conventional fraud or rip-off monitoring providers have to catch as much as the fashionable cybersecurity challenges banking establishments face.

- Service provider losses from fraud in on-line funds are projected to exceed $362 billion globally between 2023 and 2028.

- In 2028, service provider losses from on-line cost fraud are anticipated to achieve $91 billion.

- 30% of consumers with out on-line financial institution accounts are anxious about safety points.

- In 2022, people reported almost $8.8 billion in monetary fraud losses, marking a staggering 30% improve from 2021.

- 62% of all new accounts created by criminals in 2022 have been monetary accounts, making new accounts 9.5 instances riskier than mature accounts

- 67% of victims of Account Takeover (ATO) assaults discovered that their uncovered information was used for unauthorized purchases

- 87% of customers prioritize comfort over safety relating to monetary providers

- In 2023, the chance to detect breaches in a single’s Social Safety quantity was perceived as probably the most invaluable cellular banking characteristic by customers in the USA.

Transferring towards a digitally charged future

On-line banking presents a number of advantages in comparison with conventional banking, resembling simpler entry, extra comfort, and elevated flexibility. Prospects can deal with a wide range of banking duties, like transferring funds or checking account balances, at their comfort, with out the necessity to go to a department. Digital platforms additionally provide customized providers, with insights and suggestions primarily based on particular person monetary actions.

That stated, the rise of on-line banking additionally highlights the significance of enhancing safety measures to handle considerations resembling fraud, id theft, and information breaches. Regardless of these challenges, digital banking platforms proceed to adapt to satisfy the wants of immediately’s technology-driven customers.

Be taught extra concerning the rise of digital transformation in banking.

This text was initially revealed in 2023. It has been up to date with new data.