16 analysts have shared their evaluations of Gilead Sciences GILD in the course of the current three months, expressing a mixture of bullish and bearish views.

The desk beneath presents a condensed view of their current rankings, showcasing the altering sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Complete Scores | 2 | 8 | 6 | 0 | 0 |

| Final 30D | 1 | 0 | 0 | 0 | 0 |

| 1M In the past | 0 | 5 | 3 | 0 | 0 |

| 2M In the past | 0 | 1 | 0 | 0 | 0 |

| 3M In the past | 1 | 2 | 3 | 0 | 0 |

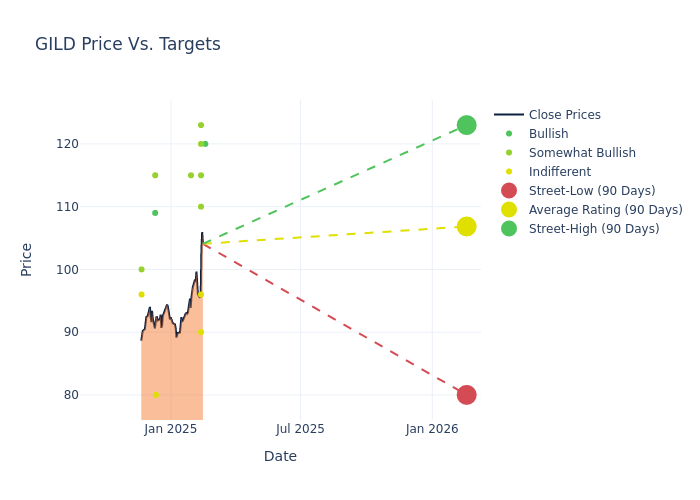

Analysts have set 12-month worth targets for Gilead Sciences, revealing a mean goal of $104.38, a excessive estimate of $123.00, and a low estimate of $80.00. This present common displays a rise of 12.88% from the earlier common worth goal of $92.47.

Diving into Analyst Scores: An In-Depth Exploration

The notion of Gilead Sciences by monetary consultants is analyzed by means of current analyst actions. The next abstract presents key analysts, their current evaluations, and changes to rankings and worth targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Worth Goal | Prior Worth Goal |

|---|---|---|---|---|---|

| James Shin | Deutsche Financial institution | Raises | Purchase | $120.00 | $80.00 |

| Brian Abrahams | RBC Capital | Raises | Sector Carry out | $90.00 | $84.00 |

| Salveen Richter | Goldman Sachs | Raises | Impartial | $96.00 | $85.00 |

| Evan Seigerman | BMO Capital | Raises | Outperform | $115.00 | $110.00 |

| Mohit Bansal | Wells Fargo | Raises | Obese | $120.00 | $105.00 |

| Joseph Catanzaro | Piper Sandler | Raises | Obese | $110.00 | $105.00 |

| Matthew Harrison | Morgan Stanley | Raises | Obese | $123.00 | $113.00 |

| Brian Abrahams | RBC Capital | Maintains | Sector Carry out | $84.00 | $84.00 |

| Chris Schott | JP Morgan | Raises | Obese | $115.00 | $105.00 |

| Matthew Harrison | Morgan Stanley | Raises | Obese | $113.00 | $87.00 |

| Olivia Brayer | Cantor Fitzgerald | Maintains | Impartial | $80.00 | $80.00 |

| Brian Abrahams | RBC Capital | Maintains | Sector Carry out | $84.00 | $84.00 |

| Matthew Biegler | Oppenheimer | Raises | Outperform | $115.00 | $105.00 |

| Tim Anderson | B of A Securities | Broadcasts | Purchase | $109.00 | – |

| Colin Bristow | UBS | Raises | Impartial | $96.00 | $70.00 |

| Salim Syed | Mizuho | Raises | Outperform | $100.00 | $90.00 |

Key Insights:

- Motion Taken: Analysts adapt their suggestions to altering market circumstances and firm efficiency. Whether or not they ‘Preserve’, ‘Increase’ or ‘Decrease’ their stance, it displays their response to current developments associated to Gilead Sciences. This info supplies a snapshot of how analysts understand the present state of the corporate.

- Score: Gaining insights, analysts present qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These rankings mirror expectations for the relative efficiency of Gilead Sciences in comparison with the broader market.

- Worth Targets: Analysts discover the dynamics of worth targets, offering estimates for the longer term worth of Gilead Sciences’s inventory. This examination reveals shifts in analysts’ expectations over time.

To achieve a panoramic view of Gilead Sciences’s market efficiency, discover these analyst evaluations alongside important monetary indicators. Keep knowledgeable and make even handed choices utilizing our Scores Desk.

Keep updated on Gilead Sciences analyst rankings.

Unveiling the Story Behind Gilead Sciences

Gilead Sciences develops and markets therapies to deal with life-threatening infectious ailments, with the core of its portfolio targeted on HIV and hepatitis B and C. Gilead’s acquisition of Pharmasset introduced rights to hepatitis C drug Sovaldi, which can be a part of newer mixture regimens that stay requirements of care. Gilead can be rising its presence within the oncology market by way of acquisitions, led by CAR-T cell remedy Yescarta/Tecartus (from Kite) and breast and bladder most cancers remedy Trodelvy (from Immunomedics).

Gilead Sciences’s Monetary Efficiency

Market Capitalization Evaluation: With an elevated market capitalization, the corporate stands out above trade averages, showcasing substantial dimension and market acknowledgment.

Income Progress: Gilead Sciences displayed constructive leads to 3 months. As of 30 September, 2024, the corporate achieved a strong income progress charge of roughly 7.02%. This means a notable improve within the firm’s top-line earnings. As in comparison with opponents, the corporate encountered difficulties, with a progress charge decrease than the typical amongst friends within the Well being Care sector.

Web Margin: Gilead Sciences’s monetary energy is mirrored in its distinctive web margin, which exceeds trade averages. With a exceptional web margin of 16.61%, the corporate showcases robust profitability and efficient price administration.

Return on Fairness (ROE): Gilead Sciences’s ROE surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 6.82% ROE, the corporate successfully makes use of shareholder fairness capital.

Return on Belongings (ROA): Gilead Sciences’s ROA surpasses trade requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 2.32% ROA, the corporate successfully makes use of its property for optimum returns.

Debt Administration: With a below-average debt-to-equity ratio of 1.26, Gilead Sciences adopts a prudent monetary technique, indicating a balanced strategy to debt administration.

The Core of Analyst Scores: What Each Investor Ought to Know

Inside the area of banking and monetary techniques, analysts concentrate on reporting for particular shares or outlined sectors. Their work entails attending firm convention calls and conferences, researching firm monetary statements, and speaking with insiders to publish “analyst rankings” for shares. Analysts usually assess and charge every inventory as soon as per quarter.

Some analysts publish their predictions for metrics resembling progress estimates, earnings, and income to offer extra steerage with their rankings. When utilizing analyst rankings, you will need to needless to say inventory and sector analysts are additionally human and are solely providing their opinions to traders.

Breaking: Wall Avenue’s Subsequent Massive Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive progress. This under-the-radar firm might surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Market Information and Information dropped at you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.