Throughout the current three months, 10 analysts have shared their insights on Common Technical UTI, expressing a wide range of opinions spanning from bullish to bearish.

The next desk supplies a fast overview of their current rankings, highlighting the altering sentiments over the previous 30 days and evaluating them to the previous months.

| Bullish | Considerably Bullish | Detached | Considerably Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 4 | 6 | 0 | 0 | 0 |

| Final 30D | 1 | 1 | 0 | 0 | 0 |

| 1M In the past | 0 | 1 | 0 | 0 | 0 |

| 2M In the past | 0 | 1 | 0 | 0 | 0 |

| 3M In the past | 3 | 3 | 0 | 0 | 0 |

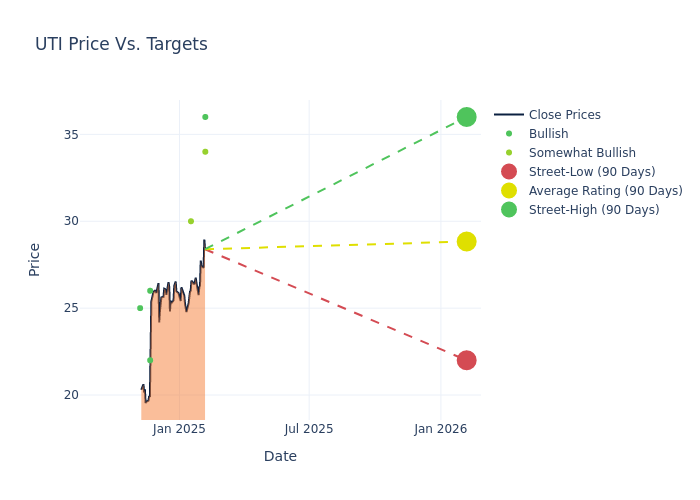

Analysts have just lately evaluated Common Technical and offered 12-month value targets. The common goal is $27.9, accompanied by a excessive estimate of $36.00 and a low estimate of $22.00. This present common has elevated by 18.22% from the earlier common value goal of $23.60.

Diving into Analyst Rankings: An In-Depth Exploration

The notion of Common Technical by monetary specialists is analyzed by current analyst actions. The next abstract presents key analysts, their current evaluations, and changes to rankings and value targets.

| Analyst | Analyst Agency | Motion Taken | Score | Present Value Goal | Prior Value Goal |

|---|---|---|---|---|---|

| Steve Frankel | Rosenblatt | Raises | Purchase | $36.00 | $30.00 |

| Mike Grondahl | Northland Capital Markets | Raises | Outperform | $34.00 | $30.00 |

| Alexander Paris | Barrington Analysis | Raises | Outperform | $30.00 | $25.00 |

| Mike Grondahl | Northland Capital Markets | Raises | Outperform | $30.00 | $24.00 |

| Steve Frankel | Rosenblatt | Raises | Purchase | $30.00 | $22.00 |

| Jasper Bibb | Truist Securities | Raises | Purchase | $26.00 | $22.00 |

| Alexander Paris | Barrington Analysis | Raises | Outperform | $25.00 | $22.00 |

| Eric Martinuzzi | Lake Road | Raises | Purchase | $22.00 | $19.00 |

| Mike Grondahl | Northland Capital Markets | Raises | Outperform | $24.00 | $20.00 |

| Alexander Paris | Barrington Analysis | Maintains | Outperform | $22.00 | $22.00 |

Key Insights:

- Motion Taken: Responding to altering market dynamics and firm efficiency, analysts replace their suggestions. Whether or not they ‘Keep’, ‘Increase’, or ‘Decrease’ their stance, it signifies their response to current developments associated to Common Technical. This affords perception into analysts’ views on the present state of the corporate.

- Score: Offering a complete evaluation, analysts provide qualitative assessments, starting from ‘Outperform’ to ‘Underperform’. These rankings mirror expectations for the relative efficiency of Common Technical in comparison with the broader market.

- Value Targets: Gaining insights, analysts present estimates for the long run worth of Common Technical’s inventory. This comparability reveals developments in analysts’ expectations over time.

To achieve a panoramic view of Common Technical’s market efficiency, discover these analyst evaluations alongside important monetary indicators. Keep knowledgeable and make considered selections utilizing our Rankings Desk.

Keep updated on Common Technical analyst rankings.

If you’re excited by following small-cap inventory information and efficiency you can begin by monitoring it right here.

Unveiling the Story Behind Common Technical

Common Technical Institute Inc is an academic establishment. It supplies undergraduate diploma, in addition to certificates applications for technicians within the automotive, diesel, collision restore, bike and marine fields. The corporate’s reportable phase which incorporates Common Technical Institute (UTI) and Concorde Profession Faculties, Company. Majority of the income is generated from UTI phase which supplies totally different sorts of diploma and non-degree transportation and expert trades technical coaching applications below manufacturers corresponding to Common Technical Institute, Motorbike Mechanics Institute, Marine Mechanics Institute and others. It additionally supplies seller technician coaching or teacher staffing providers to producers.

Unraveling the Monetary Story of Common Technical

Market Capitalization Evaluation: Under business benchmarks, the corporate’s market capitalization displays a smaller scale relative to friends. This may very well be attributed to elements corresponding to progress expectations or operational capability.

Constructive Income Development: Analyzing Common Technical’s financials over 3 months reveals a constructive narrative. The corporate achieved a noteworthy income progress price of 15.3% as of 30 September, 2024, showcasing a considerable improve in top-line earnings. As in comparison with its friends, the corporate achieved a progress price increased than the typical amongst friends in Shopper Discretionary sector.

Web Margin: Common Technical’s web margin surpasses business requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 9.59% web margin, the corporate successfully manages prices and achieves sturdy profitability.

Return on Fairness (ROE): The corporate’s ROE is a standout performer, exceeding business averages. With a powerful ROE of 7.54%, the corporate showcases efficient utilization of fairness capital.

Return on Property (ROA): Common Technical’s ROA surpasses business requirements, highlighting the corporate’s distinctive monetary efficiency. With a powerful 2.6% ROA, the corporate successfully makes use of its property for optimum returns.

Debt Administration: Common Technical’s debt-to-equity ratio stands notably increased than the business common, reaching 1.13. This means a heavier reliance on borrowed funds, elevating considerations about monetary leverage.

Understanding the Relevance of Analyst Rankings

Analysts work in banking and monetary methods and sometimes concentrate on reporting for shares or outlined sectors. Analysts might attend firm convention calls and conferences, analysis firm monetary statements, and talk with insiders to publish “analyst rankings” for shares. Analysts sometimes price every inventory as soon as per quarter.

Along with their assessments, some analysts prolong their insights by providing predictions for key metrics corresponding to earnings, income, and progress estimates. This supplementary info supplies additional steering for merchants. It’s essential to acknowledge that, regardless of their specialization, analysts are human and may solely present forecasts primarily based on their beliefs.

Breaking: Wall Road’s Subsequent Huge Mover

Benzinga’s #1 analyst simply recognized a inventory poised for explosive progress. This under-the-radar firm might surge 200%+ as main market shifts unfold. Click on right here for pressing particulars.

This text was generated by Benzinga’s automated content material engine and reviewed by an editor.

Overview Score:

Speculative

Market Information and Information delivered to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.